Next 24 hours: Why the Dollar demand on Monday?

Today’s report: Fed Chair Powell isn't one to disappoint

The market was looking for some juicy dovish speak from the Fed Chair on Friday and he certainly didn’t disappoint. Jerome Powell was out on the wires saying the time had come to adjust policy. The market took the news as confirmation it had been doing a good job with rate pricing.

Wake-up call

- German Ifo

- GBPUSD Strong contrast of messaging from BOE, Fed

- BOJ Ueda

- risk backdrop

- retail sales

- macro picture

- accommodative policy

- Macro themes

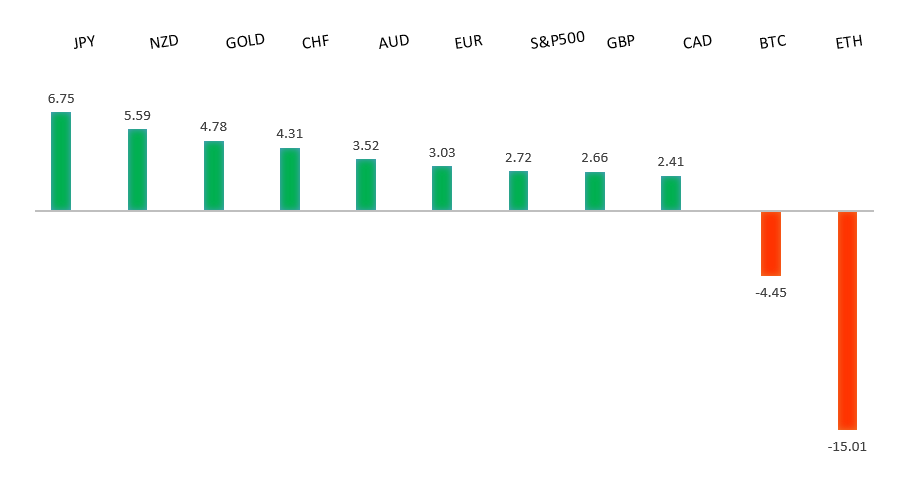

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- The Win Rate For 60/40 Portfolio Over Time, B. Carlson, AWOCS (August 22, 2024)

- Inside Great Britain’s ‘Gangbusters’ Q2, Fisher Investments (August 15, 2024)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the 2023 high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

The Euro has extended yearly and multi-month highs on the back of dovish Fed Chair comments and this latest run of Euro area data including French confidence numbers and higher Eurozone inflation expectations. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, US durable goods, and Dallas Fed manufacturing.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The door is now open for the next major upside extension towards the 2018 high at 1.4377. Any setbacks should be well supported ahead of 1.2500.GBPUSD – fundamental overview

No surprise to see the Pound race to another yearly high, taking out the 2023 peak along the way. There has been a clear contrast in messaging out from the Fed and BOE. On the one side, the Fed Chair has set the stage for a wave of easing, while on the other side, BOE Bailey has been cautious about rate cuts while stressing inflation is still not back to target. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, US durable goods, and Dallas Fed manufacturing.USDJPY – technical overview

The market has entered a period of correction after extending the uptrend to a multi-year high through 160.00. Critical support comes in around 140.00, with only a monthly close below the barrier to compromise the bullish outlook. A higher low is ideally sought out above 140.00 in favor of a bullish continuation.USDJPY – fundamental overview

BOJ Ueda has kept the Yen better bid than many had thought after recent remarks before parliament. The central banker said the BOJ would raise rates again if the economy stayed in line, while claiming financial conditions remain easy after the July hike. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, US durable goods, and Dallas Fed manufacturing.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6900 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar comes into the new week in fine form, with a focus on the 2024 high on the back of dovish Fed Chair comments, better bid commodities, and ongoing demand for equities. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, US durable goods, and Dallas Fed manufacturing.USDCAD – technical overview

A sustained hold above 1.3000 over the past several months signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area, with a break to open a retest of the 2020 high just ahead of 1.4700. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar has been bid with the rest of the currency market on broad based US Dollar selling from a more dovish Fed. However, the Canadian Dollar has also lagged relative to its peers after Canada retail sales came in on the softer side. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, US durable goods, and Dallas Fed manufacturing.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

Softer New Zealand retail sales have done nothing to slow the pace of Kiwi gains, with the currency focused on a retest of the 2024 high as it builds momentum from healthy risk appetite in global markets on the back of dovish comments from Fed Chair Powell. Key standouts on Monday’s calendar come from German Ifo reads, Canada wholesale sales, US durable goods, and Dallas Fed manufacturing.US SPX 500 – technical overview

The longer term uptrend remains intact and dips continue to be exceptionally well supported. Critical support comes in at 5093, with only a break back below this level to compromise the structure and open the door for a more significant corrective decline. Until then, the focus remains on a retest and break back above the record high.US SPX 500 – fundamental overview

The US equities market remains exceptionally well supported in 2024 on the back of an ongoing expectation for more rate cuts than less going forward. Investors are feeling better about a soft landing in the US economy and this has also been accompanied by an accommodative adjustment of Fed policy. It will however be important to keep an eye on inflation, bigger picture economic data and geopolitical risk in the months ahead.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and this next major upside extension into the 2500-3000 area. Setbacks should now be well supported above 2200 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in 2024 with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported over the coming months.