Today’s report: Thin Monday Conditions With US Out On Holiday

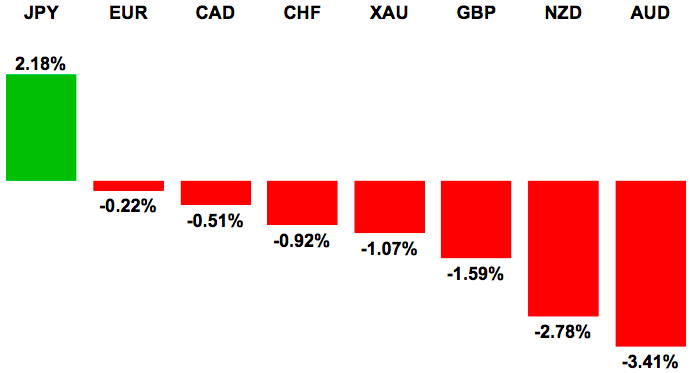

We enter the new week with the Buck broadly in demand on the back of the solid US employment report. Looking ahead, German industrial production and Eurozone Sentix investor confidence are the standouts on today’s calendar, though conditions are expected to be exceptionally thin with the US out holiday.

Wake-up call

Chart talk: Major markets technical overview video

- Euro benefits

- Policy divergence

- Yen trumps

- Swiss inflation

- Fed policy

- Canada unemployment

- RBNZ

- holiday weekend

- Risk liquidation

- USDSGD

Suggested reading

- Are Emerging Markets In Crisis?, J. Wheatley, Financial Times (September 4, 2015)

- China May Never Get Rich, N. Smith, Bloomberg View  (September 4, 2015)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The medium-term downtrend remains intact, with the latest break below 1.1150 strengthening the bearish outlook and exposing a retest of the more critical support at 1.0809 further down. Look for any rallies to now be well capped below 1.1400, with only a close above this level to put the pressure back on the topside.

EURUSD – fundamental overview

Trading conditions will be thinner than normal on this Monday, with the US market closed for the long holiday weekend. The Euro held up rather well on Friday, despite a very solid US employment report and broad based US Dollar strength. The price action continues to be a function of the inverse correlation with equities, as the Euro has also been benefitting a bit from safe haven flows on emerging market liquidation. Although Friday’s NFPs came in below forecast, the upward revision to the previous month was offsetting. Meanwhile other components were impressive, with unemployment dropping down to 5.1%, into Fed full employment territory, and wage growth picking up above forecast. Looking ahead, German industrial production and Eurozone Sentix investor confidence are the only standout releases for the day.

GBPUSD – technical overview

The market has come under intense pressure over the past several days, with the price easily dropping back below the 200-Day SMA to breach next major support at 1.5170. This now puts the focus on a retest of psychological barriers at 1.5000 in the sessions ahead, with an initial target of 1.5089, which guards against the psychological barrier. At this point, a break back above 1.5400 would be required to take the immediate pressure off the downside.

GBPUSD – fundamental overview

Up until a couple of weeks back, the market had been closely tying BOE rate hike timing with the Fed. There were some that were even talking of the possibility for an earlier BOE hike. But all of that has gone out the window, with a softer round of UK data and ongoing solid US economic readings opening a more pronounced monetary policy divergence between the Pound and US Dollar. This has weighed heavily on the Pound in recent days, with the latest knock coming from a very healthy US employment report on Friday. Although Friday’s NFPs came in below forecast, the upward revision to the previous month was offsetting. Meanwhile other components were impressive, with unemployment dropping down to 5.1%, into Fed full employment territory, and wage growth picking up above forecast. Looking ahead, Monday trade will be thinner than normal, with the US out for a long holiday weekend and only Halifax house prices out of the UK.

USDJPY – technical overview

The latest rally has been well capped ahead of 122.00 and a lower top is now sought out in favour of a resumption of declines back towards the recent extreme low at 116.12. At this point, only a break back above 121.74 would negate the short-term bearish outlook and put the pressure back on the topside.

USDJPY – fundamental overview

There was nowhere for the major pair to go on Friday but down, with a very healthy US employment report triggering an intensified risk liquidation, inviting a wave of fresh demand for the Yen. Although Friday’s NFPs came in below forecast, the upward revision to the previous month was offsetting. Meanwhile other components were impressive, with unemployment dropping down to 5.1%, into Fed full employment territory, and wage growth picking up above forecast. The prospect of tighter Fed policy amidst a vulnerable global macro picture is unsettling to investors and has resulted in a liquidation of risk correlated currencies back into the more traditional, liquid funding currencies. Looking ahead, trading conditions are expected to be quite thin on Monday, with the US market closed for the long holiday weekend.

EURCHF – technical overview

The market looks to be in the process of carving a meaningful base since taking out key multi-day range resistance at 1.0575 several days back. This has opened the latest break above the February peak at 1.0815 which now exposes fresh upside through psychological barriers at 1.1000 and towards 1.1500 further up. Any setbacks should now be well supported ahead of 1.0700, with only a break back below 1.0575 to negate the constructive outlook.

EURCHF – fundamental overview

While the pace of declines in Swiss inflation has been helping to offset safe haven Franc demand, it is still a major concern for the SNB. Year over year inflation in Switzerland has dropped to a +50 year low in August, all the way down to -1.4%. SNB Jordan has been quite vocal with his opposition to Franc strength in recent days and the central bank continues to stand ready to act if necessary. It’s clear that with inflation where it is, there very well could be more accommodation on the cards for the negative interest rate economy.

AUDUSD – technical overview

Setbacks have accelerated to the downside to yet another multi-year low, below critical psychological barriers at 0.7000. The drop opens the door for a fresh measured move downside extension towards 0.6830 in the sessions ahead. Technical studies are however tracking in oversold territory across multiple timeframes which suggests the market could be poised for a correction in the coming sessions. Still, any rallies are expected to be very well capped, with only a break back above 0.7440 to compromise the bearish outlook.

AUDUSD – fundamental overview

Ongoing China concerns, and softer Aussie data have kept the RBA leaning on the side of accommodation, with the Australian Dollar underperforming and dropping to fresh multi-year lows as a result. Aussie has also been weighed down on monetary policy divergence, with a very healthy US economic outlook continuing favour an imminent rate hike from the Fed. Friday’s US employment data was exceptionally solid and will make it that much more difficult for the Fed to hold off with its liftoff. Although Friday’s NFPs came in below forecast, the upward revision to the previous month was offsetting. Meanwhile other components were impressive, with unemployment dropping down to 5.1%, into Fed full employment territory, and wage growth picking up above forecast. Looking ahead, Monday trading conditions will be thin, with a light economic calendar and the US closed for the long holiday weekend.

USDCAD – technical overview

The market is locked within a well defined uptrend, pushing to fresh 11-year highs and closing in on next major psychological barriers at 1.3500. However, with medium-term studies looking stretched, we are seeing the onset of a correction to allow for these stretched studies to unwind. But ultimately, any corrective declines should be well supported with a higher low sought out ideally above 1.2860 in favour of a bullish continuation.

USDCAD – fundamental overview

On Friday, Canada employment data went head to head with the US employment report and while both reports had encouraging readings, it was the US report that ultimately stood out as the stronger report. Although Canada employment ticked up well above forecast, the unexpected rise in Canada unemployment by 0.2% above forecast at 7.0%, was a little unsettling. Meanwhile the US unemployment rate ticked down by 0.1% more than forecast to 5.1%, while wage growth pushed up. And although the headline US NFP print was softer, this was offset by a strong upward revision to the previous print, which on net, keeps the three month average for this series at a very healthy 221k. This in conjunction with a pullback in the price of OIL resulted in a lower Canadian Dollar, still very close to its recent 11-year low against the Buck. Looking ahead, trading conditions will be exceptionally thin today, with North America out for the long holiday, end of summer weekend.

NZDUSD – technical overview

The market remains under pressure just off fresh multi-year lows, locked within a well defined downtrend. Deeper setbacks are favoured below 0.6130, with the break to open the next major downside extension through psychological barriers at 0.6000. Any rallies are viewed as corrective and ultimately, only a break back above 0.6740 would compromise the bearish structure.

NZDUSD – fundamental overview

Although the RBNZ has avoided moving too far to the dovish side with its monetary policy, it will be very hard to argue against another 25bp rate cut to 2.75% when the central bank meets early Thursday. Indeed we did see another solid rise in dairy prices at last week’s dairy auction, but the price rise was likely more a function of a drop in volume than rising demand. Meanwhile, the discouraging business confidence readings do nothing to offer any optimistic outlook for the economy, with broader concerns over the outlook for an unstable China economy  and a declining equity market also weighing heavily. Finally, the monetary policy divergence theme is becoming all the more pronounced following the latest wave of solid US employment data, which puts the Fed that much closer to a rate hike. Trading conditions are expected to be thin on Monday with the US closed for a long holiday weekend.

US SPX 500 – technical overview

The market has been in the process of some choppy consolidation following the sharp pullback from record high territory several days back. The breakdown reflects a major structural shift in the works, with deeper setbacks now favoured over the coming days and weeks. The rebound out from the 1830 area low is viewed as corrective, with a lower top sought out at 1996 ahead of the next major downside extension and bearish continuation below 1800. Only a close back above 2000 would delay the newly adopted bearish outlook.

US SPX 500 – fundamental overview

Overall, the market looks like it’s undergoing a structural shift, with sentiment turning down as investors worry about risk associated with China and the rest of the global economy along with the implications of a Fed on the verge of tightening policy. Friday’s very healthy US employment report only puts the Fed in a tougher position to initiate liftoff and this does not sit well with an investor base that would like nothing more than for the Fed to continue to leave policy ultra accommodative. The equity market won’t return to full form until Tuesday, after the long holiday weekend in the US.

GOLD (SPOT) – technical overview

Finally signs of a potential base since breaking down to fresh multi-year lows below 1100. The recent recovery back above the previous 2015 base at 1142 strengthens the outlook and could open the door for additional upside towards 1233 over the coming days. Look for the latest round of setbacks to now be well supported on dips ahead of 1100. Only a daily close below 1100 negates and puts the pressure back on the downside.

GOLD (SPOT) – fundamental overview

Overall, there is still plenty of uncertainty out there, and with US stocks topping off record highs and China doing its best to keep its faltering economy going, there is plenty of interest for safe haven GOLD at current levels, just off multi-year lows. Hedge funds are slowly stepping back into the long position and the added risk of rising inflation over the coming months is making the position all the more compelling. There has been some mild weakness in recent trade on US Dollar demand from a solid US employment report, but the safe haven flows on the macro risk of higher US rates should ultimately offset and prop the metal.

Feature – technical overview

USDSGD continues to push to fresh +5-year highs and remains highly constructive. The uptrend is firmly intact with the latest break above 1.4170 opening the next measured move upside extension towards 1.4400. In the interim, look for any setbacks to be well supported above 1.3800. Only a daily close below 1.3800 will delay the bullish outlook.

Feature – fundamental overview

It has not been a good run for the Singapore Dollar, which remains under pressure along with the rest of the emerging markets on a deteriorating China economic outlook and more favourable US Dollar yield differentials. The Singapore Dollar has been suffering from the blow to China manufacturing after a recent China Caixin PMI print produced its lowest reading in more than 6 years. This data also follows softer fixed asset investment, retail sales, industrial production and export readings and likely suggests more soft data in the months ahead. Meanwhile, monetary policy divergence with the Fed has become all the more pronounced, with the MAS on an easing path after economists cut Singapore growth and inflation forecasts last week, while on the other side, the Fed is on the verge of liftoff following another round of solid US employment data.