Special report: BOE policy decision preview

Today’s report: All things considered

Risk assets continue to be supported into the latter half of the week, in large part due to the Fed Chair’s downplaying any concerns associated with rising interest rates and higher inflation.

Wake-up call

- solid PMIs

- BOE decision

- risk flow

- virus restrictions

- retail sales

- Crowd limits

- Stocks vulnerable

- Dealers report

- miner crackdown

- Monetary policy

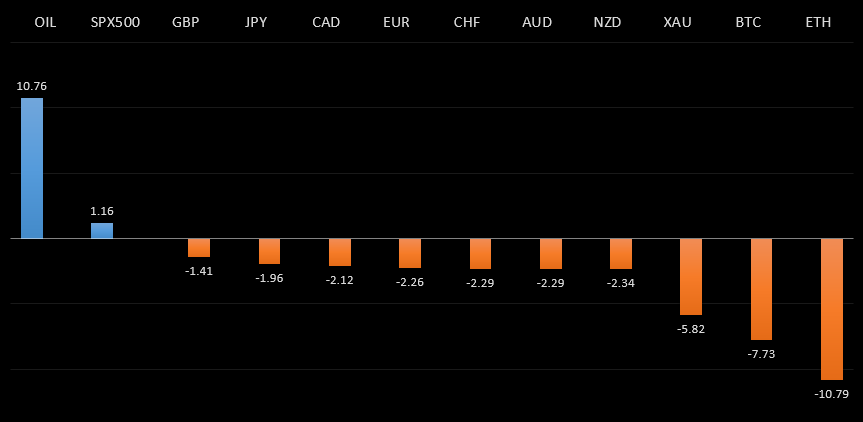

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Bank of England May Beat the Fed to Tapering, M. Ashworth, Bloomberg (June 24, 2021)

- How will Brexit reshape the City of London?, J. Guthrie, Financial Times (June 23, 2021)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has been looking for a higher low since topping out in 2021 up at 1.2350. Ideally, this next higher low is sought out ahead of 1.1600 in favour of the next major upside extension back through 1.2350 and towards a retest of the 2018 high at 1.2555 further up.EURUSD – fundamental overview

Solid PMI data out of the zone on Wednesday helped to prop up the Euro, though we did see some selling into the run up that managed to cap gains. Looking ahead, key standouts on the calendar come in the form of German Ifo reads, the BOE policy decision, Canada manufacturing sales, Canada weekly earnings, US durable goods, US initial jobless claims, US trade and US GDP.EURUSD - Technical charts in detail

GBPUSD – technical overview

Technical studies are in the process of consolidating from stretched levels after the push to fresh multi-month highs. This leaves room for additional consolidation, before the market considers a meaningful bullish continuation towards a retest of the 2018 high. But look for setbacks to now be very well supported into the 1.3500 area.GBPUSD – fundamental overview

The Pound has done a good job shrugging off mixed UK PMI reads and reports of the most new virus cases since early February, instead focusing on hawkish expectations for today's BOE decision. Looking ahead, key standouts on the calendar come in the form of German Ifo reads, the BOE policy decision, Canada manufacturing sales, Canada weekly earnings, US durable goods, US initial jobless claims, US trade and US GDP.USDJPY – technical overview

The major pair has run into massive resistance in the form of the monthly Ichimoku cloud. This translates to a longer-term trend that is still bearish despite the run up, with risk for deeper setbacks ahead. It would take a clear break back above 113.00 to negate the outlook.USDJPY – fundamental overview

We continue to see decent sell interest in the Yen, with most of the price action attributed to healthy investor risk appetite and an ongoing bid in US equities. Looking ahead, key standouts on the calendar come in the form of German Ifo reads, the BOE policy decision, Canada manufacturing sales, Canada weekly earnings, US durable goods, US initial jobless claims, US trade and US GDP.