| ||

| 12th June 2025 | view in browser | ||

| Fed cuts loom as markets wobble | ||

| Global markets are jittery as President Trump intensifies trade negotiations, announcing plans to send formal letters to trading partners within two weeks outlining unilateral tariffs ahead of the July 9 deadline, though Treasury Secretary Scott Bessent suggests a possible extension of the current tariff pause for countries negotiating in good faith. | ||

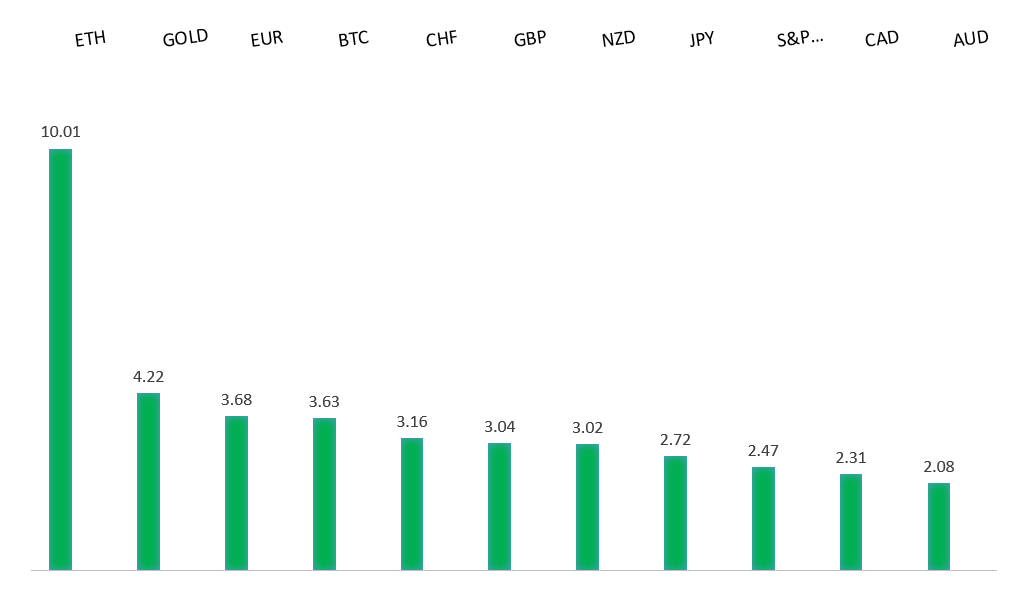

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1574 - 21 April/2025 high - Strong R1 1.1530 - 12 June high - Medium S1 1.1373 - 10 June low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| Global investors puled $24.7 billion out of US equities in May—the largest outflow in a year—shifting focus to European and emerging markets due to concerns over US fiscal policy, rising debt, and potential trade tariffs sparking a recession, according to LSEG Lipper data. European funds saw $21 billion in inflows last month, totaling $82.5 billion this year, boosted by lower interest rates and Germany’s $1 trillion stimulus, while emerging market ETFs attracted $3.6 billion, pushing yearly inflows to $11.1 billion. The dollar’s weakening and US Treasury sell-offs are driving this trend, with the euro nearing April’s high and looking to keep pushing, as ECB policy and fading US safe-haven appeal fuel optimism for further gains. | ||

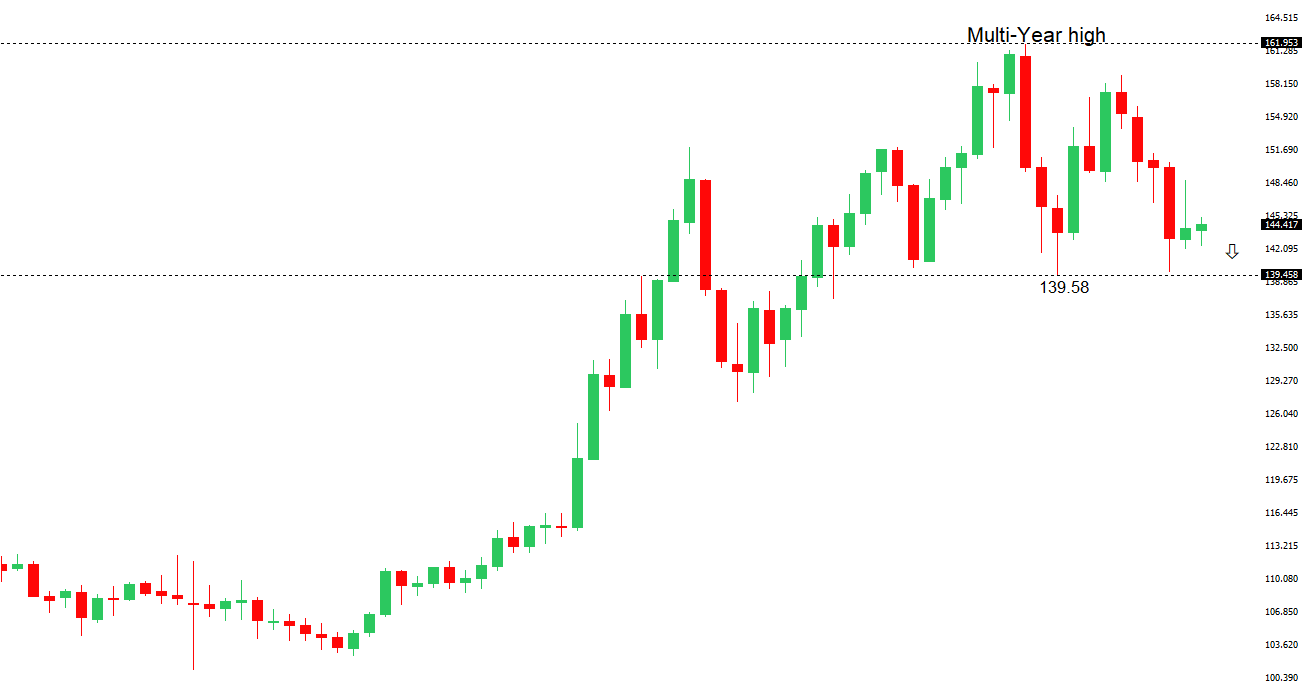

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.29 - 29 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan’s economic outlook has worsened, with the Business Survey Index for large manufacturers dropping to -4.8% in Q2 2025 from -2.4% in Q1, falling short of the expected 0.8% rebound and hitting the lowest level since early 2024, largely due to US trade barriers impacting its export-driven economy. Despite the current downturn, manufacturers are hopeful for a recovery, forecasting a rise to 5.7% in Q3 and 8.4% in Q4, though ongoing trade tensions with the Trump administration—marked by a 10% tariff on Japanese goods—could alter these projections. The yen gained as a safe-haven asset after Trump’s tariff threats, while the Nikkei 225 slipped 0.7% to 38,149, and the 10-year JGB yield fell to 1.45%, amid a complex policy stance from the BOJ, which may raise rates if inflation nears 2%. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6546 - 11 June/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar is under pressure as inflation expectations soar to 5.0% in June from 4.1% in May—the highest since mid-2023—creating a stark contrast with the official 2.4% rate and complicating the Reserve Bank of Australia’s strategy. With fading energy subsidies, tight labor markets, and supply issues likely pushing inflation toward the upper end of the 2-3% target, the Aussie is fluctuating, despite an 82% market expectation of a July rate cut and 77 basis points of cuts by December. If rising inflation fears prompt the RBA to reconsider these cuts, the Australian dollar might see a short-term boost. | ||

| Suggested reading | ||

| Different Kinds of Smart, M. Housel, Collaborative Fund (June 11, 2025) 20 Stocks To Avoid No Matter What The Market Does, M. Hulbert, MarketWatch (June 11, 2025) | ||