Next 24 hours: Get ready for that all consuming US inflation data

Today’s report: Market waiting to take cues from US inflation data

We’d best describe markets as being in a state of consolidation in the early week. The currency market has perhaps been a little more cautious than the stocks market, but overall, nothing much to write home about.

Wake-up call

- ECB Kazaks

- BOE Mann

- FinMin Suzuki

- consumer confidence

- despite commodities

- policy objectives

- Geopolitical risk

- Global outlook

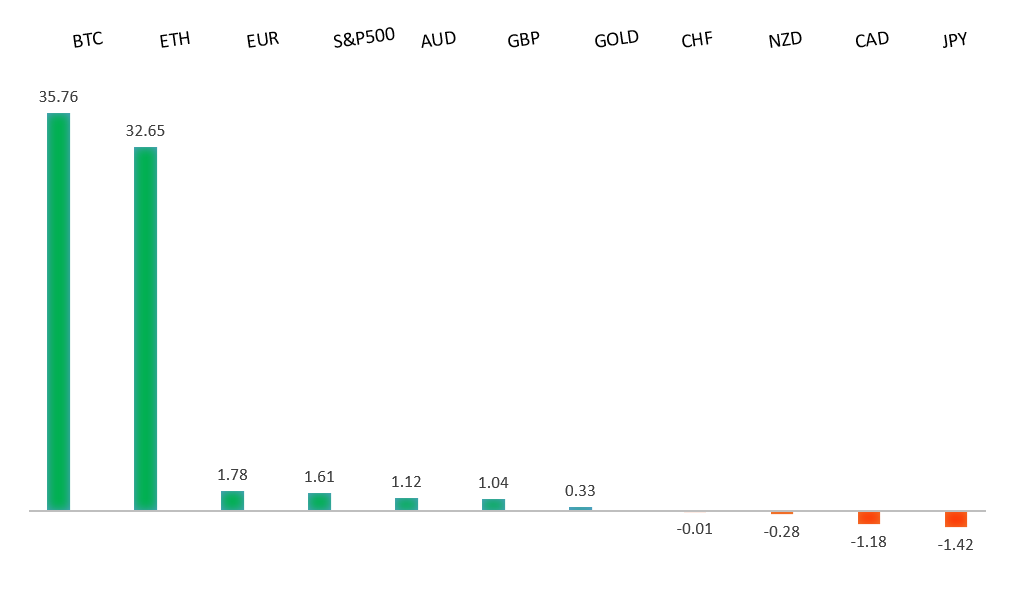

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Does Uptick In Unemployment Signal a Downturn?, Fisher Investments (November 9, 2023)

- When Will the Fed Cut Rates?, B. McBride, Calculated Risk (November 12, 2023)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

Any additional setbacks should be well supported on dips below 1.0500 in favor of the start to the next major upside extension. Ultimately, only a monthly close back below 1.0500 would give reason for concern. Back above 1.0770 will take the immediate pressure off the downside.EURUSD – fundamental overview

There were some hawkish comments out from ECB Kazaks on Monday, which helped to give the Euro a mild boost. Kazaks saw risk of an inflation spillover and said it was too soon to call for peak rates. Key standouts on Tuesday’s calendar come from UK jobs data, ECB speak, Eurozone employment reads, Eurozone GDP, Eurozone and German ZEWs, US inflation, and a wave of Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2000. Next key resistance comes in at 1.2429.GBPUSD – fundamental overview

It seems the Pound got a solid boost from hawkish voting member Mann on Tuesday. BOE Mann said both climate change and the path to net zero would cause higher, more persistent and volatile inflation. Key standouts on Tuesday’s calendar come from UK jobs data, ECB speak, Eurozone employment reads, Eurozone GDP, Eurozone and German ZEWs, US inflation, and a wave of Fed speak.USDJPY – technical overview

At this stage, it looks like the market is wanting to resume the bigger picture uptrend and head back towards a retest of that multi-year high from October 2022 up at 151.95. Look for any weakness to continue to be well supported on dips.USDJPY – fundamental overview

Japan FinMin Suzuki drummed up more verbal intervention for a second day, reiterating excessive FX moves were undesirable, and that an appropriate response would be taken if necessary. BOJ Deputy Governor Shinichi Uchida said current inflation was driven by a weak Yen and high raw material costs, echoing what Governor Ueda said last week. He added the key for the BOJ would be whether wages rose sufficiently enough to support consumer spending. Key standouts on Tuesday’s calendar come from UK jobs data, ECB speak, Eurozone employment reads, Eurozone GDP, Eurozone and German ZEWs, US inflation, and a wave of Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6523 will take the immediate pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar has been struggling in early Tuesday trade on the back of a weak Aussie consumer confidence report. The latest reading signaled renewed pessimism, while respondents expressed concerns over the higher cost of living and a further rise in interest rates. Labor market confidence and house-related sentiment were largely unchanged, though the latter was already in a deeply pessimistic position. Key standouts on Tuesday’s calendar come from UK jobs data, ECB speak, Eurozone employment reads, Eurozone GDP, Eurozone and German ZEWs, US inflation, and a wave of Fed speak.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar hasn't been able to get any help from a run higher in stocks and a recovery in commodities prices. The currency has been suffering of late on the back of a recent run of developments including a more dovish leaning Bank of Canada, and softer Canada economic data. Key standouts on Tuesday’s calendar come from UK jobs data, ECB speak, Eurozone employment reads, Eurozone GDP, Eurozone and German ZEWs, US inflation, and a wave of Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market once again stalling out on a run up into the 0.6500 area. Ultimately, a break back above 0.6056 would be required to take the immediate pressure off the downside. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

The RBNZ was out talking risks to policy objectives. RBNZ Assistant Governor Karen Silk acknowledged economic indicators were moving in line with policy objectives, citing incredibly muted credit growth and employment indicators heading in the right direction. However, she said risks such as high immigration could underpin resilient demand. It is worth recalling that RBNZ will require at least a mild recession to tame inflation before considering reducing interest rates. Key standouts on Tuesday’s calendar come from UK jobs data, ECB speak, Eurozone employment reads, Eurozone GDP, Eurozone and German ZEWs, US inflation, and a wave of Fed speak.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4500 will be required to take the immediate pressure off the downside. Next key support comes in at 4308.US SPX 500 – fundamental overview

Investors continue to struggle with the reality of a higher for longer Fed policy track in the face of ongoing worry around inflation, while also contending with an escalation in geopolitical risk. Overall, we expect inflation to continue to be a problem in 2023 that results in downside pressure into rallies despite market expectations that would argue otherwise.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1600 on a monthly close basis ahead of the next major upside extension. Next major resistance comes in at 2100, above which opens the next extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less stable and upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.