Special report: ECB Decision Preview

Today’s report: Disconnect between data and Fed pricing

We’ve just seen another surge in global equities on the back of the China Reserve Requirement Ratio cut and a solid round of PMI data across the map. What’s been helping the surge is also what would now appear to be a more suspicious market pricing of Fed rates.

Wake-up call

- ECB decision

- recent data

- hike speculation

- China stimulus

- dovish communication

- global sentiment

- inflation risk

- Macro themes

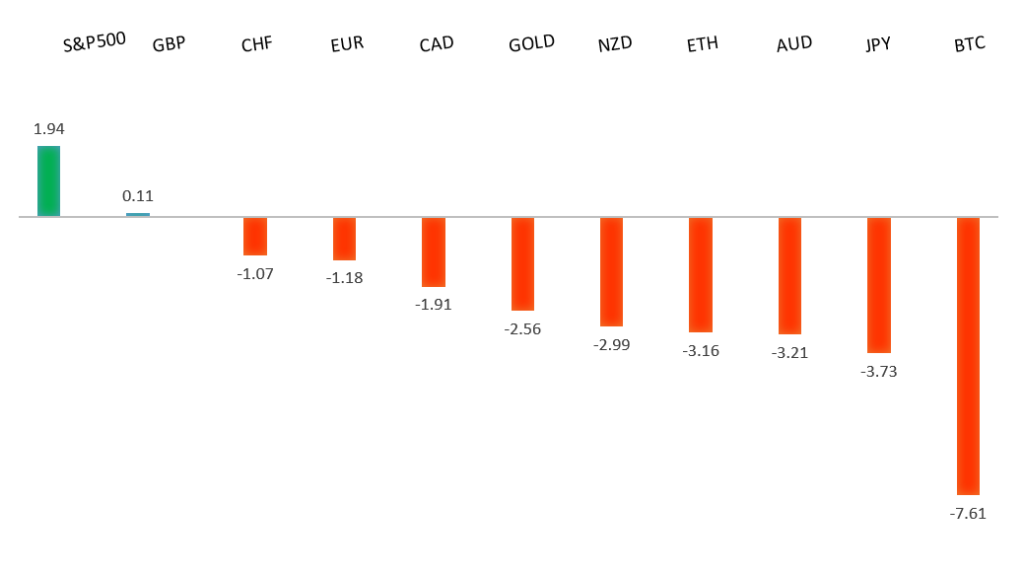

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- What To Conclude from the S&P 500's Record High, Fisher Investments (January 22, 2024)

- Fighting Agricultural Pollution in England’s Waterways, Financial Times (January 25, 2024)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the 2023 high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

Headline PMI data out of the Eurozone came in better on Wednesday. This was also accompanied by a boost in local equity markets which helped to prop the Euro back up. Key standouts on Thursday’s calendar come from German Ifo reads, the ECB policy decision, Canada earnings, Canada manufacturing sales, US durable goods, US GDP, US initial jobless claims, US new home sales, and an ECB Lagarde speech.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2000. Next key resistance comes in at 1.2849.GBPUSD – fundamental overview

The Pound got a boost from better than expected UK PMI numbers. Market odds for a BOE rate cut over the next two meetings sit at virtually zero. Key standouts on Thursday’s calendar come from German Ifo reads, the ECB policy decision, Canada earnings, Canada manufacturing sales, US durable goods, US GDP, US initial jobless claims, US new home sales, and an ECB Lagarde speech.USDJPY – technical overview

The market remains confined to a strong uptrend, with sights set on a retest and break of the multi-year high from 2022 at 151.95. A push through this level will open the next major upside extension towards 155.00. Key support comes in at 140.00, with only a weekly close below to delay the constructive outlook.USDJPY – fundamental overview

Better than expected PMI data out of Japan has fueled the rate hike speculation talk, which has opened additional demand for the Yen. Key standouts on Thursday’s calendar come from German Ifo reads, the ECB policy decision, Canada earnings, Canada manufacturing sales, US durable goods, US GDP, US initial jobless claims, US new home sales, and an ECB Lagarde speech.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6900 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Stronger Aussie PMIs, news of the China stimulus, and ongoing demand for US and global equities have helped to push the Australian Dollar higher in recent sessions. Key standouts on Thursday’s calendar come from German Ifo reads, the ECB policy decision, Canada earnings, Canada manufacturing sales, US durable goods, US GDP, US initial jobless claims, US new home sales, and an ECB Lagarde speech.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Bank of Canada left rates on hold as widely expected, but delivered a more dovish leaning communication after signaling the end of the tightening cycle. Key standouts on Thursday’s calendar come from German Ifo reads, the ECB policy decision, Canada earnings, Canada manufacturing sales, US durable goods, US GDP, US initial jobless claims, US new home sales, and an ECB Lagarde speech.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

The New Zealand Dollar has been supported in recent sessions on the back of broad based risk on flow. Key standouts on Thursday’s calendar come from German Ifo reads, the ECB policy decision, Canada earnings, Canada manufacturing sales, US durable goods, US GDP, US initial jobless claims, US new home sales, and an ECB Lagarde speech.US SPX 500 – technical overview

Longer-term technical studies continue to look quite extended after pushing to fresh record highs, begging for a deeper correction ahead. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4800 will be required to delay the outlook. Next key support comes in at 4714.US SPX 500 – fundamental overview

The Fed has finally bent to the will of the market, with the December 2023 policy decision revealing rate projections coming down from previous and more in line with what the market has been looking for. This has translated to more investor friendly policy going forward, opening the door for a run to fresh record highs in 2024. At the same time, we worry inflation remains a risk both the market and Fed are not taking as seriously as needed, which could once again force the Fed back into a more restrictive path and weigh heavily on stocks.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1900 on a monthly close basis ahead of the next major upside extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less stable and upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.