| ||

| 12th September 2025 | view in browser | ||

| Fed cuts ahead, ECB stays cautious | ||

| Recent U.S. inflation data aligned closely with expectations, reinforcing predictions the Federal Reserve will cut interest rates soon, likely starting with a 25-basis-point reduction next week. Meanwhile, the European Central Bank held its key deposit facility rate steady at 2%, as widely anticipated. | ||

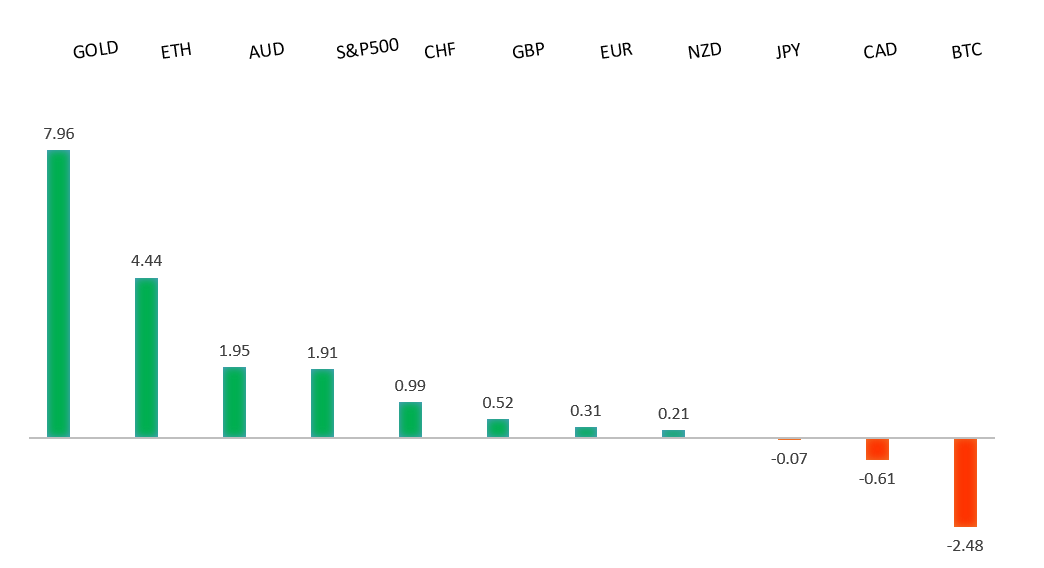

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1830 - 1 July/2025 high - Strong R1 1.1789 - 24 July high - Medium S1 1.1608 - 3 September low - Medium S2 1.1574 - 27 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The European Central Bank decided to maintain its key interest rates steady, keeping the deposit rate at 2%, as inflation remains under control and the eurozone economy shows greater resilience than expected. This marks the second straight meeting without changes, reflecting a cautious, data-driven approach with no hints on future moves, even as the bank has already cut rates in half from 4% over the past year—leading many analysts to believe no further cuts are coming, and some now anticipate a potential hike possibly not until June 2026. Despite challenges like U.S. tariffs, labor market issues, and French political unrest, the ECB slightly raised its growth outlook to 1.2% for 2025 and 1% for 2026, while projecting inflation at 1.7% in 2026 and 1.9% in 2027, staying near the 2% target; policymakers are split on risks, with some eyeing a stronger euro as a drag and others pointing to trade tensions or defense spending as potential boosts. Meanwhile, with U.S. inflation data meeting expectations and rising jobless claims, markets are fully pricing in a 25-basis-point Federal Reserve rate cut next week, followed by more in October and December, which could widen policy gaps and push the euro higher against the dollar in the weeks ahead. | ||

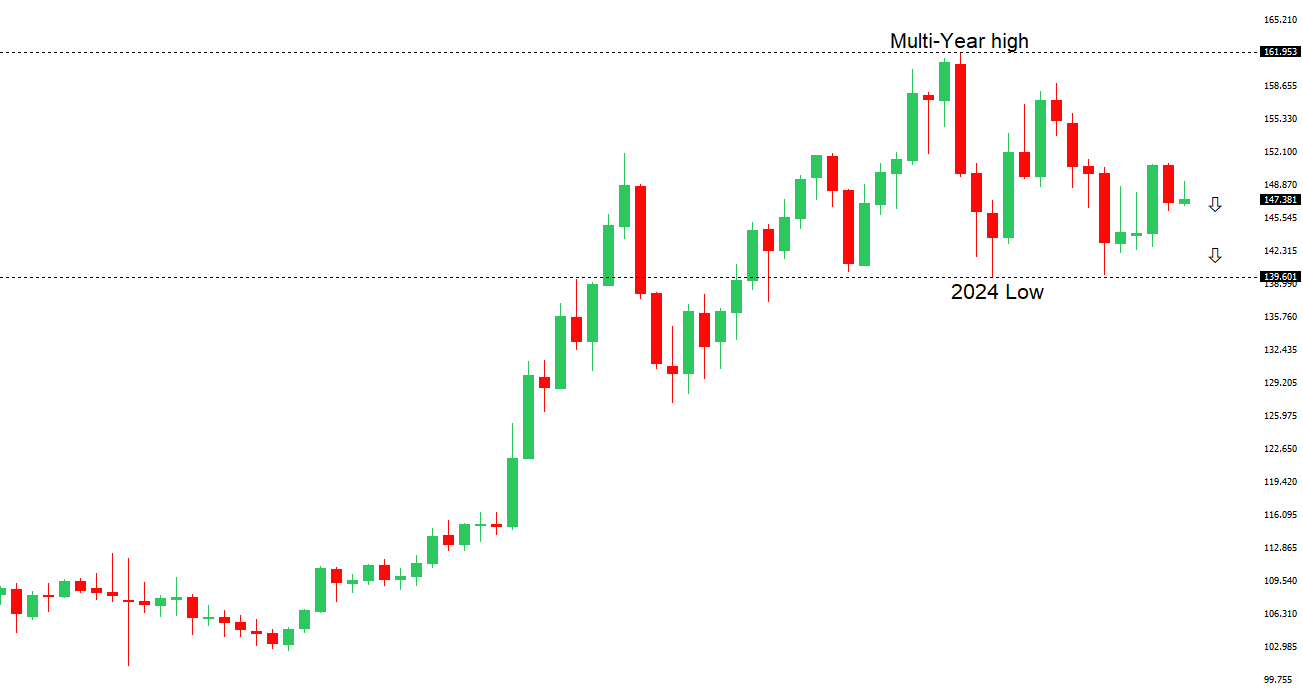

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.14 - 3 September high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan is likely to keep its current policy unchanged next week, awaiting clarity on new leadership and fiscal direction after Ishiba’s resignation, with no major shifts expected until a new prime minister is appointed in October. Sanae Takaichi’s potential leadership win could pressure the yen and Japanese government bonds due to her fiscal expansion and accommodative policy stance, while Shinjiro Koizumi’s reform-focused approach might lead to milder market reactions. Despite political uncertainty, one major US bank predicts USDJPY could drop to around 140 in Q4 due to narrowing US-Japan interest rate differentials, and BOJ officials see room for a rate hike later this year, potentially in October or December, supported by strong economic indicators. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6700 - Figure - Medium R1 0.6667 - 12 September/2025 high - Strong S1 0.6483 - 2 September low - Medium S1 0.6414 - 22 August low - Strong | ||

| AUDUSD: fundamental overview | ||

| The US CPI data met expectations, leading markets to anticipate a 25bps Fed rate cut next week, with further cuts expected in October and December, supported by higher-than-expected US Initial Jobless Claims. This sparked a risk-on sentiment, pushing US equity benchmarks to record highs and boosting high-beta currencies like the Australian dollar to a fresh yearly high. Strong Australian 2Q GDP growth, driven by robust household consumption, exports, and spending, has reduced expectations for a November RBA rate cut to 72%, as inflation remains within the RBA’s target range. Positive Chinese manufacturing data further supports the Australian dollar, which is expected to stay resilient amid broad US dollar weakness, with the RBA unlikely to adopt an aggressively dovish stance soon. | ||

| Suggested reading | ||

| Eighth Member of the FOMC? Mr. Market, M. Pring, Pring Turner (September 10, 2025) Backward Looking Job Figures Don’t Tell Us Much, Fisher Investments (September 9, 2025) | ||