Today’s report: Fed Lockhart Strengthens September Liftoff Prospect

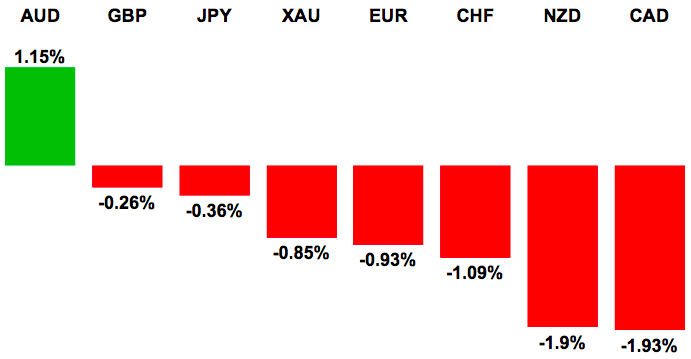

The market has been fixated on the timing of Fed liftoff and this has been the primary driver of broader price action. Tuesday’s hawkish Fed Lockhart comments have fueled another US Dollar surge and attention will now shift to today’s US ADP employment report for additional insight.

Wake-up call

Chart talk: Major markets technical overview video

- ADP employment

- UK construction

- Fed Lockhart

- Swiss CPI

- Aussie outperforms

- OIL bounce

- GDT disappoints

- Friday NFPs

- Sell-stops

- USDSGD

Suggested reading

- China Hopes To Defy History of Market Bailouts, S. McArdle, Bloomberg  (August 4, 2015)

- Has Greece Crisis Created Two-Speed Europe?, Q. Peel, Financial Times (August 4, 2015)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

Difficult to determine if the market is in the process of rolling back over below 1.0800, or if there is still room for a bounce around the figure and another run higher. Ultimately, the downtrend remains firmly intact and a lower top is sought out in favour of a bearish resumption towards the critical multi-year low from March at 1.0462. In the interim, any rallies are viewed as corrective, with only a break back above 1.1130 to take the immediate pressure off the downside.

EURUSD – fundamental overview

There is definitely a feel of lighter summer doldrum trade in the major pair, though solid offers continue to emerge into rallies. The highlight on Tuesday unquestionably came from Fed Lockhart, who said the US economy was ready for rate hikes. This opened some decent downside pressure in the major pair into the end of day, with the market trading back down towards recent lows in the 1.0800 area. Looking ahead, the key standouts on today’s economic calendar are Eurozone retail sales and a batch of data in the US including ADP employment, trade and ISM non-manufacturing.

GBPUSD – technical overview

Setbacks have been very well supported and the market could be looking to carve out a fresh higher low at 1.5350 in favour of the next major upside extension back towards and above the recent 2015 high at 1.5930. At this point, only back below 1.5350 would negate the constructive outlook and compromise the constructive outlook.

GBPUSD – fundamental overview

Not much going on for this pair at the moment, with the market differing to some quiet summer range trade. Tuesday’s softer UK construction data did weigh a bit, while hawkish comments from Fed Lockhart opened additional mild USD bids. There has also been talk of M&A related Sterling outflows, with UK Shire looking to acquire US based Baxalta. Looking ahead, second tier UK data is unlikely to factor and the market will focus on the US economic calendar, with ADP employment, trade and ISM non-manufacturing due.

USDJPY – technical overview

Although the broader uptrend remains firmly intact, the market has been showing signs of exhaustion off fresh multi-year highs at 125.85. The latest topside failure ahead of 125.00 opens the door for deeper setbacks in the sessions ahead, potentially towards the recent 121.32 multi-day low. Monthly studies are highly overbought and have been warning of the need for additional consolidation and correction to allow for these studies to unwind. As such, for the time being, rallies may continue to be well capped towards 125.00.

USDJPY – fundamental overview

Fed Lockhart’s comments that September would be an “appropriate time” for liftoff given the improved labour market and growth outlook, and that it would take a “significant deterioration in the economic picture” to convince him otherwise, have been the source of this latest bout of demand for the major pair. Clearly monetary policy divergence and interest rate differentials are critical drivers of price action here, and with the Fed official leaning to the hawkish side, fresh bids have emerged. Still, the market is trading into the Kuroda line ahead of 125.00 and with equity markets also under pressure, there have been a decent amount of offsetting flows to prevent USDJPY from really making a run. Looking ahead, the market will focus on the US economic calendar with ADP employment, trade and ISM non-manufacturing due.

EURCHF – technical overview

The market looks to be in the process of carving out a meaningful base. From here, there is risk for a recovery back towards the February 1.0815 peak, with any setbacks expected to be very well supported above 1.0575 on a daily close basis. However, ultimately, only a daily close below 1.0400 would delay the recovery outlook and give reason for pause.

EURCHF – fundamental overview

Recent price action in this cross rate has been rather interesting, with the market rallying in risk off settings and pulling back when risk comes back on. While risk on/risk off correlations are perhaps less relevant than they once were, the fact that the correlation has been a strong inverse correlation in recent days is what is perplexing. The most logical explanation for the price action is that the SNB has been committed to stepping in to weaken the Franc as risk comes off so that it can offset the safe haven Franc demand. But once risk appetite returns to global markets, the SNB no longer needs to intervene as natural forces are supportive of Franc outflows. Of course the danger with all this is if risk really comes off for a sustained period. At that point, it would mostly likely be difficult for the SNB to offset the flows and this would open another major bout of unwelcome Franc demand. But in the interim, the SNB can breathe out, with EURCHF well off extreme lows. Swiss CPI is the key economic release for this market on Wednesday.

AUDUSD – technical overview

The recent break back above 0.7350 has triggered a double bottom that could open the door for a push to 0.7500 in the sessions ahead. Ultimately however, the broader downtrend remains firmly intact and any gains should be very well capped ahead of 0.7800 in favour of the next lower top and bearish continuation.

AUDUSD – fundamental overview

Solid demand for the Australian Dollar this week, with the currency recovering from multi-year lows against the Buck on the back of above forecast Australia retail sales and trade data, and an RBA statement which finally showed satisfaction with the decline in the Australian Dollar. The RBA had been jawboning the currency lower over the course of the past several meetings and finally deviated from this line, instead acknowledging Aussie had adjusted to declines in commodities prices. Hawkish comments from the more centrist and sometimes dovish Fed Lockhart did however manage to take some of the wind out of the sails of the latest Aussie recovery, after the central banker said the timing was appropriate for a September Fed hike. Looking ahead, the market will focus on the US economic calendar with ADP employment, trade and ISM non-manufacturing due.

USDCAD – technical overview

The market is locked within a well defined, strong uptrend, pushing to fresh 11-year highs. However, with daily studies tracking in overbought territory, there is risk for some form of a meaningful corrective pullback in the sessions ahead to allow for these stretched studies to unwind. Ideally, any corrective declines should be well supported ahead of 1.2600, with a higher low sought out in favour of a bullish continuation.

USDCAD – fundamental overview

The Canadian Dollar hasn’t been able to catch a break of late, with the currency dropping to a fresh 11-year low in Tuesday trade. The Loonie had attempted an early day recovery rally, aided by a rebound in OIL prices from multi-day lows, but could not hold onto gains, with hawkish Fed Lockhart comments proving too much for CAD. Today, we get Canada trade data, though the market will likely be more focused on the batch of data out of the US which includes ADP employment, trade and ISM non-manufacturing. Of course, price action in the highly correlated OIL market will also play a major role in influencing the beaten down currency’s direction.

NZDUSD – technical overview

Daily studies have turned up from oversold territory, and there is risk for additional consolidation in the sessions ahead to allow for these studies to further unwind before the market considers a bearish continuation below the recent multi-year low at 0.6498. Still, any rallies should be well capped ahead of 0.6850 in favour of the existing downtrend.

NZDUSD – fundamental overview

The New Zealand Dollar has held up relatively well in the face of a slew of currency negative developments over the past several hours. Hawkish Fed Lockhart comments, another disappointing GDT auction, lower equities and a weaker New Zealand employment report have all weighed on the currency, though the market has managed to avoid an outright collapse below the 0.6500 area. Looking ahead, the market will focus on the US economic calendar with ADP employment, trade and ISM non-manufacturing due.

US SPX 500 – technical overview

The market has stalled out just shy of the May record high, with the lack of bullish momentum suggestive of exhaustion and warning of deeper setbacks ahead. Look for the latest topside failure to strengthen the bearish outlook in favour of deeper setbacks below the critical March low at 2040. At this point, only a break and daily close above 2137 would negate and open a bullish continuation to fresh record highs.

US SPX 500 – fundamental overview

Sellers continue to emerge into rallies ahead of the record high from May and there is a growing sense this market could be in the process of carving out some form of a material top. The reality of a September liftoff is something the equity market has not properly considered to date, but with Fed Lockhart saying a September rate hike would be appropriate, the market may be getting a little jittery with the idea the Fed will start taking free money off the table. More clarity will be offered in today’s ADP employment report, though clearly Friday’s NFPs will be the major volatility generator. Anything on the solid side will further cement September liftoff odds and could in turn trigger a more intensified liquidation.

GOLD (SPOT) – technical overview

The market remains under intense pressure, breaking to fresh multi-year lows below 1100. At this point, the downside break opens the door for the possibility of another drop towards major psychological barriers at 1000. However, it is worth noting that daily studies are oversold and there is room for a short-term bounce. But a daily close back above the previous 2015 base at 1142 would be required to take the immediate pressure off the downside.

GOLD (SPOT) – fundamental overview

The GOLD market remains under pressure at multi-year lows, with the prospect for a Fed rate hike and broad based US Dollar demand opening intense downside pressure in the beaten down metal. Speculative positioning has recently shifted to the short side and the market is now contemplating the next major drop down towards critical barriers at $1000. Friday comments from famed investor John Paulson that the yellow metal is now fairly valued haven’t really done anything to bolster demand this week, and the focus now shifts to today’s US ADP employment report. Dealers cite stops above 1140 and below 1070.

Feature – technical overview

USDSGD remains locked in a very well defined uptrend, with the market closing in on a retest of the multi-year peak from March at 1.3938. Look for any setbacks to now be very well supported ahead of 1.3500, while only a break back below 1.3284 would compromise and force a shift in the structure.

Feature – fundamental overview

The Singapore Dollar continues to extend declines and is fast approaching the multi-year low from earlier this year. Hawkish comments from Fed Lockhart that there is a “high bar” for not hiking rates at the September meeting have been one source for this latest bout of SGD weakness, while an IMF report that “significant work” is needed before Yuan reserve status in the SDR basket can be granted is also a fresh concern for the correlated emerging market currency. Looking ahead, today’s US ADP employment report will be important to watch for additional insight into the Fed liftoff timeline, which is looking more and more like September.