| ||

| 27th August 2025 | view in browser | ||

| Trump’s Fed shake-up weakens Dollar | ||

| The U.S. dollar weakened in late trading as falling front-end rates reflected market expectations of a dovish Federal Reserve appointment under the Trump administration, with NEC Director Kevin Hassett suggesting Governor Cook may resign before the September meeting, potentially replaced by David Malpass. | ||

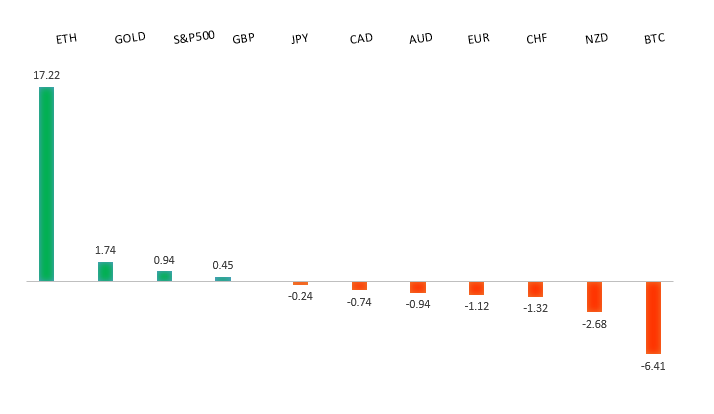

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1789 - 24 July high - Medium R1 1.1743 - 22 August high - Medium S1 1.1583 - 22 August low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro hovers below its July four-year high as the ECB signals a pause in rate cuts, citing strong labor markets and German business morale reaching a 15-month peak, contrasting with the Fed’s expected September easing. European bond yields, like Germany’s 10-year at 2.75% and France’s at 3.51%, rose amid fiscal concerns and reduced ECB cut expectations, while European stocks, led by semiconductors, saw modest gains. Trade tensions with the U.S. persist, with the EU planning to remove tariffs on U.S. goods in response to Trump’s demands. Upcoming Eurozone confidence data and Switzerland’s Q2 GDP, expected to slow to 0.1%, highlight diverging U.S.-Europe economic paths, likely shaping markets through 2025. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 148.52 - 12 August high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Japanese yen remained stable as investors awaited key economic data, particularly Tokyo’s inflation report, which could support further Bank of Japan rate hikes. Economists predict the “core-core” CPI will rise to 3.2%, driven by higher food and dining costs, while BOJ Governor Ueda’s hawkish comments signal confidence in sustained wage growth and inflation, potentially leading to an October rate increase. Japanese bond yields hit a 17-year high, reflecting these expectations, but market caution persists due to U.S. political uncertainties, including President Trump’s dismissal of Fed Governor Lisa Cook, raising concerns about central bank independence. The Nikkei 225 gained slightly, led by semiconductor stocks, while upcoming economic data will shape the yen’s trajectory and BOJ policy outlook. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Figure - Medium R1 0.6569 - 14 August high - Medium S1 0.6414 - 22 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar remained stable despite unexpectedly high inflation data, with July consumer prices rising to 2.8% year-on-year, surpassing forecasts of 2.3% and June’s 1.9%. Core inflation also climbed to 2.7%, complicating the Reserve Bank of Australia’s policy outlook, though markets still anticipate a rate cut in November due to the volatile nature of monthly inflation data. Australian bond yields rose, with the 10-year yield hitting 4.33%, reflecting the inflation surprise, while the RBA’s recent minutes suggested openness to rate cuts if inflation eases, creating uncertainty about future policy decisions. | ||

| Suggested reading | ||

| Attempting To Make Banks Big By Decree, J. Tamny, Forbes (August 26, 2025) It’s 1995 for AI, S. McBride, Risk Hedge (August 25, 2025) | ||