Next 24 hours: Don't forget about month end flow

Today’s report: Currency traders doubting Fed messaging

While US equities did manage to extend their record run on Tuesday, they didn’t run all that far and perhaps some of this had to do with the currency market looking less convinced with respect to Fed messaging around accommodation.

Wake-up call

- consumer sentiment

- Travel restrictions

- APAC region

- Black Swan

- Heavy liquidation

- upbeat Orr

- Stocks vulnerable

- Dealers report

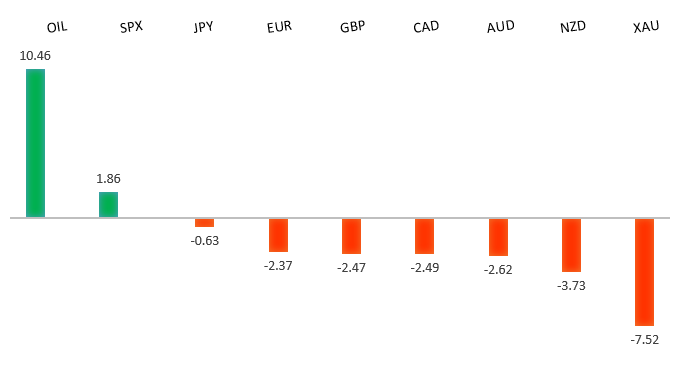

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Europe’s Covid Debt Party Just Keeps Raging On, M. Ashworth, Bloomberg (June 29, 2021)

- What Business Leaders Can Do About Biodiversity, J. Tett, Financial Times (June 29, 2021)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has been looking for a higher low since topping out in 2021 up at 1.2350. Ideally, this next higher low is sought out ahead of 1.1600 in favour of the next major upside extension back through 1.2350 and towards a retest of the 2018 high at 1.2555 further up.EURUSD – fundamental overview

Eurozone consumer sentiment traded up to a 21-year high, while German HCPI rose 2.1% as expected. But none of this had any positive impact on the Euro, with the single currency ultimately weighed down by a rates market pricing a more hawkish Fed trajectory, despite Fed efforts to downplay such an outcome. Looking ahead, key standouts on today’s calendar come in the form of Germany unemployment, UK business inventories and GDP, Eurozone inflation, a BOE Haldane speech, US ADP employment, Canada GDP and producer prices, US pending home sales and Chicago PMIs.EURUSD - Technical charts in detail

GBPUSD – technical overview

Technical studies are in the process of consolidating from stretched levels after the push to fresh multi-month highs. This leaves room for additional consolidation, before the market considers a meaningful bullish continuation towards a retest of the 2018 high. But look for setbacks to now be very well supported into the 1.3500 area.GBPUSD – fundamental overview

The Pound was unable to ignore the news of the travel restrictions imposed on the UK by Portugal and Hong Kong, with the currency under pressure as a result. Rate differentials in favour of the US Dollar also factored into the lower Pound on Tuesday as the market continued to doubt the Fed being able to keep to its more dovish leaning communications. Looking ahead, key standouts on today’s calendar come in the form of Germany unemployment, UK business inventories and GDP, Eurozone inflation, a BOE Haldane speech, US ADP employment, Canada GDP and producer prices, US pending home sales and Chicago PMIs.USDJPY – technical overview

The major pair has run into massive resistance in the form of the monthly Ichimoku cloud. This translates to a longer-term trend that is still bearish despite the latest run higher. Look for additional upside to be limited, with scope for a topside failure and bearish resumption over the coming sessions. It would take a clear break back above 113.00 to negate the outlook.USDJPY – fundamental overview

Expanded virus restrictions across the APAC region have resulted in a wave of flight to safety that has also translated to Yen demand on the traditional correlation with risk off. Looking ahead, key standouts on today’s calendar come in the form of Germany unemployment, UK business inventories and GDP, Eurozone inflation, a BOE Haldane speech, US ADP employment, Canada GDP and producer prices, US pending home sales and Chicago PMIs.AUDUSD – technical overview

Technical studies have turned up in recent months, after the market traded down to its lowest levels since 2003 in 2020. There is evidence of a longer-term bottom following the latest push back through 0.7000, though at this stage, there is risk for a deeper pullback to allow for shorter term studies to unwind. Setbacks should now be well supported ahead of 0.7400.AUDUSD – fundamental overview

Growing virus fears have hit the Australian Dollar this week. Restrictions are back in play and Macquarie has issued a report that the probability of a 'Black Swan' event is rising. Looking ahead, key standouts on today’s calendar come in the form of Germany unemployment, UK business inventories and GDP, Eurozone inflation, a BOE Haldane speech, US ADP employment, Canada GDP and producer prices, US pending home sales and Chicago PMIs.USDCAD – technical overview

Has been in major decline since topping out in 2021 above 1.4600. At this stage, with the decline now well extended, the market is likely to find solid support into the 1.2000 area ahead of a resumption of gains. Ultimately, only a weekly close below 1.2000 would suggest otherwise. Back above 1.2500 will strengthen the outlook.USDCAD – fundamental overview

We're seeing a liquidation of Canadian Dollar longs this week, even in the face of the recovering OIL price on Tuesday. Most of the flow can be attributed to an overcrowded long trade in the Loonie and a shifting expectation from the market that the Fed will be needing to be more hawkish than it wants to be. Looking ahead, key standouts on today’s calendar come in the form of Germany unemployment, UK business inventories and GDP, Eurozone inflation, a BOE Haldane speech, US ADP employment, Canada GDP and producer prices, US pending home sales and Chicago PMIs.NZDUSD – technical overview

The market has been very well supported in recent months and there is evidence of a longer-term base. Look for setbacks to hold up above 0.7100, with sights set on a run back towards the 0.7500 area.NZDUSD – fundamental overview

RBNZ Governor Orr was out doing his best to try and stop the bleed of the falling Kiwi rate, saying activity was returning to pre-COVID levels, and export prices were up on global demand. But ultimately, risk off flow from the uptick in the virus and a market pricing a more hawkish Fed, were behind the weakness in the New Zealand Dollar on Tuesday. Looking ahead, key standouts on today’s calendar come in the form of Germany unemployment, UK business inventories and GDP, Eurozone inflation, a BOE Haldane speech, US ADP employment, Canada GDP and producer prices, US pending home sales and Chicago PMIs.US SPX 500 – technical overview

Longer-term technical studies are looking quite exhausted and the market is showing signs of wanting to roll over after racing to another record high. Look for rallies to be well capped ahead of 4350, with a break back below 4139 to strengthen the outlook.US SPX 500 – fundamental overview

We're trading just off fresh record highs, and yet, with so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on easy money policy incentives and government stimulus, should no longer be as enticing to investors. Meanwhile, ongoing worry associated with coronavirus fallout and risk of rising inflation should weigh more heavily on investor sentiment into the second half of 2021.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and an acceleration beyond the next major psychological barrier at 2000. Setbacks should now be well supported above 1600.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about exhausted monetary policy, extended global equities, and coronavirus fallout. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.