| ||

| 21st November 2025 | view in browser | ||

| Fed talk and soft data sour year end hopes | ||

| Markets started Thursday on a positive note thanks to Nvidia’s strong earnings, with a generally constructive tone in FX and rates, but sentiment quickly soured after Fed officials highlighted renewed inflation concerns. | ||

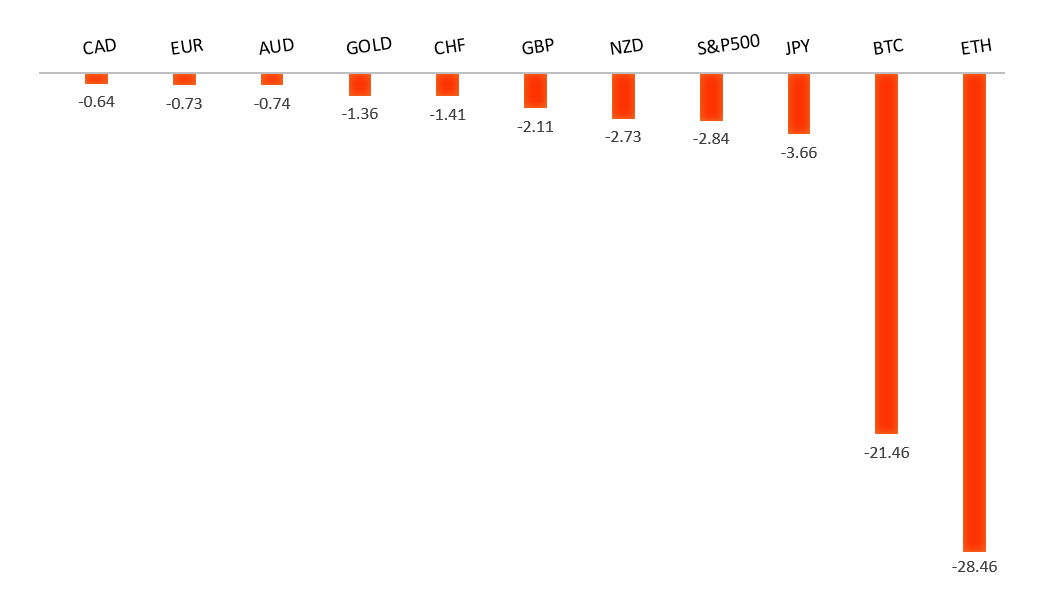

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| ECB official Gabriel Makhlouf says the current policy stance is appropriate and sees no need to change rates unless clear evidence emerges, urging against overreacting to small or temporary dips below the 2% inflation target. While upcoming forecasts could push some policymakers toward a cut, he’s not concerned about inflation slightly undershooting—around 1.8%—as expectations remain well anchored. A narrowing rate gap with the Fed, combined with expected Eurozone growth support from German fiscal measures, could help the euro, which one major bank notes is already undervalued by about 2%. Recent Eurozone data, however, paints a mixed picture: German producer prices show tentative stabilization, but construction output has weakened sharply and consumer confidence remains deeply negative, signaling persistent economic fragility despite easing price pressures. | ||

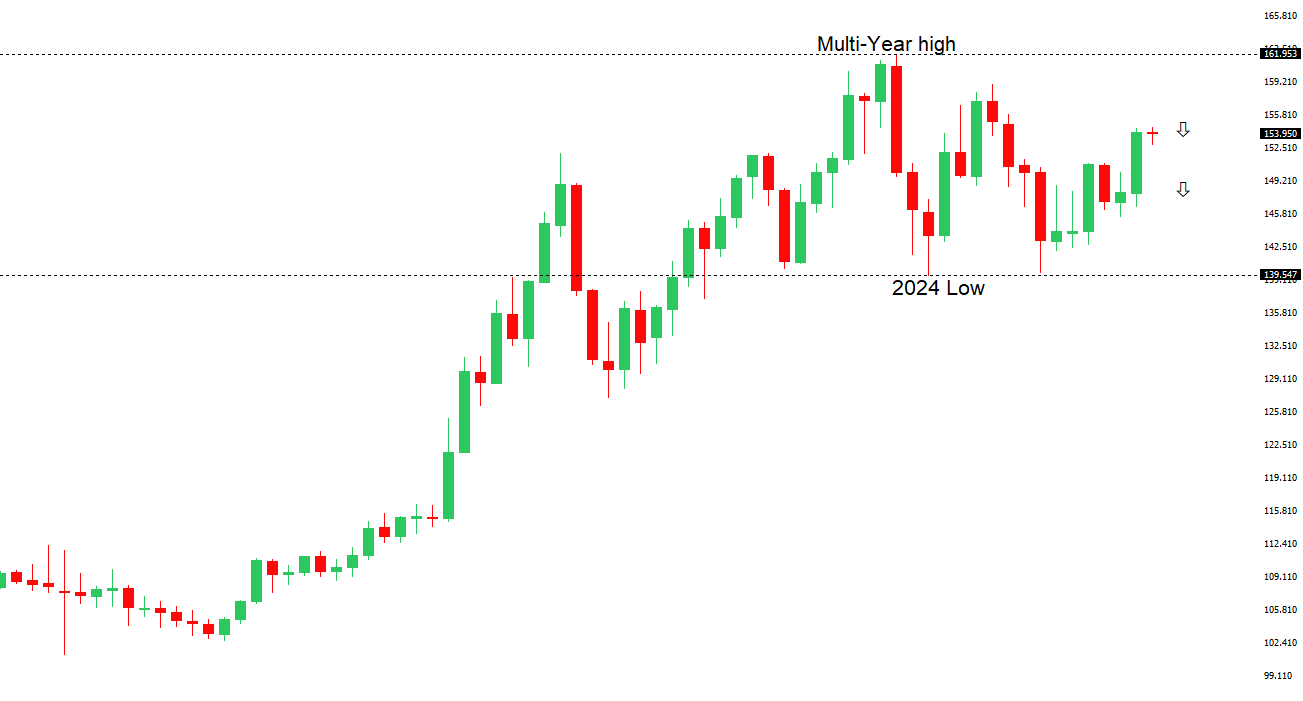

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.88 - 10 January/2025 high - Strong R1 157.90 - 20 November high - Medium S1 156.00 - Figure - Medium S2 155.21 - 19 November low - Medium | ||

| USDJPY: fundamental overview | ||

| Recent remarks from members of Japan’s leadership have intensified yen weakness by suggesting the BOJ is unlikely to raise rates before March 2026 and may be facing growing government influence over its decisions. Finance Minister Katayama’s comments about potentially revising the BOJ–government accord, along with her signaling no immediate plans to address yen weakness, have fueled concerns about reduced central-bank independence and encouraged speculative pressure on the currency. At the same time, a massive new stimulus package requiring heavier bond issuance, rising geopolitical friction with China, and expectations that the Fed will drive future direction all keep USDJPY biased upward. Even with inflation running above the BOJ’s 2% target for a record stretch, any near-term rate hike may be seen as a one-off, leaving dovish policy, negative real rates, and a weakening yen as the likely outlet—making any intervention short-lived. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6415 - 21 August low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar fell with the broader risk-off tone in crypto and equities, but strong support levels and an oversold RSI suggest downside may be limited. The RBA remains on hold as Australia’s labor market stays very tight, wages are elevated, and inflation risks linger, prompting policymakers to adopt a patient, data-dependent stance after earlier rate cuts. Recent economic data—from firm PMIs to solid spending and wage figures—reinforces expectations that easing is likely finished, with some analysts seeing rates steady at 3.60% through 2025. If the RBA stays paused while the Fed cuts in 2026, Australia could hold the highest G10 yield, supporting the Aussie. Meanwhile, improved export prospects—including tariff relief from the U.S. and record iron ore shipments—add to Australia’s constructive growth outlook. | ||

| Suggested reading | ||

| 10 Life Lessons From Warren Buffett, D. Lefkovitz, Morningstar (November 19, 2025) When Will The Stock Market Bubble Burst?, D. Lachman, AEIdeas (November 19, 2025) | ||