Next 24 hours: Yen sees some upside for a change

Today’s report: Market pricing and Fed pricing on the same page

We haven’t seen all that much movement in markets over the past 24 hours. Volatility has come down, with currencies chopping around and US equities consolidating off record highs. The lackluster price action can be best reflected through a check in on OIS pricing which has held steady over the past week.

Wake-up call

- German docket

- consumer credit

- excessive moves

- Aussie inflation

- Canada GDP

- RBNZ aftermath

- policy outlook

- Macro themes

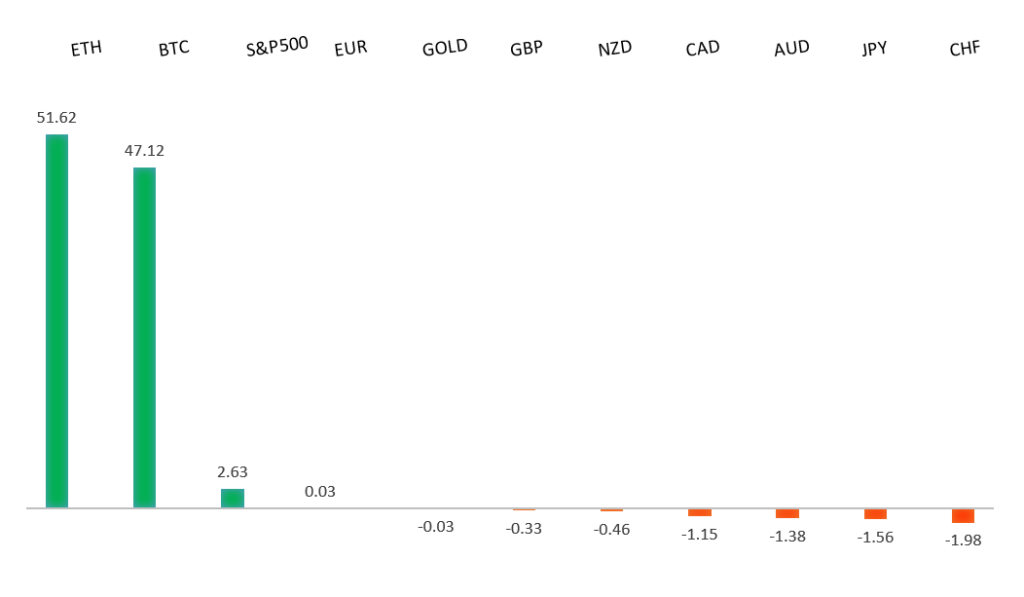

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- More Than Ever, Stock Investors Are Thinking Like Owners, J. Rekenthaler, Morningstar (February 26, 2024)

- Can we take the 'forever' out of forever chemicals?, P. Hollinnger, Financial Times (February 27, 2024)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the 2023 high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

The Euro took an early Wednesday hit on the back of softer Eurozone services, industrial and economic confidence reports, but managed to recover later in the day after US GDP fell short. Key standouts on Thursday’s calendar come from German retail sales, German unemployment, German inflation, UK consumer credit and net lending, Canada GDP, US initial jobless claims, personal income, personal spending, core PCE, Chicago PMIs, pending home sales, and Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2000. Next key resistance comes in at 1.2849.GBPUSD – fundamental overview

The Pound has held up well into dips but has been mostly quiet this week on a lackluster UK economic calendar. Earlier this week, we got some hawkish leaning comments from BOE Ramsden. Key standouts on Thursday’s calendar come from German retail sales, German unemployment, German inflation, UK consumer credit and net lending, Canada GDP, US initial jobless claims, personal income, personal spending, core PCE, Chicago PMIs, pending home sales, and Fed speak.USDJPY – technical overview

The market remains confined to a strong uptrend, with sights set on a retest and break of the multi-year high from 2022 at 151.95. A push through this level will open the next major upside extension towards 155.00. Key support comes in at 145.90, with only a weekly close below to delay the constructive outlook.USDJPY – fundamental overview

The Yen has managed to generate some bids, perhaps on the back of more official talk. The line that came out was that authorities are watching markets with a high level of urgency and are ready to take FX-related measures as needed. Japan industrial production came out slightly lower, while retail sales came out higher. Key standouts on Thursday’s calendar come from German retail sales, German unemployment, German inflation, UK consumer credit and net lending, Canada GDP, US initial jobless claims, personal income, personal spending, core PCE, Chicago PMIs, pending home sales, and Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6900 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar is doing its best to try and recover after a round of bearish Wednesday economic data in the form of a softer CPI indicator and below forecast construction work. Key standouts on Thursday’s calendar come from German retail sales, German unemployment, German inflation, UK consumer credit and net lending, Canada GDP, US initial jobless claims, personal income, personal spending, core PCE, Chicago PMIs, pending home sales, and Fed speak.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar has extended declines to fresh yearly lows against the Buck, taking its hits on softer Canada data, a downturn in stocks, and weaker commodities prices. Key standouts on Thursday’s calendar come from German retail sales, German unemployment, German inflation, UK consumer credit and net lending, Canada GDP, US initial jobless claims, personal income, personal spending, core PCE, Chicago PMIs, pending home sales, and Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

On Wednesday, the RBNZ left rates on hold as widely expected but caught the market off guard with a more dovish leaning policy communication. The central bank made no mention of the possibility for any rate hikes, while also downgrading its forecast peak target rate. At the post decision presser, RBNZ Orr said any discussion for a rate hike was dismissed very quickly. Key standouts on Thursday’s calendar come from German retail sales, German unemployment, German inflation, UK consumer credit and net lending, Canada GDP, US initial jobless claims, personal income, personal spending, core PCE, Chicago PMIs, pending home sales, and Fed speak.US SPX 500 – technical overview

Longer-term technical studies continue to look quite extended after pushing to fresh record highs, begging for a deeper correction ahead. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close above 5000 will be required to delay the outlook. Next key support comes in at 4842.US SPX 500 – fundamental overview

Though we have seen an adjustment of investor expectations towards the amount of rate cuts in 2024, the market still believes policy will end up erring more towards the investor friendly, accommodative side of things. This bet has kept stocks well bid and pushing record highs. Still, it's important to highlight the fact that the Fed has yet to declare a victory over inflation and could disappoint investors with less accommodative policy than desired going forward. If this happens, stocks could be in for a nasty bearish reversal.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1900 on a monthly close basis ahead of the next major upside extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less stable and upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an end.