Next 24 hours: Keeping an eye on the yellow metal

Today’s report: Back to fuller form as US returns

Markets will get back to fuller form on this Monday as the US returns from the holiday break. As things stand, we’ve seen a wave of Dollar selling and risk on flow in recent days, mostly on the back of an expectation that inflation has peaked out in the US.

Wake-up call

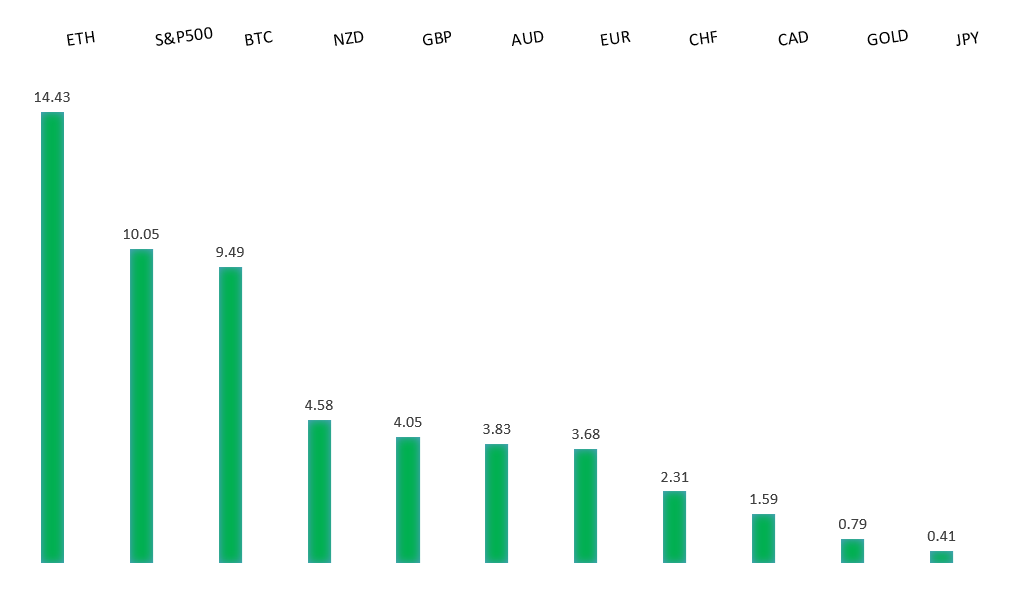

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Something New on Wall Street for 2024 — Humility, Bloomberg (November 27, 2023)

- Citigroup and the 'financial supermarket' experiment, Financial Times (November 23, 2023)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the yearly high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

The Euro has been trading flat in recent sessions amid mixed ECB comments. ECB Muller suggested the central bank may not need to raise rates further, echoing ECB President Christine Lagarde’s calls for adopting a wait-and-see stance to assess the impact of previous tightening. On the other hand, other ECB members were less optimistic. ECB Joachim Nagel said on Saturday the ECB was not yet where they wanted to be on inflation, while ECB Vice President Luis de Guindos said the risks to the economic outlook were tilted to the downside, also warning inflation could rise in the coming months. Key standouts on Monday’s calendar come from UK CBI trades, an ECB Lagarde speech, US new home sales, and Dallas Fed manufacturing.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2000. Next key resistance comes in at 1.2747.GBPUSD – fundamental overview

The Pound continues to find demand on the back of the recent hawkish comments from BOE Pill. Elsewhere, the UK House of Lords Economic Affairs Committee’s report called for a review of BOE’s role and operations to enhance performance and accountability. Meanwhile, according to a Bloomberg report, UK PM Sunak dismissed austerity claims about his economic plans, calling them “unfounded.” Key standouts on Monday’s calendar come from UK CBI trades, an ECB Lagarde speech, US new home sales, and Dallas Fed manufacturing.USDJPY – technical overview

The market remains confined to a strong uptrend, with sights set on a retest and break of the multi-year high from 2022 at 151.95. A push through this level will open the next major upside extension towards 155.00. Key support comes in at 147.00, with only a daily close below to delay the constructive outlook.USDJPY – fundamental overview

The Yen has found some bids on this Monday, perhaps on the back of the latest Japan services PMI data. Japan services PMIs accelerated to their highest level since Jan 2020, up from a downwardly revised 2% in September to 2.3% year over year in October, beating the forecast of 2.1% year over year. Key standouts on Monday’s calendar come from UK CBI trades, an ECB Lagarde speech, US new home sales, and Dallas Fed manufacturing.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6630 will take the immediate pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Australia Treasurer Jim Chalmers revealed a proposed bill that would eliminate the federal government’s dormant veto power to override RBA on interest rate decisions while creating distinct RBA boards for governance and interest rate setting. Other notable changes include the mandate of “promoting the economic prosperity and welfare of the people of Australia” on top of the price stability and full employment objectives. Key standouts on Monday’s calendar come from UK CBI trades, an ECB Lagarde speech, US new home sales, and Dallas Fed manufacturing.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar is coming out of an impressive Friday session after taking in a much better than expected round of Canada retail sales data. Key standouts on Monday’s calendar come from UK CBI trades, an ECB Lagarde speech, US new home sales, and Dallas Fed manufacturing.NZDUSD – technical overview

Overall pressure remains on the downside with the market once again stalling out on a run up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6133 would be required to take the immediate pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

The New Zealand Dollar seems to be feeling the weight of a renewed round of risk off flow as the week gets going. Key standouts on Monday’s calendar come from UK CBI trades, an ECB Lagarde speech, US new home sales, and Dallas Fed manufacturing.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4600 will be required to take the immediate pressure off the downside. Next key support comes in at 4308.US SPX 500 – fundamental overview

Investors continue to struggle with the reality of a higher for longer Fed policy track in the face of ongoing worry around inflation, while also contending with geopolitical risk in 2023. Overall, we expect inflation to continue to be a problem in 2023 that results in downside pressure into rallies despite recent data and market expectations that would argue otherwise.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1600 on a monthly close basis ahead of the next major upside extension. Next major resistance comes in at 2100, above which opens the next extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less stable and upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.