Special report: FOMC Minutes Preview

Today’s report: US CPI, FOMC Minutes to Offer Fed Timing Hints

It hasn’t been the busiest of weeks, with the combination of a light economic calendar and razor thin August trade playing a major part. Still, there is plenty of risk out there at the moment, with ongoing China uncertainty, a potential resurfacing in Greece troubles and the timing of Fed liftoff all capable of making waves.

Wake-up call

Chart talk: Major markets technical overview video

- second-tier data

- UK inflation

- US CPI

- safe-haven FX

- China equities

- OIL rebound

- Solid GDT

- FOMC Minutes

- Fed timing

- USDTRY

Suggested reading

- Market Bears Have Upper Hand, J. Mackintosh, Financial Times (August 18, 2015)

- Why Greece Can’t Fulfill Bailout’s Terms, L. Bershidsky, Bloomberg View (August 18, 2015)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

An impressive rebound in recent trade back to the 61.8% fib retrace of the May-July move suggests the market is more comfortable consolidating than anything else at the moment. A lot of choppy price action right now, though with the broader downtrend intact, any additional rallies should be very well capped below 1.1400. Ultimately, a break below 1.0800 would be required to open the door for fresh downside and a bearish continuation exposing the multi-year low from March at 1.0462.

EURUSD – fundamental overview

There hasn’t been a whole lot to drive price action this week, with the economic calendar in the Eurozone and US exceptionally light. Still, the Euro has been under decent pressure, with solid second-tier US data driving weakness. Tuesday’s better than forecast US housing starts is the latest such release, though building permits were a disappointment but didn’t seem to get any attention. Looking ahead, Wednesday should be a much busier day for the major pair, with the Eurozone current account and construction wetting participant appetites ahead of some highly anticipated US risk in the form of CPI and the FOMC Minutes.

GBPUSD – technical overview

Setbacks have been very well supported and the market could be looking to carve out a fresh higher low at 1.5350 in favour of the next major upside extension back towards and above the recent 2015 high at 1.5930. Look for a daily close above 1.5690 to confirm and accelerate gains. At this point, only back below 1.5350 would negate the constructive outlook and compromise the constructive outlook.

GBPUSD – fundamental overview

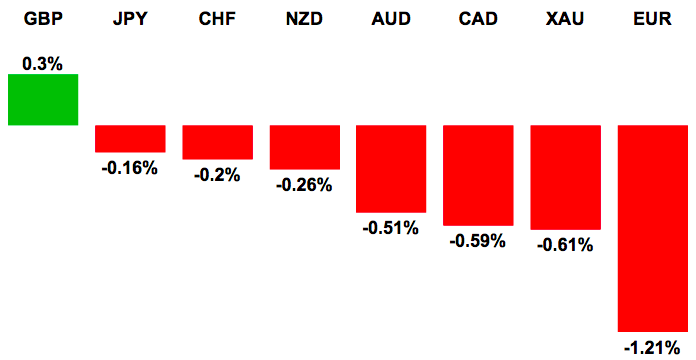

The Pound is back to outperforming this week, with Tuesday’s hotter UK CPI readings putting a sooner than later BOE rate hike back on the table. The market had been selling Pounds in the previous week on some softer data and a downbeat QIR report, but hawkish BOE Forbes comments set the tone in the early week and the UK currency has found renewed bids. The market could now be poised for a near-term retest of the 2015 high from June at 1.5930. Still, there is a good amount of risk in Wednesday trade, with US CPI and the FOMC Minutes ahead.

USDJPY – technical overview

The rally has been well capped around 125.00 and ahead of the critical multi-year peak from June at 125.85. Though the broader uptrend remains firmly intact, longer-term studies are well overbought and warn of some form of a more meaningful correction before any bullish trend resumption beyond 125.85. As such, look for the latest topside failure to trigger deeper setbacks, initially towards 123.00. Ultimately, only a daily close back above 125.85 would force a shift in the outlook.

USDJPY – fundamental overview

There wasn’t much of anything for Yen traders to chew on in Tuesday trade and the market was left consolidating in a tight range ahead of today’s busier session. Second-tier US housing data was the only data of note, with housing starts coming in better than forecast, while building permits offset this positive result with a weaker showing. Looking ahead, things are expected to heat up, with US CPI and the FOMC Minutes due for release. Everything hinges on the timing of Fed liftoff and whether the central bank will go ahead and raise rates next month, and today’s risk could do a good job of influencing investor expectations.

EURCHF – technical overview

The market looks to be in the process of carving a meaningful base since taking out key multi-day range resistance at 1.0575 several days back. This has opened the latest break above the February peak at 1.0815 which now exposes fresh upside towards psychological barriers at 1.1000 further up. At this point, daily studies are however a little stretched, so we are seeing a bit of a short-term retreat to allow for these studies to unwind. But any setbacks should be well supported ahead of 1.0575.

EURCHF – fundamental overview

The SNB has unquestionably benefitted from some razor thin summer trade, with the Franc selling off to more comfortable levels for the Swiss central bank. However, the selling has stalled out over the past few sessions and there are signs of renewed safe haven demand as China uncertainty and the threat of another blowup in Greece weigh on sentiment. Equity markets have been rolling over a bit over the past several days and should this liquidation intensify, it could open an unwelcome resurgence in Franc demand.

AUDUSD – technical overview

While the downtrend remains firmly intact, with the market breaking to yet another multi-year low in the previous week, there is risk for a period of consolidation in the days ahead to allow for some stretched studies to unwind before any meaningful bearish resumption. Still, rallies are expected to be well capped and look for any corrective gains to stall out ahead of 0.7700.

AUDUSD – fundamental overview

Not much of a reaction from the market to Tuesday’s RBA Minutes, which echoed the most recent monetary policy statement. The central bank said current policy was appropriate while also adding the weaker Australian Dollar was helping balance the economy. Aussie is mildly offered into Wednesday trade with most of the price action attributed to another hit to Chinese equities and some solid US housing starts. Volatility is expected to pick up in today’s trade with US CPI and the FOMC Minutes due for release. Early Wednesday Aussie Westpac leading indicators and skilled vacancies haven’t factored into price action.

USDCAD – technical overview

The market is locked within a well defined uptrend, recently pushing to fresh 11-year highs. However, with daily studies now unwinding from overbought territory, there is risk for some form of a more meaningful corrective pullback towards support at 1.2861 in the sessions ahead to allow for these stretched studies to unwind. Ultimately, any corrective declines should be well supported ahead of 1.2600, with a higher low sought out in favour of a bullish continuation.

USDCAD – fundamental overview

The Canadian Dollar has been better bid this week, with the beaten down currency recovering of recent 11 year lows against the Buck. The latest bout of Loonie strength has been driven off a decent bounce in OIL prices and news that Fitch has affirmed Canada’s AAA rating with a stable outlook. The Canadian economic calendar is empty on Wednesday, though this market is still likely to see a good amount of volatility with OIL flows and key US risk ahead in the form of CPI and the FOMC Minutes. The market has been looking for additional hints into the Fed’s next move and tomorrow’s US events could offer some more clarity over the likelihood for a September liftoff.

NZDUSD – technical overview

Daily studies are in the process of unwinding from oversold off fresh multi-year lows and there is risk for additional consolidation in the sessions ahead to allow for these studies to further unwind before the market considers a legitimate bearish continuation below 0.6500. Still, any rallies should be well capped ahead of 0.6850 in favour of the existing downtrend.

NZDUSD – fundamental overview

The New Zealand Dollar has been better bid in recent trade, with the commodity currency finally benefitting from a solid GDT auction which saw a welcome 14.8% rise. GDT auctions have been discouraging in recent months and the positive result has opened the door for some profit taking on Kiwi shorts. Also helping to support the currency is news that New Zealand companies will be permitted to sell dairy products after a 2 year ban. Finally, an early Wednesday release of a less negative New Zealand PPI print has helped to keep the currency supported on dips. Overall however, the currency is at risk for deeper declines as uncertainty in China becomes increasingly concerning, while yield differentials with the Fed become more pronounced. Looking ahead, key risk lies ahead in the form of US CPI and the FOMC Minutes.

US SPX 500 – technical overview

The market has stalled out just shy of the May record high, with the lack of bullish momentum suggestive of exhaustion and warning of deeper setbacks ahead. Look for the latest topside failure to strengthen the bearish outlook in favour of weakness below the critical March low at 2040. At this point, only a break and daily close above 2137 would negate and open a bullish continuation to fresh record highs.

US SPX 500 – fundamental overview

US equities aren’t exactly excited about solid US economic data these days, with the improvement in the US economy pushing the Fed closer to a rate liftoff and removal of current ultra accommodative central bank policy. This free money has served as an incentive to be buying risk assets since the early stages of the financial markets crisis, and if the Fed goes ahead and raises rates next month, the incentive will start to come off the table. And so, today’s US risk could play an influential role in price action with US CPI and the Fed Minutes due. Anything on the hotter side of consensus CPI forecasts will increase the odds of a September liftoff and almost certainly weigh on stocks. The Minutes are due later in the day and if they keep with the tone of recent Fed rhetoric, they should invite even more downside pressure on stocks.

GOLD (SPOT) – technical overview

Finally some signs of a potential base since breaking down to fresh multi-year lows below 1100. Still, the downtrend remains firmly intact and the market could be looking for a fresh lower top ahead of the next major downside extension towards critical psychological barriers at 1000. At this point a daily close back above the previous 2015 low at 1142 would be required to take the immediate pressure off the downside.

GOLD (SPOT) – fundamental overview

Much of the focus in the GOLD market right now is on the outlook of Fed policy and the timing of liftoff. GOLD has been hit hard over the past several months on the back of a resurgence in demand for the inversely correlated US Dollar. Wednesday’s US CPI readings and the FOMC Minutes will offer additional hints into the timing of liftoff and if the market perceives the risk as translating into a less hawkish Fed, this could invite additional demand for the yellow metal. Still, irrespective of the Wednesday risk, there have been some longer-term macro players that have stepped in to build into long GOLD positions at what they deem to be discounted levels below $1100.

Feature – technical overview

USDTRY remains locked in a well defined uptrend, with the market breaking to fresh record highs beyond 2.8000. From here, there is risk for the current gains to extend towards a measured move in the 2.9000 area, though with monthly technical readings through the roof, additional upside could be hard to come by. The monthly RSI reading is tracking at a violently overbought level of 85, quite often a red flag for some form of a reversal the other way.

Feature – fundamental overview

Another miserable day for the Turkish Lira, which fell by over 1% to a fresh record low against the Buck. The latest weakness comes on the back of a CBRT rate decision which produced no rate hikes, despite the intense slide in the emerging market currency. There has been a lot of pressure on the central bank to refrain from raising rates, though the CBRT is caught between a rock and a hard place, with the failure to tighten inviting the more aggressive Lira depreciation. Efforts to impliment alternative tools have failed to slow declines thus far after the central bank said it would sell more US Dollars in its daily auction. Turkey is already contending with intense political uncertainty with the government falling apart and an early election on the horizon.