| ||

| 29th October 2025 | view in browser | ||

| Tariffs on trial, US Dollar on tilt | ||

| The US and China are poised to showcase a positive outcome from their leaders’ meeting at the upcoming APEC summit, highlighting quick agreements on soybean purchases, fentanyl controls, and tariff extensions, though deeper issues like national security and tech rivalry remain unresolved, merely delaying a shift to a multipolar world without derailing the current risk-on sentiment. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

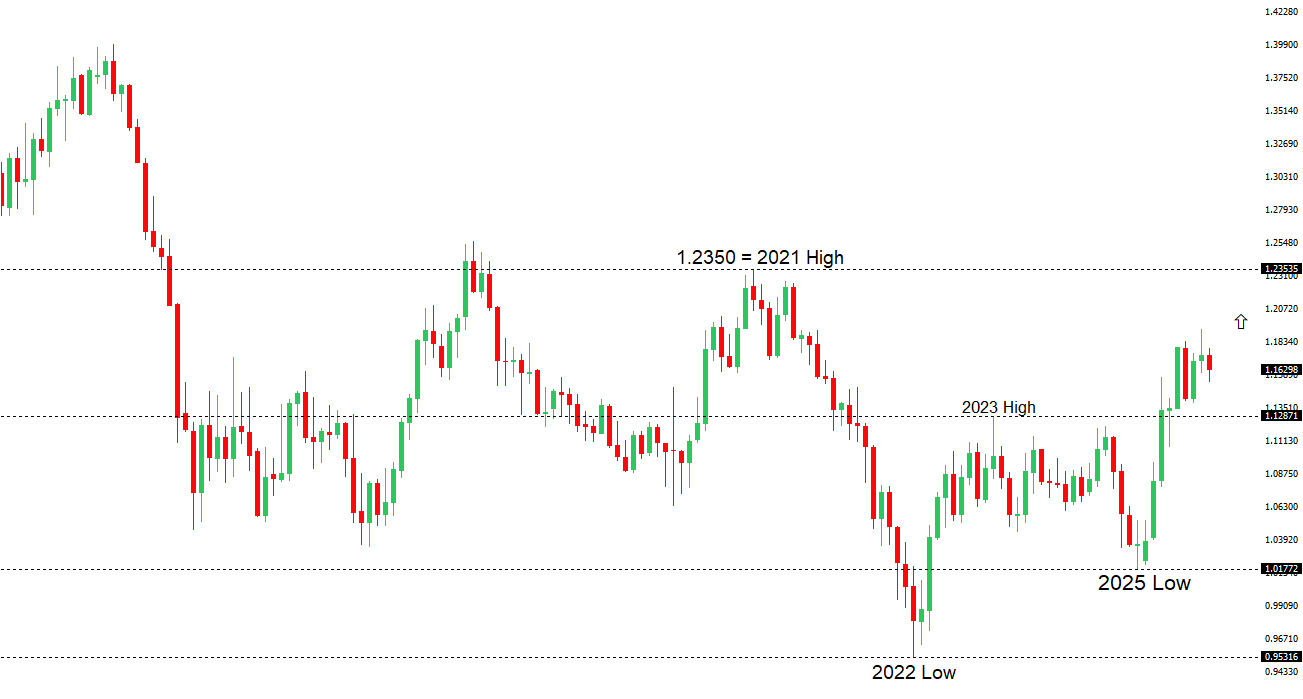

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1729 - 17 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The ECB is holding firm on its “Goldilocks” outlook, expecting U.S. tariff effects to fade quickly with Germany’s fiscal stimulus, backing unchanged rates at the October 30 meeting, while Lagarde likely stresses policy is “in a good place”—signaling inflation is largely tamed and cuts are off the table—despite underlying trade and geopolitical risks; stable inflation expectations (1-year at 2.7%, 3-year at 2.5%) reinforce this steady stance. The ECB-Fed rate gap, hopes for U.S.-China trade de-escalation after a Trump-Xi meeting, and France’s political compromise on corporate tax hikes to trim its deficit are all boosting the euro. However, November’s GfK Consumer Confidence unexpectedly fell to -24.1 (from a revised -22.5 prior, worse than -22.0 forecast) on job security fears, signaling private consumption recovery will stay weak despite a slight uptick in purchase willingness. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.27 - 10 October high - Medium S1 149.38 - 17 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| The USDJPY rally stalled near the key October 10 high of 153.27 as traders grew cautious ahead of the Fed’s expected 25bps rate cuts this meeting and in December, contrasted with the BoJ likely holding rates but possibly signaling a hawkish tilt, prompting profit-taking; concerns from Japan’s Economics Minister about FX volatility and US Treasury Secretary Bessent’s calls for BoJ flexibility to curb yen weakness fueled intervention speculation, while failure to break 153.27 could trigger CTA liquidations. Longer-term, markets may underestimate potential BoJ hikes amid robust inflation and wage growth, with Governor Ueda possibly hinting hawkishly and a Takaichi regime prioritizing fiscal discipline over unchecked stimulus despite coalition pressures. This week’s US-China trade optimism post-APEC could briefly weigh on the yen by boosting risk sentiment, but deeper unresolved tensions suggest limited aggressive yen recovery. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6608 - 28 October high - Medium S1 0.6471 - 16 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian Dollar is trading with an upside bias, fueled by positive risk-on sentiment and optimism for a “win-win” outcome in upcoming US-China presidential talks, supporting trade-sensitive currencies. RBA Governor Bullock’s cautious, hawkish comments—highlighting sticky inflation, a shallower easing path than peers, and the need to balance jobs and prices—boosted the pair further, with markets expecting a rate pause. Today’s hotter-than-expected Q3 inflation data (1.3% QoQ, 3.2% YoY, core at 3.0%) pushed annual CPI to 3.5%, above the RBA’s target and ruling out near-term cuts. If the Fed delivers dovish guidance on Wednesday, AUDUSD bulls could see a third boost, targeting a retest of the September 30 high. | ||

| Suggested reading | ||

| The great dam removal, S. Morris, Financial Times (October 28, 2025) What Every Investor Needs to Know About the Gold Rally, K. Fisher, NY Post (October 27, 2025) | ||