| ||

| 16th October 2025 | view in browser | ||

| Trade truce hopes weaken dollar | ||

| The US dollar remains under pressure following Fed Chair Powell’s dovish speech signaling no opposition to October rate cuts and a potential end to quantitative tightening, while optimism from France’s stabilizing politics has bolstered the euro, adding to dollar downside. | ||

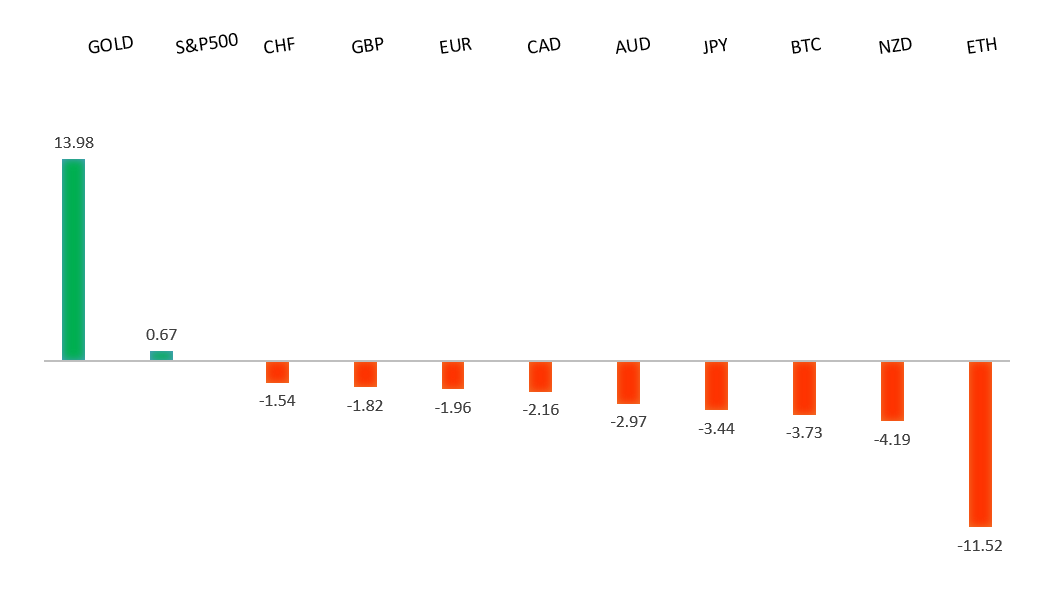

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1676 - 16 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Eurozone industrial production fell 1.2% in August month-on-month (beating forecasts of -1.6%), while year-on-year growth slowed to 1.1% from 2.0%, dashing recent optimism and signaling renewed contraction after a U.S. demand peak. Analysts note that big investment plans will take time to boost output, and shifting U.S. trade patterns offer little near-term help, so Q3 manufacturing won’t lift GDP—keeping economic prospects subdued. The euro’s recovery stays muted despite France’s budget progress, weighed down by weak German data like the disappointing ZEW survey. Markets need stronger German stimulus or broad Eurozone growth to confidently buy EURUSD; a dovish Fed pivot or U.S. data flop could also spark a euro rally. ECB’s Muller urged patience with current rates, warning China’s rare earth export curbs could reignite Eurozone inflation if they hit global supply chains. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.28 - 10 October high - Medium S1 150.20 - 7 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Sanae Takaichi, Japan’s LDP leader, is seeking support from the Japan Innovation Party (Ishin) to win the October 21 prime minister vote after her coalition’s collapse; their backing could make her the country’s first female PM, with shared policies boosting optimism despite Ishin’s conditional stance. Opposition parties like the CDP, DPP, and Ishin hold enough seats to challenge her but remain divided on security and energy issues, hindering a unified candidate led by DPP’s Yuichiro Tamaki. A Takaichi-Ishin alliance would signal fiscal continuity, spurring government spending, slower BOJ tightening, moderate yen weakness, rising equities, and higher bond yields—though skeptics doubt her ability to push bold plans amid LDP infighting and Japan’s 250% GDP debt load, likely leaving her with a weak minority government. BOJ’s Naoki Tamura urged gradual rate hikes to 1% neutral amid rising inflation, predicting early 2% target achievement despite politics, while US Treasury Secretary Bessent hinted Washington dislikes the yen’s weakness and expects it to stabilize with sound BOJ policy. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6573 - 10 October high - Medium S1 0.6473 - 10 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian Dollar has stabilized after Fed Chair Powell’s dovish speech endorsing an October rate cut and hinting at ending quantitative tightening, amid a lull in US-China trade tensions. Among G-10 currencies, the Australian Dollar is most vulnerable to escalations, but we expect a conciliatory Trump-Xi meeting at APEC to extend the November 10 tariff truce—making AUDUSD an attractive, especially if the RBA turns cautious on further cuts. Australia’s September jobs data disappointed, with employment rising only 14.9k (vs. 20k forecast), pushing unemployment to a 4-year high of 4.5% and participation to 67.0%; this softens the labor market, spiking odds of an RBA November rate cut to over 70% (fourth this year), though inflation concerns linger, while the government eyes productivity reforms to boost job absorption. | ||

| Suggested reading | ||

| Prediction Markets Can Solve The Fed’s Data Problem, D. Horstmeyer, Barron’s (October 14, 2025) The Economics of Running an AI Company, V. Tangermann, Futurism (October 15, 2025) | ||