Today’s report: Optimism Fades on Stacked Calendar Day

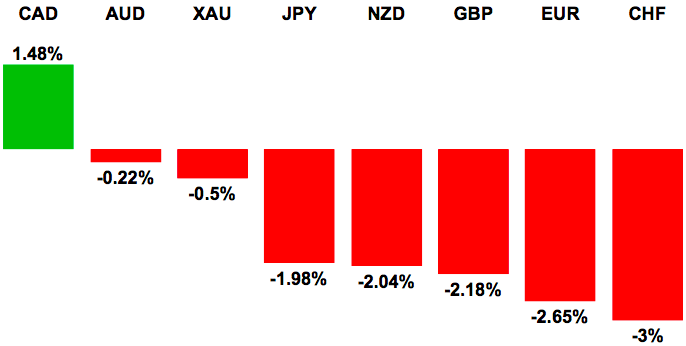

Concern over the China outlook is back in the spotlight following the release of data further strengthening the bearish case. Interestingly enough, developed currencies continue to inversely correlate with equities, and the pullback in stocks is helping to prop the Euro in Tuesday trade. RBA holds.

Wake-up call

Chart talk: Major markets technical overview video

- German employment

- bank holiday

- US data

- weaker Franc

- RBA

- Canada GDP

- RBNZ

- China PMIs

- Hedge funds

- USDSGD

Suggested reading

- Easy Money, Dangerous Bubbles, M. Buchanan, Bloomberg View (August 31, 2015)

- Don’t Buy This ‘Reflexive Bounce’: Burbank, Z. Guzman, CNBC (August 26, 2015)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The bearish performance over the past several sessions suggests the market could finally be done with its run to the topside after overshooting resistance at 1.1467 and trading all the way up to a fresh multi-month high at 1.1715. The medium-term downtrend is still very much intact and deeper setbacks over the coming sessions below 1.1100 will strengthen the downtrend resumption case and suggest a medium-term lower top is now in place. However, inability to close below 1.1100 will leave the door open for a resumption of gains back towards and through 1.1715.

EURUSD – fundamental overview

A quiet end of month trading day for the Euro on Monday, and the market is left mostly consolidating into Tuesday trade. Some slightly firmer Eurozone inflation readings helped to prop the Euro a bit, while softer Chicago PMIs and a sharp drop in Dallas Fed manufacturing further supported the single currency off recent lows. Looking ahead, we get German and Eurozone employment, German and Eurozone manufacturing PMIs, US construction spending and US ISM manufacturing.

GBPUSD – technical overview

Monday’s daily close below the 200-Day SMA suggests the market could be on the verge of rolling over for deeper setbacks towards 1.5000 in the sessions ahead. The market had mostly been trading above the 200-Day SMA since early June and after stalling ahead of the 2015 high, the price action is suggestive of some form of topping. At this point, a daily close back above 1.5509 would be required to put the focus back on the topside.

GBPUSD – fundamental overview

Many UK traders are only coming back to their desks today, following the Monday bank holiday. Still, end of month flows were not supportive of the UK currency, with the Pound mostly pressured and looking to establish back below the 200-Day moving average. A softer round of US data in the form of Chicago PMIs and very weak Dallas Fed manufacturing did little to help the Pound on Monday. Looking ahead, we get UK mortgage approvals, consumer credit and manufacturing PMIs, followed by US construction spending and ISM manufacturing.

USDJPY – technical overview

The market has finally rolled over after stalling out ahead of the multi-year high from June at 125.85. Monthly technical studies were severely overbought and warned of such a correction, and the pullback has not let down, with the market collapsing back towards 116.00 ahead of the latest sharp bounce. But rallies are now classified as corrective, and the market could be looking to carve out a fresh lower top ahead of 122.00 in favour of the next downside extension. Only a daily close back above 122.00 would negate the newly adopted bearish outlook and take the pressure off the downside.

USDJPY – fundamental overview

Not a lot going on for this major pair in a very quiet end of month trading session, though we have seen the Yen recover off recent declines against the Buck. The price action has been driven off some softer US data, with Chicago PMIs below forecast and Dallas Fed manufacturing coming in much weaker than previous, and a pullback in US equities, with safe haven Yen bids coming back into play on renewed China concerns. Looking ahead, USÂ construction spending and ISM manufacturing are the key releases later today.

EURCHF – technical overview

The market looks to be in the process of carving a meaningful base since taking out key multi-day range resistance at 1.0575 several days back. This has opened the latest break above the February peak at 1.0815 which now exposes fresh upside through psychological barriers at 1.1000 and towards 1.1500 further up. Any setbacks should now be well supported ahead of 1.0575.

EURCHF – fundamental overview

The 180 in investor sentiment from just one week ago has been a welcome development for this correlated cross rate, which has retained a bid tone. Overall however, there is still a lot of uncertainty out there, and investors are growing increasingly wary of the impact of stimulatory moves by central banks and governments. As such, if the risk market does come back under pressure, it could spell major trouble for the SNB. The SNB balance sheet has ballooned to around 85% of GDP, which means it is unlikely there is a lot left in the tank for future interventions.

AUDUSD – technical overview

Setbacks have accelerated sharply to the downside to yet another multi-year low, with the market stalling just shy of critical psychological barriers at 0.7000. At this point, technical studies are unwinding from stretched levels, and there is risk for some choppy consolidation in the sessions ahead before the possibility of a bearish resumption below 0.7000. Any rallies should however be well capped below 0.7440.

AUDUSD – fundamental overview

Mixed early Tuesday Australia data didn’t factor into price action, with the market more focused on the RBA rate decision and broader macro themes. The RBA left rates on hold at a record low level of 2% as was widely expected, and reaffirmed its stance on the need for accommodative monetary policy. The market is pricing in another rate cut by the end of the year and with the global macro picture looking less stable, it would seem further accommodation could very well be on the cards. Looking ahead, US construction spending and ISM manufacturing are due.

USDCAD – technical overview

The market is locked within a well defined uptrend, pushing to fresh 11-year highs and closing in on next major psychological barriers at 1.3500. However, with medium-term studies looking stretched, we are seeing the onset of a correction to allow for these stretched studies to unwind. But ultimately, any corrective declines should be well supported with a higher low sought out ideally above 1.2860 in favour of a bullish continuation.

USDCAD – fundamental overview

A late Monday surge in the price of OIL has helped the Canadian Dollar extend a much needed recovery off 11-year lows against the Buck. Chatter OPEC was open to talks with other producers in an effort to regain market stability was sourced as a driver for the extended recovery in OIL, which of course favourably impacted the correlated Canadian Dollar. Next Wednesday the Bank of Canada will have a lot to think about when making its decision, and the price of OIL will be a major factor. But we also get a good amount of data out of Canada this week, which will influence, starting with today’s GDP. In the US, construction spending and ISM manufacturing are due.

NZDUSD – technical overview

Daily studies are in the process of unwinding from oversold off a violent decline to fresh multi-year lows and there is risk for additional consolidation in the sessions ahead to allow for these studies to further unwind before the market considers a legitimate bearish continuation below 0.6130. Still, any rallies should be well capped below 0.6740 in favour of the existing downtrend.

NZDUSD – fundamental overview

Many now believe that this latest round of softer New Zealand business confidence seals the deal on another RBNZ rate cut when the central bank meets next week on September 9th. This would be the third rate cut since May and could very well open the door for fresh declines below last Monday’s 0.6130 multi-year low. Ongoing uncertainty surrounding China is also a negative for Kiwi and will continued to be monitored closely. Looking ahead, US construction spending and ISM manufacturing are due.

US SPX 500 – technical overview

The recent breakdown below 2040 has been a significant development, with the move confirming the formation of a major top off record highs. We have since seen a rapid acceleration of declines, with the market crashing through a measured move downside extension objective at 1940, stalling just shy of 1800 thus far. Technical studies are now unwinding from super stretched readings, so there is risk for some additional consolidation before the market looks for a bearish continuation below 1800. Still, any rallies are now expected to be well capped below 2000 on a daily close basis.

US SPX 500 – fundamental overview

Stocks have come back under pressure into Tuesday and it seems the market could be settling into a new area code following the sharp drop seen over the past couple of weeks. The recovery off the extreme low from last Monday has finally stalled out and there is a good amount of sell interest out there into this rally. Monday’s softer Chicago PMIs and discouraging Dallas Fed manufacturing won’t be enough to deter the Fed from thinking about a liftoff but could have been enough to weigh on equities. Ongoing uncertainty surrounding the China outlook and an expectation the Fed will indeed go ahead and raise rates this year are not comforting prospects for the stock market and should continue to weigh going forward. The latest round of China PMIs, bot official and Caixin offered no downside surprises, but the below 50 prints further confirm the ongoing slowdown in the economy.

GOLD (SPOT) – technical overview

Finally signs of a potential base since breaking down to fresh multi-year lows below 1100. The recent recovery back above the previous 2015 base at 1142 strengthens the outlook and could open the door for additional upside towards 1233 over the coming days. Look for the latest round of setbacks to now be well supported on dips ahead of 1100. Only a daily close below 1100 negates and puts the pressure back on the downside.

GOLD (SPOT) – fundamental overview

Overall, there is still plenty of uncertainty out there, and with US stocks starting to show signs of topping off record highs and China doing its best to keep its economy going, there is plenty of interest for safe haven GOLD at current levels, just off multi-year lows. Hedge funds are slowly stepping back into the long position and the added risk of rising inflation over the coming months is making the position all the more compelling.

Feature – technical overview

USDSGD has been consolidating just off a fresh +5-year high and remains highly constructive. The uptrend is firmly intact and any setbacks should be well supported above 1.3800 in favour of a higher low and bullish continuation towards next key resistance at 1.4245, in the form of the 2010 high. Only a daily close below 1.3800 will delay the bullish outlook.

Feature – fundamental overview

It has not been a good run for the Singapore Dollar, which remains under pressure along with the rest of the emerging markets on a deteriorating China economic outlook and more favourable US Dollar yield differentials. The Singapore Dollar is still suffering from the blow to China manufacturing after a recent China Caixin PMI print produced its lowest reading in more than 6 years. This data also follows softer fixed asset investment, retail sales, industrial production and export readings and likely suggests more soft data in the months ahead. This in conjunction with the expectation for a Fed rate hike this year should translate into more SGD weakness going forward.