Special report: ECB Policy Decision Preview

Today’s report: Hard to shake off the downbeat vibes

There hasn’t been a whole lot of activity into Thursday, though what little we’ve seen has been risk off in nature. The market has already looked past a stronger China trade report, instead focusing on concerns around the overall global growth outlook and Fed policy trajectory.

Wake-up call

- Solid data

- OECD outlook

- easy policy

- RBA outlook

- Loonie outperforms

- Slumping dairy

- Stocks vulnerable

- Dealers report

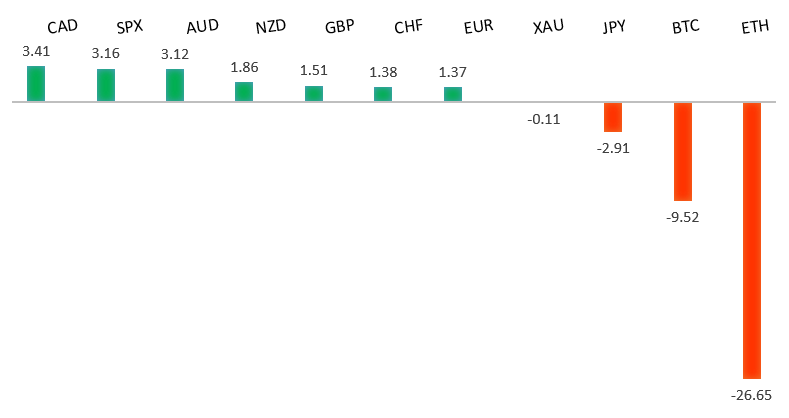

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Watch for Waves From Europe's Evolving Inflation Shock, J. Authers, Bloomberg (June 9, 2022)

- Can We Save the World's Forests?, C. Hodgson, Financial Times (June 9, 2022)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has come under intense pressure in recent weeks, with setbacks accelerating to retest the multi-year low from 2017. A clear break below 1.0300 now sets up the next downside extension towards parity. At the same time, technical studies have been in the process of unwinding from oversold. But back above 1.1000 would be required at a minimum to take the immediate pressure off the downside.EURUSD – fundamental overview

The Euro was an outperformer in FX markets on Wednesday. Most currencies were under pressure against the Buck. But the Euro managed to trade up on the combination of an upward revision to Eurozone GDP, solid German industrial production, and positioning into today's ECB meeting. Key standouts on today’s calendar come from the ECB policy decision and US initial jobless claims.EURUSD - Technical charts in detail

GBPUSD – technical overview

The market continues to be exceptionally well supported on dips down into the 1.2000 area, with the latest setback once again holding up ahead of the barrier. Overall, the daily trend remains bearish, though there are signs of the market wanting to put in a meaningful bottom ahead of the next major upside extension. Look for a clear break back above 1.3000 to strengthen this outlook.GBPUSD – fundamental overview

The Pound comes into Thursday under some pressure. The currency has been worrying more about the political outlook, while absorbing softer UK construction PMI reads and a downbeat assessment of the UK economy from the OECD. Key standouts on today’s calendar come from the ECB policy decision and US initial jobless claims.USDJPY – technical overview

The market has rocketed higher to its highest levels since 2002 after breaking through the 2015 high. Technical studies are however looking stretched, with scope for a sizable consolidation and correction in the weeks ahead. Look for additional upside from here to be limited to the 2002 high 135.00 area. A break back below 130.00 would take the immediate pressure off the topside.USDJPY – fundamental overview

Policy divergence continues to play a strong hand here, with market participants once again focusing on yield differentials that weigh heavily in the US Dollar's favor. The BOJ is clearly still committed to easy policy despite what's going on with other major central banks and the impact on the Yen, now at a 20 year low against the Buck. Key standouts on today’s calendar come from the ECB policy decision and US initial jobless claims.AUDUSD – technical overview

The market has been in recovery mode since bottoming out off the yearly low. Overall however, conditions remain quite choppy, and while the short-term pressure has been taken off the downside, rallies towards 0.7500 should be very well offered.AUDUSD – fundamental overview

There Australian Dollar hasn't been able to do anything with this week's 50 basis point RBA rate hike and accompanying hawkish communication. Instead, the currency has been weighed down by the broader reduction in global risk sentiment and expectations for higher rates in the US. Key standouts on today’s calendar come from the ECB policy decision and US initial jobless claims.USDCAD – technical overview

A recent surge back above 1.3000 signals an end to a period of bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.3500 area. Setbacks should be very well supported down into the 1.2500 area.USDCAD – fundamental overview

The Canadian Dollar has managed to outperform its peer group, on account of a hawkish Bank of Canada, solid Canada data and higher oil prices. Nevertheless, we have seen some weakness in the Loonie into the latter half of the week on account of global risk liquidation. Key standouts on today’s calendar come from the ECB policy decision and US initial jobless claims.NZDUSD – technical overview

The market has been in recovery mode since bottoming out off the yearly low. Overall however, conditions remain quite choppy, and while the short-term pressure has been taken off the downside, rallies should be very well offered.NZDUSD – fundamental overview

Broad based risk off flow has resulted in renewed downside pressure in the New Zealand Dollar. We've also seen Kiwi selling on cross related demand for AUDNZD in the aftermath of this week's hawkish leaning RBA decision. Not helping matters either has been a decline in ANZ May commodity prices and a slump in dairy. Key standouts on today’s calendar come from the ECB policy decision and US initial jobless claims.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. Back above 4,312 will be required at a minimum to take the immediate pressure off the downside. Next major support comes in around 3,400.US SPX 500 – fundamental overview

With so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on easy money policy incentives and government stimulus, should no longer be as enticing to investors. Meanwhile, ongoing worry associated with coronavirus fallout, rising inflation, and geopolitical tension should continue to weigh more heavily on investor sentiment in 2022.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1700.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about exhausted monetary policy, extended global equities, coronavirus fallout, inflation risk, and geopolitical tension. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.