Next 24 hours: European banking index recovers

Today’s report: Bank stocks remain under pressure

There wasn’t a whole lot of activity in markets on Tuesday, but what we did see was a less enthusiastic equity market. Bank stocks were back to struggling and the US Dollar was selling off, despite the risk off flow, on the back of expectations all of this stress will force the Fed to shift priorities.

Wake-up call

- ECB Muller

- BOE Bailey

- traditional flow

- Metals prices

- Oil surge

- capital ratios

- Inflation headache

- Dealers report

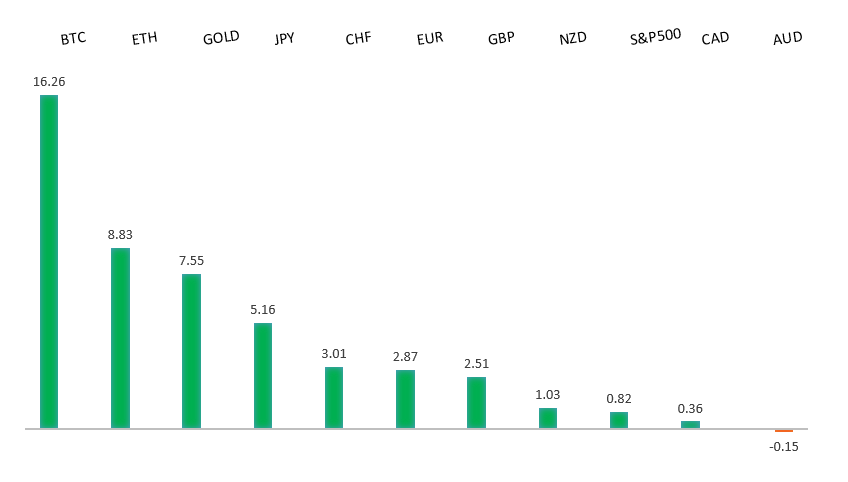

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- History Says to Buy the Fed Pause. Should You?, J. Levin, Bloomberg (March 28, 2023)

- How Congo Aims to Double Copper Production, T. Wilson, FT (March 28, 2023)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro remains well supported on dips following a run to the topside through 1.1000 earlier this year. Any additional setbacks should be well supported ahead of 1.0500 in favor of the formation of the next major higher low and a bullish continuation. Ultimately, only a monthly close back below 1.0500 would give reason for concern.EURUSD – fundamental overview

The Euro has been better bid this week on the back of a wave of hawkish ECB speak. ECB Muller is the latest to comment, saying there is room to raise rates. Key standouts on Wednesday’s calendar come from BOE consumer credit and net lending, the BOE financial policy summary, and US pending home sales.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The recent weekly close back above the September high at 1.1739 strengthens this prospect. Any setbacks should now be well supported ahead of 1.1500. Next key resistance comes in at 1.2668.GBPUSD – fundamental overview

The combination of BOE Bailey warning inflation is still too high, while also reassuring UK banks are resilient, has been a combination resulting in GBP upside in the early week. BOE Bailey was out adding UK banks benefit from tougher regulation. Key standouts on Wednesday’s calendar come from BOE consumer credit and net lending, the BOE financial policy summary, and US pending home sales.USDJPY – technical overview

The major pair has seen a nice recovery following the massive correction out from multi-year highs. Setbacks have finally been well supported ahead of 125.00 in the 127s thus far. At this stage, it looks like the market could be wanting to resume the bigger picture uptrend and head back towards a retest of that multi-year high from October 2022 up at 151.95. Look for any weakness to continue to be well supported in favor of higher lows along the way.USDJPY – fundamental overview

The Yen has continues to hold up well overall on positive Japan data and safe haven bid appeal. Japan CPI data due tomorrow and will be watched. JGB yields have run to their highest level in two weeks. Key standouts on Wednesday’s calendar come from BOE consumer credit and net lending, the BOE financial policy summary, and US pending home sales.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base following the late 2022 surge back above 0.6500. The recent weekly close back above previous support now turned resistance at 0.6682 strengthens the outlook for a bullish structural shift. Next key resistance comes in at 0.7284. Setbacks should be well supported ahead of 0.6500.AUDUSD – fundamental overview

The Australian Dollar is trading higher this week on solid Aussie retail sales and rallying metals prices. Key standouts on Wednesday’s calendar come from BOE consumer credit and net lending, the BOE financial policy summary, and US pending home sales.USDCAD – technical overview

A recent surge back above 1.3000 signals an end to a period of bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar has been enjoying a bit of a resurgence in recent sessions on the back of a very healthy recovery in the price of oil. Key standouts on Wednesday’s calendar come from BOE consumer credit and net lending, the BOE financial policy summary, and US pending home sales.NZDUSD – technical overview

Overall pressure remains on the downside with the market once again stalling out on a run up into the 0.6500 area. Ultimately, a break back above 0.6577 would be required to take the immediate pressure off the downside.NZDUSD – fundamental overview

The RBNZ's 2022 flood risk assessment for residential mortgages assessed bank capital ratios as resilient to the most severe sensitivities in the stress test. Key standouts on Wednesday’s calendar come from BOE consumer credit and net lending, the BOE financial policy summary, and US pending home sales.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4300 will be required at a minimum to take the immediate pressure off the downside. Next major support comes in at 3763.US SPX 500 – fundamental overview

We've finally reached a point in the cycle where the Fed recognizes unanchored inflation expectations pose a greater downside risk than over-tightening. This is significant, as it means less investor friendly monetary policy that risks potential recession in the months ahead. Overall, we expect inflation to continue to be a problem in H1 2023 that results in downside pressure into rallies.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1600 on a monthly close basis ahead of the next major upside extension. The recent break back above 1808 strengthens the bullish outlook. Next major resistance comes in at the record high from 2020 at 2076.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.