Today’s report: Black Friday.....for markets

It’s worth highlighting the exceptionally thin trading conditions as the week gets set to close out, with US desks already cleared out since mid-week for the Thanksgiving holiday break. Having said that, we are seeing some intense risk off flow into Friday.

Wake-up call

- COVID situation

- ban flights

- can't ignore

- retail sales

- Oil dump

- relative underperformer

- Stocks vulnerable

- Dealers report

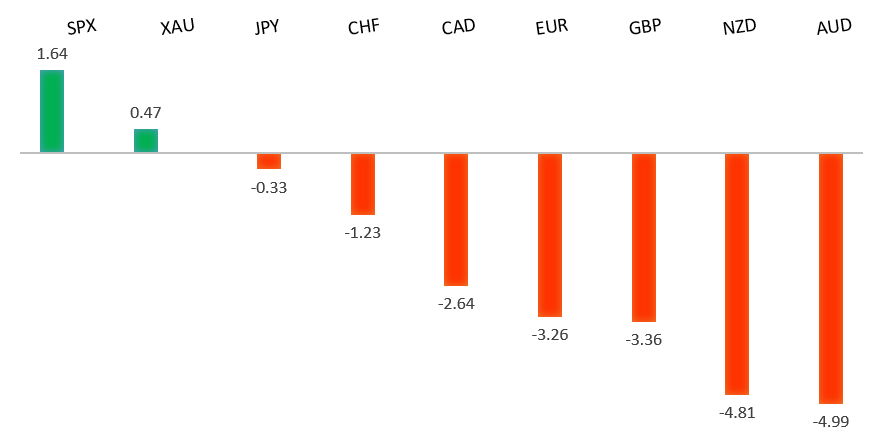

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Black Gold Turns the U.S. and China Into Frenemies, M. Gilbert, Bloomberg (November 25, 2021)

- How Space-Based Solar Power Can Save the Planet, P. Hollinger, Financial Times (November 24, 2021)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

Setbacks have extended to retest the critical 61.8% fib retrace off the 2020 low to 2021 high move. Technical studies are now tracking in extended territory on the weekly chart, warning of the need for a corrective bounce ahead. Look for the market to hold up on a weekly close basis above the 61.8% fib retrace around 1.1275.EURUSD – fundamental overview

Yield differentials and a worsening COVID situation in Europe continue to weigh on the Euro to fresh yearly and multi-month lows. ECB's Villeroy isn't worried about inflationary drivers in the EU becoming structural and sees no evidence of strong upward pressure on wages. Villeroy is ready to end PEPP on schedule while retaining the program's infrastructure intact as a "virtual tool box." Trading conditions will be exceptionally thin on account of the US Thanksgiving holiday break. Key standouts on today’s calendar include German import prices, and an ECB Lagarde speech.EURUSD - Technical charts in detail

GBPUSD – technical overview

The market is in a correction phase in the aftermath of the run to fresh multi-month highs earlier this year. At this stage, additional setbacks should be limited to the 1.3200 area ahead of the next major upside extension towards a retest and break of critical resistance in the form of the 2018 high.GBPUSD – fundamental overview

The Pound has been under pressure on yield differentials with the US Dollar, and on this latest uptick in the coronavirus. Trading conditions will be exceptionally thin on account of the US Thanksgiving holiday break. Key standouts on today’s calendar include German import prices, and an ECB Lagarde speech.USDJPY – technical overview

The longer-term trend is bearish despite the recent run higher. Look for additional upside to be limited, with scope for a topside failure and bearish resumption back down towards the 100.00 area. It would take a clear break back above 116.00 to negate the outlook.USDJPY – fundamental overview

Yield differentials are clearly having a bigger impact after the market priced in a more hawkish Fed path on the Powell reappointment. At the same time, after dropping to fresh yearly lows against the Dollar this week, we've seen a resurgence in Yen demand into Friday as risk off flow intensifies on the back of the latest COVID fears. Trading conditions will be exceptionally thin on account of the US Thanksgiving holiday break. Key standouts on today’s calendar include German import prices, and an ECB Lagarde speech.AUDUSD – technical overview

The Australian Dollar has been in the process of a healthy correction following the impressive run towards a retest of the 2018 high earlier this year. At this stage, the correction is starting to look stretched and setbacks should be well supported down into the 0.7000 area.AUDUSD – fundamental overview

Aussie retail sales have exceeded expectation, but this hasn't prevented the Australian Dollar from trading back down to the yearly low on the back of intensified risk off flow on renewed COVID worry. Trading conditions will be exceptionally thin on account of the US Thanksgiving holiday break. Key standouts on today’s calendar include German import prices, and an ECB Lagarde speech.USDCAD – technical overview

Finally signs of a major bottom in the works after a severe decline from the 2020 high. A recent weekly close back above 1.2500 encourages the constructive outlook and opens the door for a push back towards next critical resistance in the 1.3000 area. Any setbacks should be well supported into the 1.2200s.USDCAD – fundamental overview

US equity futures are taking a massive hit on Friday as COVID fears perk back up. Oil has also been dumping, only adding further to downside pressure on the Loonie. Trading conditions will be exceptionally thin on account of the US Thanksgiving holiday break. Key standouts on today’s calendar include German import prices, an ECB Lagarde speech, and the Canada budget balance.NZDUSD – technical overview

The market has entered a period of intense correction after running up to a yearly and multi-month high. Back below 0.6800 would suggest a more significant bearish structural shift.NZDUSD – fundamental overview

The New Zealand Dollar was already underperforming this week on the back of a very discouraging retail sales print and comments from RBNZ Orr that heavy household debt is a reason for concern. We've seen added pressure to yearly lows into Friday as worry around COVID intensifies. All of this has the market reconsidering hawkish RBNZ bets. Trading conditions will be exceptionally thin on account of the US Thanksgiving holiday break. Key standouts on today’s calendar include German import prices, and an ECB Lagarde speech.US SPX 500 – technical overview

Longer-term technical studies are looking quite exhausted and the market is showing signs of wanting to roll over after racing to another record high. At the same time, the latest breakout above 4600 introduces the possibility for the next major upside extension through 4800. At this stage, it will take a break back below 4500 to take the immediate pressure off the topside.US SPX 500 – fundamental overview

We're trading just off fresh record highs, and yet, with so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on easy money policy incentives and government stimulus, should no longer be as enticing to investors. Meanwhile, ongoing worry associated with coronavirus fallout and risk of rising inflation should weigh more heavily on investor sentiment in Q4 2021.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and an acceleration beyond the next major psychological barrier at 2000. Setbacks should now be well supported above 1600.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about exhausted monetary policy, extended global equities, and coronavirus fallout. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.