| ||

| 6th October 2025 | view in browser | ||

| Global markets brace for fiscal strain | ||

| The U.S. economy faces uncertainty due to a government shutdown that has halted key data releases. Meanwhile, global markets are watching the Swiss National Bank’s increased euro purchases, Japan’s new leadership pushing for stimulus and low rates, and Australia’s cautiously optimistic outlook driven by a stronger yuan and a slower RBA easing cycle. | ||

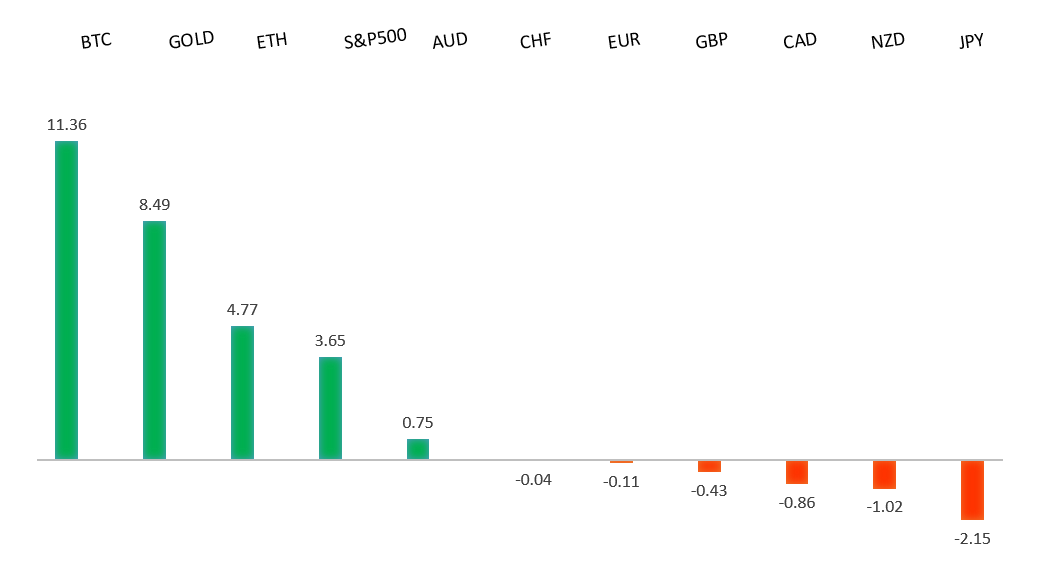

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1919 - 16 September/2025 high -Strong R1 1.1820 - 23 September high - Medium S1 1.1646 - 25 September low - Medium S2 1.1574 - 27 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro remains above its 50-day moving average, driven by expectations of potential U.S. Federal Reserve rate cuts if economic data weakens, though a U.S. government shutdown has limited official data, stalling decisive movements. Private sector reports, like the ISM services and ADP employment data, suggest economic slowdown and persistent inflation concerns. Meanwhile, ECB President Christine Lagarde expressed confidence in the euro area’s stable inflation near 2%, indicating no immediate need for policy changes. The Swiss National Bank significantly increased euro purchases in Q2 2025 to counter Swiss franc appreciation, shifting reserves to favor the euro over the dollar, influenced by U.S. tariffs and trade tensions, potentially signaling a broader trend that could further weaken the dollar. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 151.21 - 28 March high - Strong R1 150.92 - 1 August high - Strong S1 149.00 - Figure - Medium S2 147.46 - 23 September low - Medium | ||

| USDJPY: fundamental overview | ||

| Sanae Takaichi’s election as the leader of Japan’s Liberal Democratic Party positions her to become Japan’s first female prime minister, representing the party’s conservative wing and advocating for aggressive economic stimulus inspired by Abenomics. Her administration is expected to push for continued low interest rates and significant fiscal spending, potentially weakening the yen further and delaying Bank of Japan rate hikes, though some analysts believe the BOJ may still tighten policy due to persistent inflation above the 2% target and a weakening yen nearing 150 per dollar. Despite her preference for monetary easing, the BOJ’s independence and economic indicators like corporate profits and labor shortages could drive gradual rate increases, with a critical window for a hike in October or January, as later decisions may be complicated by budget planning and smaller wage hikes. Key economic data, including household spending, current account balance, and the Bloomberg Japan Economic survey, will be released this week, providing further insight. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6707 - 17 September/2025 high - Strong R1 0.6660 - 18 September high - Medium S1 0.6520 - 26 September low - Medium S1 0.6483 - 2 September low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar is expected to start the week with a cautiously optimistic outlook due to recent U.S. economic data weakening the U.S. dollar, amid the ongoing U.S. government shutdown. Stronger Australian economic data and a slower, more cautious approach to monetary easing by the Reserve Bank of Australia have supported Aussie, with expectations of fewer Federal Reserve rate cuts in the U.S. further boosting its near-term prospects. However, risks like high domestic inflation, potential U.S. tariffs, and weaker Chinese demand could reverse these gains if economic momentum falters. Modest growth in August household spending (5.0% YoY vs. 5.2% forecast) suggests softening consumer demand, increasing the likelihood of an RBA rate cut in November. Meanwhile, a steadily strengthening Chinese yuan, seen as a strategic move in trade relations, supports Aussie as a yuan proxy. Key Australian data releases this week, including consumer confidence and inflation expectations, along with RBA officials’ testimony, will be closely watched. | ||

| Suggested reading | ||

| No Shutdown Ever Caused Bear Market, Recession, Fisher Investments (October 1, 2025) Making a Case For Why The Market Will Keep Climbing, J. Remsburg, InvestorPlace (October 3, 2025) | ||