Today’s report: Risk Assets Shrug Off Latest China Measures

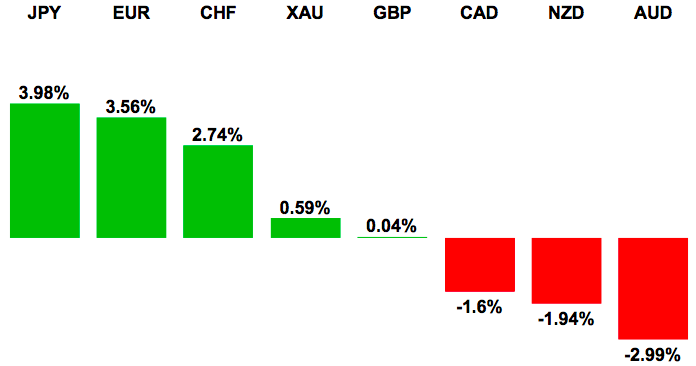

Market reaction to the latest China interest rate and RRR cuts has been less than inspiring, with risk correlated assets already coming back under pressure into the Tuesday close. The economic calendar for Wednesday is exceptionally thin, however, US durable goods orders and a Fed Bullard speech will get attention.

Wake-up call

Chart talk: Major markets technical overview video

- interesting correlation

- Light calendar

- Yen recovers

- negative sentiment

- November RBA

- OIL slide

- Kiwi trade

- CB accommodation

- Recovery stalls

- USDTRY

Suggested reading

- What To Expect From Fed’s Jackson Hole Meeting, M. El-Erian, Bloomberg View (August 24, 2015)

- Commodity Suffer After China’s “Black Mondayâ€, F. Bermingham, GTR (August 25, 2015)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has finally calmed down after surging through several short-term resistance levels to a fresh multi-month high at 1.1715. The bullish price action exposes the next major resistance zone in the the 1.1825-1.1875 area further up. But daily studies are looking rather stretched and the market could also be poised for a medium-term bearish resumption in the sessions ahead. A daily close back below 1.1370 will be required to strengthen this prospect and put the pressure back on the downside.

EURUSD – fundamental overview

The most interesting thing about the Euro right now is the inverse correlation it’s sharing with equities. The news of China’s interest rate and RRR cuts opened an impressive resurgence in risk appetite on Monday, and this resulted in some renewed Euro selling. However, the late Monday sell-off in stocks translated into a fresh round of Euro buying, with the single currency recovering back towards the daily high. It seems risk off price action is helping the Euro as participants look to diversify away from the US Dollar now that Fed rate expectations have been scaled back. Conversely, any recovery in equities is viewed as stabilizing and puts the prospect for sooner Fed rate hikes back on the table. Looking ahead, there in no data scheduled today on the Eurozone calendar, while in the US, the key focus will be on durable goods orders and Fed Dudley comments.

GBPUSD – technical overview

Setbacks have been very well supported and the market could be looking to carve out a fresh higher low at 1.5350 in favour of the next major upside extension back towards and above the recent 2015 high at 1.5930. Monday’s bullish close above 1.5690 strengthens the constructive outlook. At this point, only back below 1.5350 would negate.

GBPUSD – fundamental overview

The data light economic calendar out of the UK has left the Pound trading off broader macro flows and sentiment. Nothing changes today, with second-tier UK data unlikely to factor. Overall, the prospect of a scaled back Fed rate hike timeline has been weighing on the Pound as well, with the BOE closest to the Fed in terms of policy reversal timing. As such, any delays from the Fed should translate into delayed expectations for a BOE rate hike. Looking ahead, US durable goods orders and a Fed Dudley speech are the key standouts on today’s calendar.

USDJPY – technical overview

The market has finally rolled over after stalling out ahead of the multi-year high from June at 125.85. Monthly technical studies were severely overbought and warned of such a correction, and the pullback has not let down, with the market collapsing back towards 116.00 ahead of the latest minor consolidation. From here, the market could be looking for a medium-term higher low above 115.00 ahead of a bullish resumption, though at this point, more consolidation is expected before any directional breakout moves.

USDJPY – fundamental overview

The Yen is back to trading off older, traditional risk correlations, with the currency finding strong demand over the past few sessions as equity markets collapse and risk comes off. Concern over the China outlook has been a major thorn at investor’s sides, and this has led to broad based risk liquidation and a reversal of flows back into the Yen. Early Tuesday Yen weakness in the aftermath of a China interest rate and RRR cut could not be sustained, and with stocks once again selling off into the Tuesday close, the Yen was also once again finding bids. Looking ahead, price action in stock markets will continue to dictate direction, while on the calendar, US durable goods and a Fed Dudley speech are the key standouts.

EURCHF – technical overview

The market looks to be in the process of carving a meaningful base since taking out key multi-day range resistance at 1.0575 several days back. This has opened the latest break above the February peak at 1.0815 which now exposes fresh upside towards through psychological barriers at 1.1000 and towards 1.1500 further up. Any setbacks should now be well supported ahead of 1.0575.

EURCHF – fundamental overview

It is incredibly impressive the Franc has remained relatively offered in the face of the broader risk liquidation. But if this rotation away from risk assets keeps up, it could spell major trouble for the SNB. Overall, with the SNB balance sheet ballooning to around 85% of GDP, it is unlikely there is a lot left in the tank for future interventions.

AUDUSD – technical overview

Setbacks have accelerated sharply to the downside to yet another multi-year low, with the market stalling just shy of critical psychological barriers at 0.7000. At this point, technical studies are unwinding from stretched levels, and there is risk for some choppy consolidation in the sessions ahead before the possibility of a bearish resumption below 0.7000. Any rallies should continue to be well capped below 0.7440.

AUDUSD – fundamental overview

The Australian Dollar hasn’t found much comfort in the latest China interest rate and RRR cuts, with the currency under pressure, just off its Monday multi-year low. RBA Stevens was out in the early session adding some bearishness after saying the potential for growth may be lower than the central bank had been expecting. Clearly the downturn in China is having a negative impact on the correlated Australian economy and this has been reflected in the price action, with Aussie lower and odds for a 25bp November RBA rate cut increasing to 76% from 48% last Friday. Looking ahead, risk sentiment will be a major driver of price action, while on the calendar, US durable goods and a Fed Dudley speech are the key standouts.

USDCAD – technical overview

The market is locked within a well defined uptrend, pushing to fresh 11-year highs and closing in on next major psychological barriers at 1.3500. However, with medium-term studies looking stretched, there is risk for some form of a meaningful corrective pullback in the sessions ahead to allow for these stretched studies to unwind. Ultimately however, any corrective declines should be well supported with a higher low sought out ideally above 1.2860 in favour of a bullish continuation.

USDCAD – fundamental overview

The Canadian Dollar has extended declines to another fresh 11-year low despite some stabiization in markets post Monday’s equities collapse. China measures to cut interest rates and the RRR may have helped the Loonie a bit, but with the currency still a victim of declining OIL prices, it continues to be difficult to attract any meaningful interest. The weakness in OIL has resulted in a pricing in of additional rate cuts from the Bank of Canada in the months ahead which has factored into Cad weakness. Looking ahead, the Canadian economic calendar is empty, with the key events coming in the form of US durable goods and a Fed Dudley speech.

NZDUSD – technical overview

Daily studies are in the process of unwinding from oversold off a violent decline to fresh multi-year lows and there is risk for additional consolidation in the sessions ahead to allow for these studies to further unwind before the market considers a legitimate bearish continuation below 0.6130. Still, any rallies should be well capped below 0.6740 in favour of the existing downtrend.

NZDUSD – fundamental overview

The New Zealand Dollar has done a formidable job recovering out from a violent Monday drop to fresh multi-year lows. The recovery has coincided with a recovery off the lows in equities and has been helped along with the news of the latest China interest rate and RRR cuts. However, with stocks selling off into the Tuesday close and shrugging off the newest China measures, there is risk Kiwi will come back under pressure. Local data early Wednesday has not been supportive, with New Zealand trade coming in on the softer side. Looking ahead, US durable goods and a Fed Dudley speech are the key standouts.

US SPX 500 – technical overview

The recent breakdown below 2040 has been a significant development, with the move confirming the formation of a major top off record highs. We have since seen a rapid acceleration of declines, with the market crashing through a measured move downside extension objective at 1940, stalling just shy of 1800 thus far. Technical studies are now unwinding a bit from super stretched readings, so there is risk for some additional consolidation before the market looks for a bearish continuation below 1800. Still, any rallies are now expected to be well capped below 2000.

US SPX 500 – fundamental overview

An early Tuesday move from China to cut interest rates and the RRR helped lift stocks further away from recent extreme lows, though the China measures didn’t seem to have any lasting impact on sentiment. Fresh sell interest has emerged into rallies and even with the Fed likely to hold off in September, investors are becoming increasingly uneasy with a shaky global economic outlook and a Fed that can no longer offer much more in the way of accommodation. Over the past week, we have seen a dovish FOMC Minutes and further PBOC accommodation have little positive impact on risk assets, something that should be a worrying development for bulls.

GOLD (SPOT) – technical overview

Finally signs of a potential base since breaking down to fresh multi-year lows below 1100. The latest break and close back above the previous 2015 base at 1142 strengthens the recovery outlook and could open the door for additional upside towards 1233 over the coming days. Look for any setbacks to now be well supported on dips ahead of 1100. Only a daily close below 1100 negates and puts the pressure back on the downside.

GOLD (SPOT) – fundamental overview

GOLD has come under pressure over the past few sessions, with the recovery stalling out after some stability returned to markets post a major shake-up. The stability has invited resurgence in demand for risk assets, which has made the yellow metal less attractive. China’s latest interest rate and RRR cuts have contributed to the pullback. Still, overall, risk markets are looking quite unsettled at the moment and this should continue to invite demand for the safe haven metal on dips.

Feature – technical overview

USDTRY remains locked in a well defined uptrend, with the market breaking to fresh record highs beyond 3.0000. However, at this point, with technical readings through the roof, additional upside should be limited. Daily, weekly and monthly RSI readings are tracking in severe overbought territory, in need of some form of decent corrective pullback before a bullish trend resumption. Look for last Thursday’s bearish close off record highs to potentially act as the catalyst for a deeper correction.

Feature – fundamental overview

Nothing new from the CBRT Minutes and the Lira has reacted accordingly, comfortably consolidating in a tight range. But overall, the combination of already tight CBRT policy, political uncertainty, failing emerging markets and a Fed still on pace for a rate hike in the months ahead, should keep the Lira trading near its recent record lows against the Buck.