| ||

| 9th September 2025 | view in browser | ||

| Labor woes lock in Fed cuts | ||

| Last week’s disappointing nonfarm payrolls report has solidified expectations for a Federal Reserve rate cut in September, with markets even considering a larger 50-basis-point reduction. Investors are closely watching upcoming August PPI and CPI data for signs of controlled inflation, though CPI is expected to rise to 2.9% from 2.7%, indicating persistent price pressures. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1830 - 1 July/2025 high - Strong R1 1.1789 - 24 July high - Medium S1 1.1608 - 3 September low - Medium S2 1.1574 - 27 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Central bank policy divergence, with the Federal Reserve likely cutting rates while the ECB holds steady, supports a stronger euro, with one bank forecasting a rise above $1.20 by year-end. German industrial production in July exceeded expectations, hinting at stabilization, but a narrowing trade surplus and weaker exports highlight ongoing challenges for Germany’s export-driven economy, with recovery prospects uncertain amid potential U.S. tariff risks in 2025. | ||

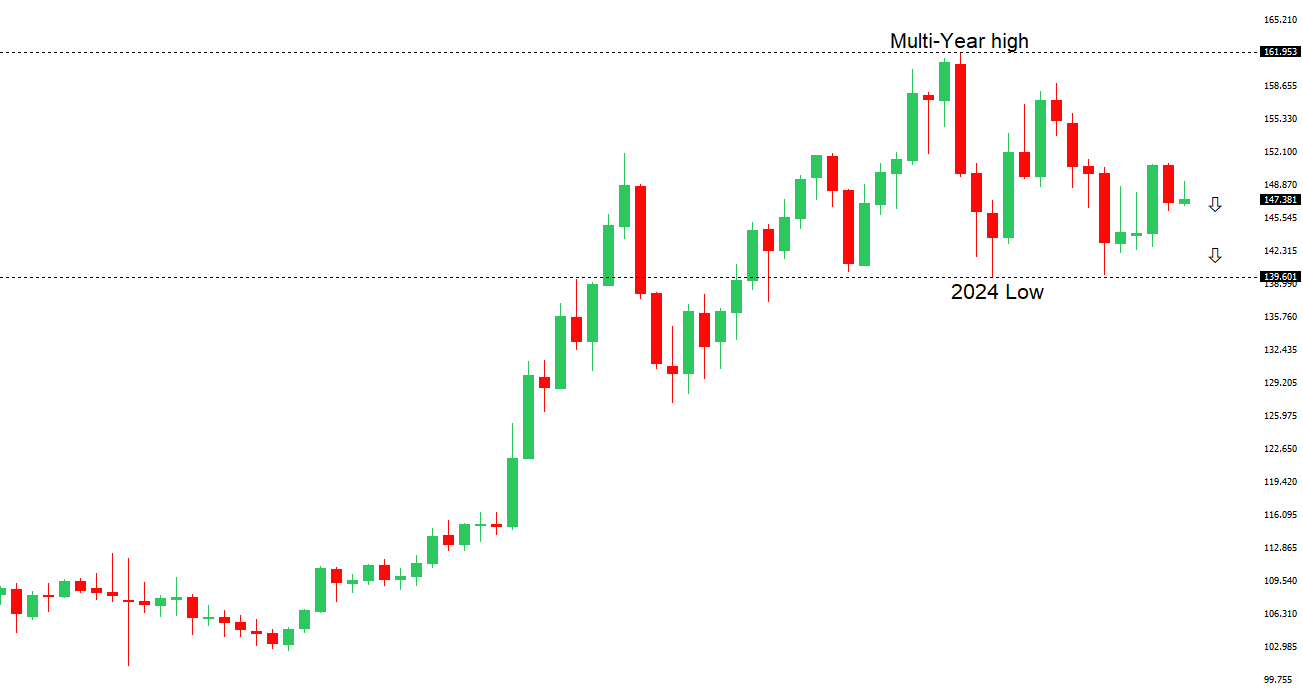

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.14 - 3 September high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Yen has held up relatively well, despite Japan’s political uncertainty following Ishiba’s resignation, with narrowing U.S.-Japan rate differentials factoring into the price action. Japan’s Q2 GDP growth was revised upward to 2.2%, driven by strong consumption, capital spending, and exports, though new U.S. tariffs may dampen future growth, keeping the Bank of Japan cautious on rate hikes. Political uncertainty, particularly around the Liberal Democratic Party leadership race, risks further yen weakness and higher Japanese government bond yields, with outcomes hinging on whether fiscal expansionist Sanae Takaichi or reform-focused Shinjiro Koizumi wins. Despite some optimism from reduced U.S. tariffs on Japanese autos, the BoJ is unlikely to shift policy soon, though LDP lawmaker Kono Taro supports rate hikes to bolster the yen and curb inflation. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6700 - Figure - Medium R1 0.6625 - 24 July/2025 high - Strong S1 0.6483 - 2 September low - Medium S1 0.6414 - 22 August low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar remains bullish following weak U.S. jobs data, which has increased expectations for a significant Federal Reserve rate cut in September. Upcoming U.S. inflation data (PPI and CPI) and Australian economic indicators, including consumer and business confidence, will influence the AUD’s near-term trajectory. Strong Australian GDP growth, driven by robust household consumption and exports, has reduced the likelihood of a November RBA rate cut to 80%, with the RBA likely to maintain steady rates unless consumer sentiment weakens further. Despite a recent drop in consumer confidence, improved business conditions and positive Chinese economic data support the AUD’s resilience. | ||

| Suggested reading | ||

| A Monetary Schism? The Avignon Federal Reserve, R. Wigglesworth, FT Alphaville (September 3, 2025) The Myths Of Chinese Exceptionalism, S. Sumner, The Pursuit of Happiness (September 3, 2025) | ||