Special report: Monday Reflections and Key Levels

Today’s report: Bloodbath Intensifies in Monday Trade

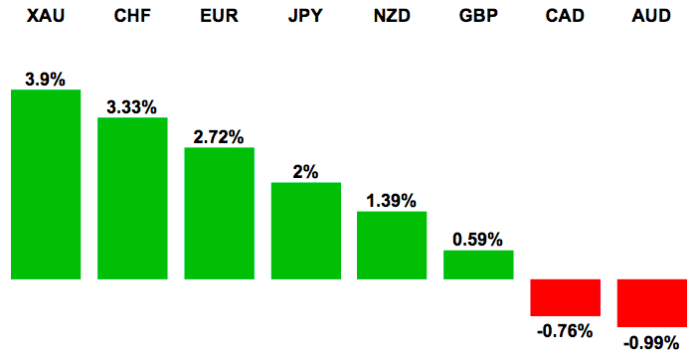

The bloodbath has spilled over into Monday, with the Shanghai Index obliterated. The Dollar has been trading with mixed emotion, as it remains quite strong against risk correlated currencies, but shows weakness against the majors. The Euro is at multi-month highs, while Aussie, Cad and OIL sink to fresh multi-year lows.

Wake-up call

Chart talk: Major markets technical overview video

- China collapse

- Shifting landscape

- Fed Lockhart

- Franc inflows

- identity crisis

- sliding OIL

- positives

- capitulationÂ

- finding comfort

- USDTRY

Suggested reading

- Money Managers Split On Stock Market Plunge, A. Mahmudova, MarketWatch (August 21, 2015)

- Promise and Peril of Macroprudential Policy, B. Eichengreen, Project Syndicate (August 7, 2015)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has gone parabolic, surging through several short-term resistance levels to break to a fresh multi-month high above 1.1467. Daily studies are now starting to look a little stretched and the market could be poised for a bearish resumption in the sessions ahead. A daily close above 1.1500 would negate this possibility and open a more significant structural shift. However, inability to close above 1.1500 will keep the focus on the downside.

EURUSD – fundamental overview

The Euro has been a standout outperformer in recent trade, with the single currency rocketing higher against the Buck to fresh multi-month highs in the 1.1500 area. The move has been driven off a scaling back in expectations for a Fed rate hike next month, with China deteriorating and global equities under violent pressure. This has shifted yield differentials back in the Euro’s favour a bit and the market is in the process of some repositioning. Still, there is risk these bullish Euro bets may be getting a little ahead of themselves, with the uncertain environment also potentially welcoming stronger safe haven US Dollar flows. Fed Bullard also was out warning against leaving rates too low for too much longer and this could play into price action in a more liquid Monday session. Looking ahead, we get Eurozone and German PMIs followed by some second-tier data in the US. Fed Lockhart is scheduled to speak late in the day.

GBPUSD – technical overview

Setbacks have been very well supported and the market could be looking to carve out a fresh higher low at 1.5350 in favour of the next major upside extension back towards and above the recent 2015 high at 1.5930. Look for a close above 1.5690 on Friday to confirm and accelerate gains. At this point, only back below 1.5350 would negate the constructive outlook and compromise the constructive outlook.

GBPUSD – fundamental overview

The Pound continues to be well supported on dips amidst a bout of broad based profit taking on USD long positions. Scaled back expectations for a Fed liftoff have been driving most of the price action, with many believing the Fed will now sit back and do nothing in September, in light of the ongoing slide in OIL prices, lower equities and deteriorating fundamentals in China. Still, with many expecting the Bank of England to be next in line to raise rates behind the Fed, the scaling back in Fed rate hike bets has indirectly weighed on the Pound, with participants also scaling back Bank of England bets. This has prevented the Pound from making any serious upside moves. Additionally, gains have also been tempered by offsetting data last week after UK inflation was hotter, while UK retail sales disappointed . Looking ahead, the economic calendar for Monday is exceptionally thin with no UK data and only second tier data out of the US. Fed Lockhart is scheduled to speak late in the day.

USDJPY – technical overview

Though the broader uptrend remains firmly intact, longer-term studies are now rolling over from overbought and in the process of unwinding those stretched studies. As such, look for deeper setbacks towards 120.00 in the sessions ahead. Friday’s daily close below 123.00 confirms. Ultimately, only a daily close back above 123.50 would force a shift in the outlook.

USDJPY – fundamental overview

The Yen has been a strong outperformer in recent trade, with the currency benefitting on two fronts. We have seen a resurgence in demand on the back of scaled back Fed interest rate hike expectations following last week’s more dovish FOMC Minutes. Meanwhile, the sharp drop in global equities has also been fueling demand, with market participants liquidating risk assets and moving back into funding currencies. Looking ahead, there is very little on the economic calendar for Monday and a speech from Fed Lockhart could very well be the biggest event of the day.

EURCHF – technical overview

The market looks to be in the process of carving a meaningful base since taking out key multi-day range resistance at 1.0575 several days back. This has opened the latest break above the February peak at 1.0815 which now exposes fresh upside towards psychological barriers at 1.1000 further up. At this point, daily studies are however a little stretched, so we are seeing a bit of a short-term retreat to allow for these studies to unwind. But any setbacks should be well supported ahead of 1.0575.

EURCHF – fundamental overview

The SNB has unquestionably benefitted from some razor thin summer trade, with the Franc selling off to more comfortable levels for the Swiss central bank. However, the Franc selling has stalled out over the past few sessions and there are signs of renewed safe haven demand as equities collapse, China uncertainty intensifies and OIL continues to slide. It is actually impressive the Franc has remained relatively offered in the face of the broader risk liquidation. But if this risk liquidation keeps up, it could spell trouble major trouble for the SNB. Overall, with the SNB balance sheet ballooning to around 85% of GDP, it is unlikely there is a lot left in the tank for future interventions.

AUDUSD – technical overview

The market has broken down to a fresh multi-year low below the previous recent base at 0.7215 and this sets the stage for a deeper drop towards psychological barriers at 0.7000. A daily close below 0.7215 will confirm and accelerate declines, while inability to do so will suggest more consolidation before the next major drop. Ultimately, only back above 0.7440 negates and takes the pressure off the downside.

AUDUSD – fundamental overview

The Australian Dollar isn’t too sure which way to break right now, with the currency tempted to move in both directions. Broad based USD selling on the back of scaled back Fed liftoff bets has been helping to keep the currency supported, while a downturn in global sentiment on deteriorating fundamentals in China have put a solid cap on gains. Looking ahead, the market will continue to digest these latest developments, while monitoring the price action in broader FX and risk assets for directional insight. The economic calendar for Monday is quite light, with some second tier US data and a Fed Lockhart speech standing out.

USDCAD – technical overview

The market is locked within a well defined uptrend, pushing to fresh 11-year highs and closing in on next major psychological barriers at 1.3500. However, with medium-term studies looking stretched, there is risk for some form of a meaningful corrective pullback in the sessions ahead to allow for these stretched studies to unwind. Ultimately however, any corrective declines should be well supported with a higher low sought out in favour of a bullish continuation.

USDCAD – fundamental overview

The Canadian Dollar is still having a very tough time catching any breaks, with the currency remaining under pressure just off fresh 11 year lows against the Buck, despite scaled back Fed rate hike expectations and some solid Friday Canada data. On Friday, Canada inflation was basically in line with forecasts while Canada retail sales where a good deal stronger. And yet the Loonie couldn’t hold onto any post data gains, with the currency continuing to be driven off the price action in OIL. OIL has dropped to yet another multi-year low on Monday, breaking below critical psychological barriers at $40. The setbacks in OIL are increasing bets for additional accommodation from the Bank of Canada, and this is offsetting any lure of the Canadian Dollar on scaled back Fed bets. Looking ahead, the Canada calendar is empty, with only second tier US data due along with a Fed Lockhart speech.

NZDUSD – technical overview

Daily studies are in the process of unwinding from oversold off fresh multi-year lows and there is risk for additional consolidation in the sessions ahead to allow for these studies to further unwind before the market considers a legitimate bearish continuation below 0.6500. Still, any rallies should be well capped ahead of 0.7000 in favour of the existing downtrend.

NZDUSD – fundamental overview

Some welcome relief for the New Zealand Dollar last week, with the currency finally finding a few things to prop it up. A solid GDT auction result and not as soft PPI data have contributed to Kiwi’s recovery, while the currency is also now benefitting on the yield differential front after the FOMC Minutes came in more dovish than expected. This has opened some broad based profit taking on USD longs which could invite additional Kiwi upside in the sessions ahead. Still, overall, with risk sentiment starting to falter, global equities on the slide and China uncertainty hanging in the balance, any rallies are expected to be met with good offers from medium-term players. Softer New Zealand inflation and consumer confidence readings are also a reminder that the RBNZ will most likely be preparing for more rate cuts at upcoming meetings. Looking ahead, the economic calendar for Monday is quite light, with some second tier US data and a Fed Lockhart speech standing out.

US SPX 500 – technical overview

The recent breakdown below 2040 has been a significant development, with the move confirming the formation of a major top off record highs. We have since seen an acceleration of declines, with the market crashing through a measured move downside extension objective at 1940, stalling just shy of 1900 thus far. Technical studies are now looking violently stretched intraday, so there is risk for some corrective upside towards 2000 before the market looks to carve the next lower top for a bearish continuation below 1900.

US SPX 500 – fundamental overview

Stock market declines have intensified dramatically these past few sessions, with participants increasingly fearful of the fact there is little left for the Fed to do to support stocks. The most bearish development for the market came last Wednesday when investors failed to find any confidence in a more dovish FOMC Minutes which resulted in a scaled back expectation for Fed liftoff. Accommodative Fed policy has driven stocks to record highs and investors have been quick to add to positions at any sign of dovishness from the Fed over the past several years. As such, inability to rally on last Wednesday’s dovish Minutes has resulted in a wave of profit taking. Clearly the ongoing deterioration in China and slide in OIL prices has not helped to inspire much confidence.

GOLD (SPOT) – technical overview

Finally signs of a potential base since breaking down to fresh multi-year lows below 1100. The latest break and close back above the previous 2015 base at 1142 strengthens the recovery outlook and could open the door for additional upside towards 1233 over the coming days. Look for any setbacks to now be well supported on dips ahead of 1100. Only a daily close below 1100 negates and puts the pressure back on the downside.

GOLD (SPOT) – fundamental overview

GOLD continues to mount an impressive recovery out from recent multi-year lows below $1100. The metal has managed to extend gains on a combination of a more dovish than expected FOMC Minutes, which fueled broad based selling in the US Dollar, and a pickup in safe haven demand with risk assets rolling over. The threat of risk associated with China and the deterioration in emerging markets has finally invited renewed demand for the beaten down yellow metal.

Feature – technical overview

USDTRY remains locked in a well defined uptrend, with the market breaking to fresh record highs beyond 3.0000. However, at this point, with technical readings through the roof, additional upside should be limited. Daily, weekly and monthly RSI readings are tracking in severe overbought territory, in need of some form of decent corrective pullback before a bullish trend resumption. Look for last Thursday’s bearish close off record highs to potentially act as the catalyst for a deeper correction.

Feature – fundamental overview

While the more dovish than expected FOMC Minutes may have stalled the depreciation in the Lira for the moment, the currency is going to need a lot more help right now to extend its recovery from last week’s record lows. Even though the Fed Minutes were more dovish, the Fed is still moving towards a rate hike this year. The Lira is contending with a toxic combination of variables which on top of the Fed policy divergence theme include a broken down Turkish government, deteriorating Chinese economy and an already tight CBRT policy that is strangling the local economy. Turkish economic minister Zeybacki has been doing his best to slow the depreciation in the Lira, focusing on the country’s positives which include the budget gap being among the ‘world’s best’ and the ‘magnificent recovery’ of the current account over the past two years. Still, overall, it is a tough road ahead for the Lira.