| ||

| 19th November 2025 | view in browser | ||

| UK CPI, Fed Minutes, Nvidia earnings anchor market focus | ||

| The Pound is holding steady ahead of the UK’s October CPI release, expected to ease, with softer household energy costs offsetting still-firm food and fuel prices. | ||

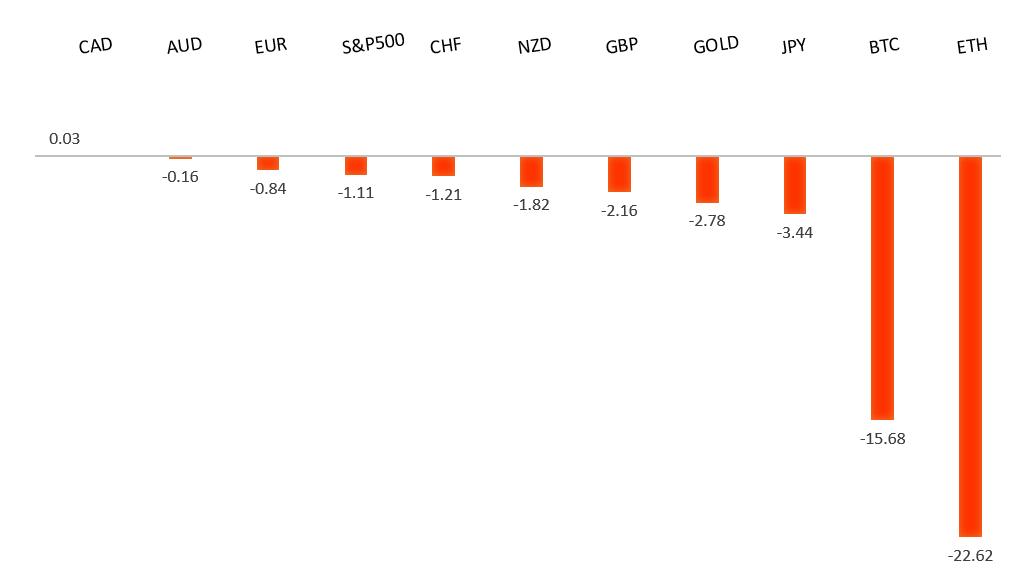

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The ECB has slightly eased banks’ capital requirements for 2026, reflecting confidence in a sector that is already strongly capitalized, with CET1 ratios far above minimum levels. This move frees up capital for lending and shareholder payouts, which can support bank stocks and strengthen the euro. One European bank analyst sees the euro as modestly undervalued and expects it to appreciate further, especially as upcoming U.S. economic data—delayed by the recent government shutdown—may weaken the dollar and reinforce expectations of a December Fed rate cut. This bank projects the euro to reach about $1.18 by year-end. | ||

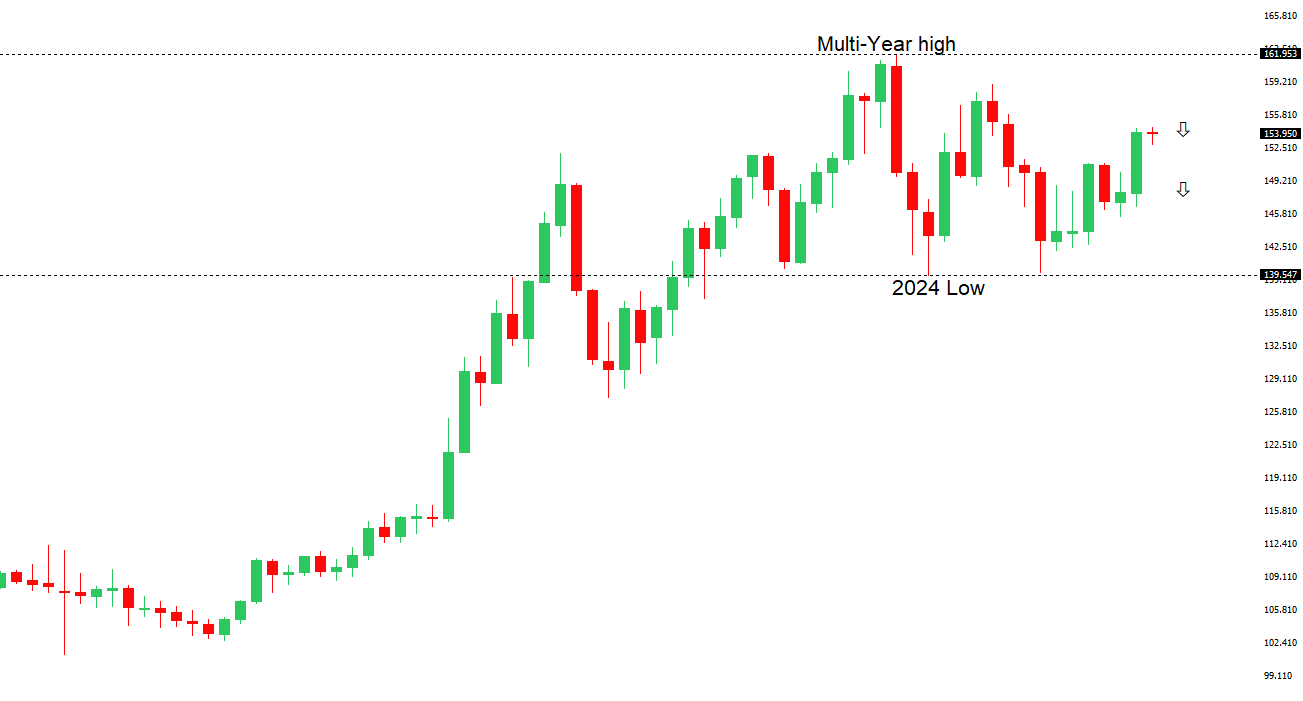

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped above 155.00. | ||

| ||

| R2 155.98 - 28 January high - Medium R1 155.74 - 18 November high - Medium S1 153.62 - 14 November low - Medium S2 152.82 - 7 November low - Strong | ||

| USDJPY: fundamental overview | ||

| Japan’s yen remains under pressure as traders test the limits of government tolerance, despite Finance Minister Katayama’s warnings. Weak GDP data and Prime Minister Takaichi’s upcoming large fiscal stimulus—possibly as high as ¥25 trillion—raise concerns that expanded bond issuance could further weigh on the currency. Diplomatic tensions with China and potential trade retaliation add another layer of downside risk. Meanwhile, BOJ Governor Ueda signals only gradual tightening, and markets increasingly expect a single near-term rate hike that may not be followed by more. With fiscal expansion looming and the yen sliding, upcoming meetings between Ueda and key cabinet ministers are drawing scrutiny for signs of intervention or shifts in policy coordination. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6458 - 5 November low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| China’s heightened tensions with Japan over comments on Taiwan and a risk-off slump in global equities have weighed on risk currencies like the AUD and NZD. Still, sentiment is partly supported by President Trump’s removal of U.S. tariffs on products including Australian beef, offering a boost to Australia’s export sector. Domestically, resilient economic indicators and steady wage growth suggest the RBA is likely to hold rates at 3.60% through next year, with recent data—such as improving leading indicators and stable wages—reinforcing a cautious, mildly hawkish stance. Forecasts point to steady GDP growth and slightly higher inflation into 2026, while economists note that although wage pressures remain contained, they continue to be a key consideration for the RBA’s inflation outlook. | ||

| Suggested reading | ||

| What if you could create the perfect stock from scratch?, C. Reilly, RiskHedge (November 17, 2025) This Is Not The Economic Paper You’re Looking For, J. Calhoun, Alhambra (November 16, 2025) | ||