| ||

| 1st August 2025 | view in browser | ||

| Dollar rallies on strong US data | ||

| The US dollar strengthened, fueled by robust economic data and strong tech earnings from Meta and Microsoft, pushing recession fears to a new low and pressuring speculative short positions. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1600 - 29 July high - Medium R1 1.1500 - Figure - Medium S1 1.1313 - 30 May low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| The Federal Reserve’s decision to maintain high interest rates at 4.5%, the highest among G10 central banks, reflects a cautious “wait and see” approach, potentially pressuring the EURUSD exchange rate in the near term. The euro area economy grew slightly by 0.1% in Q2, avoiding stagnation but showing weaknesses in Germany and Italy, partly due to uncertainties from new U.S. tariffs impacting trade. Despite these challenges, Pimco analysts predict the euro may strengthen against a weakening dollar as global portfolios diversify, with U.S. trade policies possibly reducing demand for U.S. assets. German inflation dipping below the ECB’s 2% target and a resilient labor market further support expectations of controlled inflation in the eurozone. | ||

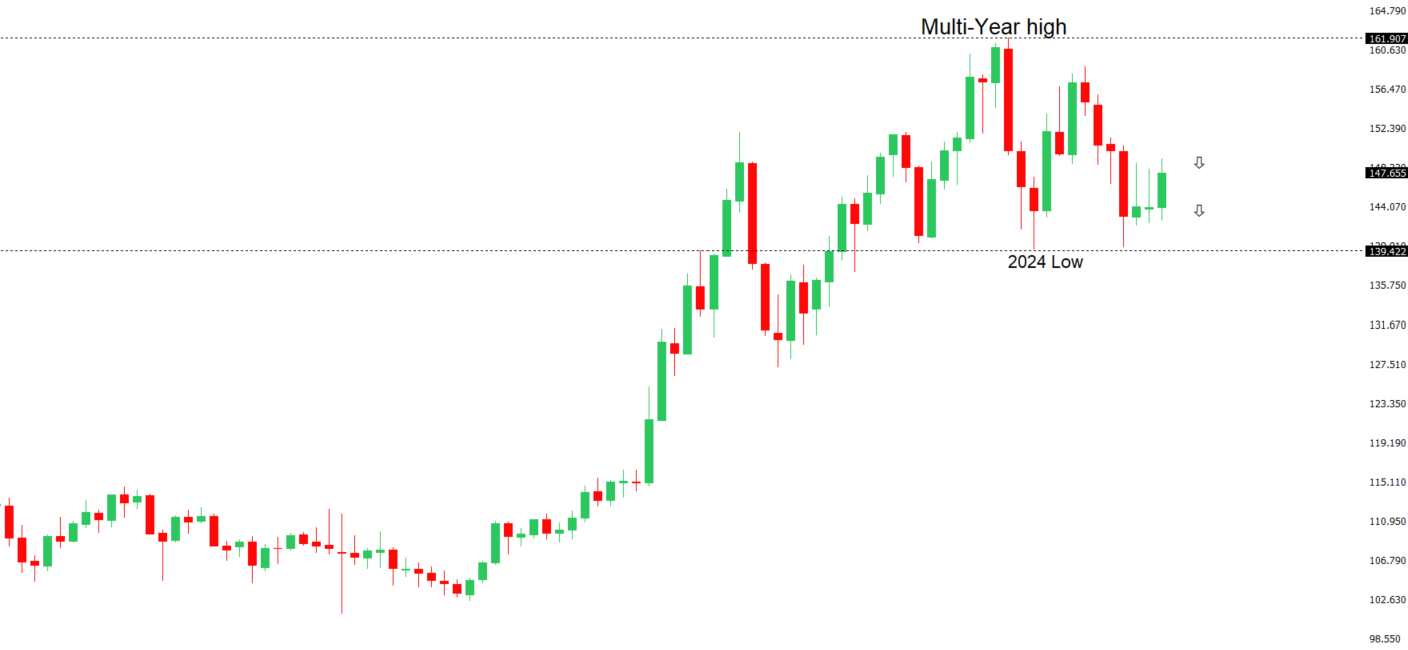

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 151.21 - 28 March high - Strong R1 150.00 - Psychological - Medium S1 147.80 - 30 July low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan maintained its interest rate at 0.5% and raised its inflation forecasts for 2025–2027, citing higher food prices, while slightly increasing its 2025 growth projection. Governor Ueda downplayed the likelihood of an imminent rate hike, emphasizing uncertainties like U.S. tariffs and global trade, leading markets to reduce expectations for near-term policy tightening. The dovish stance, combined with wide rate differentials with the U.S. Federal Reserve, strengthened USDJPY, with potential for further yen weakness amid political challenges and limited expectations of intervention by Japan’s Ministry of Finance. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6688 - 7 November 2024 high - Strong R1 0.6625 - 24 July/2025 high - Medium S1 0.6400 - Figure - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s Q2 CPI rose slightly below expectations at 0.7% quarterly and 2.1% annually, supporting a likely 25bps rate cut by the RBA in August. The trimmed mean CPI of 2.7% aligned with RBA forecasts, indicating contained inflation. Despite a rise in unemployment to 4.3%, the RBA views it as near full employment. Strong retail sales (1.2% MoM) and building approvals (11.9% MoM) suggest robust consumer spending and a potential housing sector recovery, though sustained growth remains uncertain. Markets anticipate at least two rate cuts in 2025, but strong economic data could prompt the RBA to pause. | ||

| Suggested reading | ||

| What’s Your Real Risk Tolerance?, M. Hulbert, MarketWatch (July 30, 2025) Why Industrial Stocks Are Booming This Year, B. Albrecht, Morningstar (July 30, 2025) | ||