Today’s report: What A Difference A Week Makes

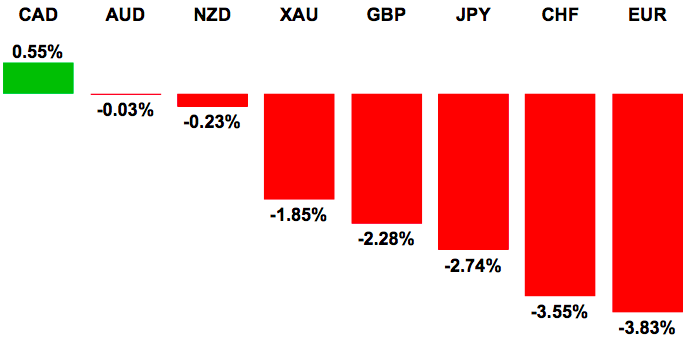

We enter the new week with US Dollar regaining momentum. The combination of stabilization in China, solid US economic data and some hawkish Jackson Hole comments from various Fed officials have all put the prospect for a September liftoff back on the table. For today, look out for end of month flow volatility.

Wake-up call

Chart talk: Major markets technical overview video

- Eurozone CPI

- Pound supported

- Hawkish Fischer

- Swiss GDP

- RBA decision

- current account

- business confidence

- Jackson Hole

- safe-haven demand

- USDSGD

Suggested reading

- What If 2008 Crisis Comes Around Again?, C. Crook, Bloomberg View (August 30, 2015)

- Stanley Fischer Talks Inflation, S. Ro, Business Insider (August 29, 2015)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The bearish performance over the past several sessions suggests the market could finally be done with its run to the topside after overshooting resistance at 1.1467 and trading all the way up to a fresh multi-month high at 1.1715. The medium-term downtrend is still very much intact and deeper setbacks over the coming sessions below 1.1100 will strengthen the downtrend resumption case and suggest a medium-term lower top is now in place. However, inability to close below 1.1100 will leave the door open for a resumption of gains back towards and through 1.1715.

EURUSD – fundamental overview

Mixed Eurozone economic, consumer confidence data and German inflation readings failed to materially impact the single currency on Friday, with the market more focused on broader macro themes. US economic produced some disappointment, with Michigan confidence coming in softer, though this too failed to have any influence. The Euro was weighed down mostly by Fed Fischer comments, after the Fed Vice Chair said the policy skew was towards tightening and that inflation didn’t need to be at 2% for the Fed to raise rates. With September now back on the table in light of Jackson Hole comments, overall solid US data and a more stable China, yield differentials are moving back in the Dollar’s favour. Looking ahead, German retail sales and Eurozone CPI are the standout releases in the European session, while in the US, we get Chicago PMIs. Also not to be overlooked are end of month flows.

GBPUSD – technical overview

Despite the latest round of intense declines below 1.5500, the broader structure is still constructive while the market holds above 1.5350 on a daily close basis, which also happens to coincide with the 200-Day SMA. However, a daily close below the 200-Day SMA will open the door for a fresh wave of declines towards 1.5000 and take the immediate pressure off the topside.

GBPUSD – fundamental overview

A relatively in line UK GDP print and some softer US data on Friday have helped to keep the Pound somewhat supported on dips towards the 200-Day moving average. But overall, the UK currency has come back under pressure against the Buck in recent days, with most of the flow moving on yield differentials. Comments out from various Fed officials at Jackson Hole were mostly on the hawkish side, and this in conjunction with last week’s blowout US durable goods and GDP prints, and a more stable China, has brought the chances for a September rate hike back to life. Looking ahead, Chicago PMIs are due, while end of month flows should not be overlooked.

USDJPY – technical overview

The market has finally rolled over after stalling out ahead of the multi-year high from June at 125.85. Monthly technical studies were severely overbought and warned of such a correction, and the pullback has not let down, with the market collapsing back towards 116.00 ahead of the latest sharp bounce. But rallies are now classified as corrective, and the market could be looking to carve out a fresh lower top ahead of 122.00 in favour of the next downside extension. Only a daily close back above 122.00 would negate the newly adopted bearish outlook and take the pressure off the downside.

USDJPY – fundamental overview

The impressive recovery may be starting to fizzle out, with the market still not feeling too confident about risk correlated assets. The Yen was sold off the extreme lows from last Monday on the back of a wave of China stimulus, solid US economic data and hawkish comments from Fed Vice Chair Fischer and Fed Lockhart out of Jackson Hole. Fischer said the Fed’s policy skew was towards tightening, while Lockhart talked about a 50/50 chance for a September rate hike. Remember, just a week ago, the market had pretty much entirely priced out the possibility for a September liftoff. But a lot has changed since last Monday and this change has supported the major pair. Still, the China recovery is very much in question and this could once again inspire safe haven Yen demand going forward. Elsewhere, there has been little reaction to much softer Japan industrial production. Looking ahead, Chicago PMIs are due, while end of month flows should not be overlooked.

EURCHF – technical overview

The market looks to be in the process of carving a meaningful base since taking out key multi-day range resistance at 1.0575 several days back. This has opened the latest break above the February peak at 1.0815 which now exposes fresh upside through psychological barriers at 1.1000 and towards 1.1500 further up. Any setbacks should now be well supported ahead of 1.0575.

EURCHF – fundamental overview

The 180 in investor sentiment from just one week ago has been a welcome development for this correlated cross rate, which has retained a bid tone. Overall however, there is still a lot of uncertainty out there, and investors are growing increasingly wary of the impact of stimulatory moves by central banks and governments. As such, if the risk market does come back under pressure, it could spell major trouble for the SNB. The SNB balance sheet has ballooned to around 85% of GDP, which means it is unlikely there is a lot left in the tank for future interventions. Friday’s better than expected Swiss GDP data won’t do anything to help the SNB’s cause.

AUDUSD – technical overview

Setbacks have accelerated sharply to the downside to yet another multi-year low, with the market stalling just shy of critical psychological barriers at 0.7000. At this point, technical studies are unwinding from stretched levels, and there is risk for some choppy consolidation in the sessions ahead before the possibility of a bearish resumption below 0.7000. Any rallies should however be well capped below 0.7440.

AUDUSD – fundamental overview

A batch of second-tier Aussie data out early Monday hasn’t done much to factor into price action, with the results mostly in line with forecasts. The ongoing focus for the Australian Dollar remains yield differentials and the health of the Chinese economy. While Aussie has been supported off recent multi-year lows on a stabilization in China following the latest stimulus measures, the currency is getting sold into rallies with the market once again talking about Fed liftoff and the possibility for a September rate hike. The RBA is due out with its next decision tomorrow and although no change is expected on rates, softer inflation and housing readings should keep the central bank on the dovish side. Looking ahead to today, Chicago PMIs are due, while end of month flows should not be overlooked.

USDCAD – technical overview

The market is locked within a well defined uptrend, pushing to fresh 11-year highs and closing in on next major psychological barriers at 1.3500. However, with medium-term studies looking stretched, there is risk for some form of a meaningful corrective pullback in the sessions ahead to allow for these stretched studies to unwind. Ultimately, any corrective declines should be well supported with a higher low sought out ideally above 1.2860 in favour of a bullish continuation.

USDCAD – fundamental overview

The Canadian Dollar has been showing some signs of wanting to make a little run for itself in recent sessions after dropping to 11-year lows against the Buck. Friday’s strong recovery in the price of OIL has been a major factor in recent price action, with the correlated Loonie benefitting from the resurgence in demand for the commodity. Still, with the odds for a September Fed liftoff increasing following hawkish Jackson Hole comments, any gains for the Loonie have been limited thus far. Looking ahead, the Canada current account balance is due later in the day along with Chicago PMIs. End of month flows should also not be overlooked.

NZDUSD – technical overview

Daily studies are in the process of unwinding from oversold off a violent decline to fresh multi-year lows and there is risk for additional consolidation in the sessions ahead to allow for these studies to further unwind before the market considers a legitimate bearish continuation below 0.6130. Still, any rallies should be well capped below 0.6740 in favour of the existing downtrend.

NZDUSD – fundamental overview

Solid Kiwi building permits data has been more than offset by the subsequent activity outlook and business confidence releases, both coming in a good deal weaker than previous. This adds more to the case for additional RBNZ rate cuts and the New Zealand Dollar has been underperforming in the early week as a result. Kiwi has also been weighed down on broader flows in the Buck’s favour, with solid US data last week being followed up by hawkish Jackson Hole Fed comments. Looking ahead, Chicago PMIs are due, while end of month flows should not be overlooked.

US SPX 500 – technical overview

The recent breakdown below 2040 has been a significant development, with the move confirming the formation of a major top off record highs. We have since seen a rapid acceleration of declines, with the market crashing through a measured move downside extension objective at 1940, stalling just shy of 1800 thus far. Technical studies are now unwinding from super stretched readings, so there is risk for some additional consolidation before the market looks for a bearish continuation below 1800. Still, any rallies are now expected to be well capped below 2032.

US SPX 500 – fundamental overview

China has done its best to inspire renewed confidence in risk markets after last week’s impressive round of PBOC accommodation and stimulus. This has helped the market extend its recovery off the recent collapse. Still, overall, investors are becoming increasingly uneasy with a shaky global economic outlook and finding confidence in central bank measures that are only being implemented because things are not so good. Moreover, with US economic data looking healthier on the hole, and with Fed officials sounding hawkish over the weekend at the Jackson Hole Symposium, there is increasing risk investors will once again look to exit long positions as Fed monetary policy long incentives fade into the sunset.

GOLD (SPOT) – technical overview

Finally signs of a potential base since breaking down to fresh multi-year lows below 1100. The recent recovery back above the previous 2015 base at 1142 strengthens the outlook and could open the door for additional upside towards 1233 over the coming days. Look for the latest round of setbacks to now be well supported on dips ahead of 1100. Only a daily close below 1100 negates and puts the pressure back on the downside.

GOLD (SPOT) – fundamental overview

A resurgence in the price of GOLD on the back of a massive wave of risk liquidation was offset in the latter half of last week after China stepped up with risk supportive measures in the form of interest rate and RRR cuts and a CNY140bln liquidity injection via SLO. But overall, there is still plenty of uncertainty out there, and with US stocks starting to show signs of topping off record highs and China doing its best to keep its economy going, there is plenty of interest for safe haven GOLD at current levels, just off multi-year lows.

Feature – technical overview

USDSGD has been consolidating just off a fresh +5-year high and remains highly constructive. The uptrend is firmly intact and any setbacks should be well supported above 1.3800 in favour of a higher low and bullish continuation towards next key resistance at 1.4245, in the form of the 2010 high. Only a daily close below 1.3800 will delay the bullish outlook.

Feature – fundamental overview

The Singapore Dollar continues to be weighed down on China risk and US yield differentials. For the moment, it’s the yield differential side of the equation that is knocking SGD after Fed Fischer was out in Jackson Hole on Friday saying he expected inflation to pick-up and the Fed’s skew was now towards tightening. Emerging market FX has not been a great place to be these past several months and these currencies are exposed to more weakness going forward. The risk of a Fed tightening cycle combined with a global economy still looking fragile is not a risk that lends itself to a constructive outlook for the Singapore Dollar.