Next 24 hours: Dollar dominance continues

Today’s report: Investors less enthusiastic about stronger US data

The market is showing signs of discomfort with the implication of yet another round of stronger economic data out of the US. On Tuesday, JOLTs job openings and ISM services both exceeded expectation. Looking ahead, we get German factory orders, German retail sales, Eurozone confidence and sentiment reads, Eurozone producer prices, US ADP employment, US initial jobless claims, and the Fed Minutes late in the day.

Wake-up call

- Healthy batch

- construction PMIs

- verbal intervention

- inflation component

- trade talk

- Dairy prices

- dovish Fed

- Macro themes

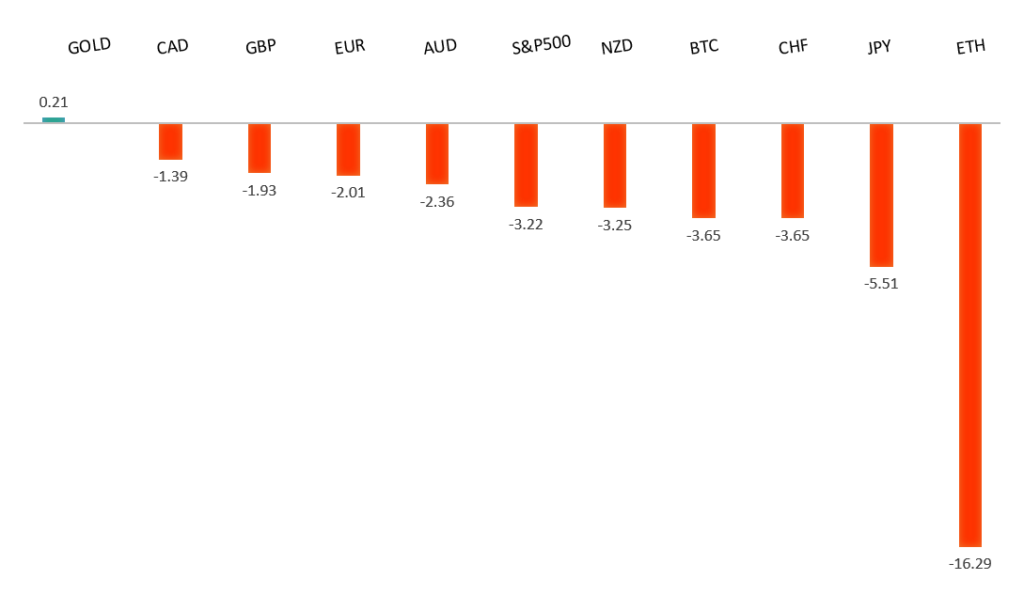

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- Market Forecasts Are Useless, Narratives Aren't, J. Calhoun, Alhambra (January 6, 2025)

- We're all gonna' get really rich!, R. Vigilante, The Next American Century (January 6, 2025)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0400, with a higher platform sought out ahead of the next major upside extension. Look for a major bounce in the days ahead and the start to a push back towards the 2023 high at 1.1276. Only a monthly close below 1.0400 negates.EURUSD – fundamental overview

The Euro has struggled to hold onto gains into the latest recovery rally despite an uptick in Euro area inflation data. The market has been more focused on yet another batch of solid and offsetting data out of the US including JOLTs job openings and ISM services. Looking ahead, we get German factory orders, German retail sales, Eurozone confidence and sentiment reads, Eurozone producer prices, US ADP employment, US initial jobless claims, and the Fed Minutes late in the day.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The door is now open for the next major upside extension towards the 2018 high at 1.4377. Setbacks should be well supported above 1.2500 on a monthly close basis.GBPUSD – fundamental overview

Discouraging UK construction PMI numbers put a damper on things, with the Pound giving back a healthy chunk of the latest recovery. This was also compounded by another healthy round of economic data out of the US on Tuesday. Looking ahead, we get German factory orders, German retail sales, Eurozone confidence and sentiment reads, Eurozone producer prices, US ADP employment, US initial jobless claims, and the Fed Minutes late in the day.USDJPY – technical overview

The market is looking to resume the longer-term uptrend after an intense correction in 2024. A higher low is ideally sought out above 140.00 in favor of a bullish continuation. The October monthly close back above 150.00 strengthens the case for longer-term uptrend resumption.USDJPY – fundamental overview

The prospect of more imminent rate hikes from the BOJ has faded, all while US economic data has been strong and Fed policy has shifted more hawkish. This has opened heavy downside pressure on the Yen, with the currency sinking to its lowest levels since July 2024. At this stage, we should expect more verbal intervention efforts like we saw on Tuesday with FinMin Kato, in an effort to slow the pace of Yen declines. Looking ahead, we get German factory orders, German retail sales, Eurozone confidence and sentiment reads, Eurozone producer prices, US ADP employment, US initial jobless claims, and the Fed Minutes late in the day.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Australia's closely watched trimmed mean core CPI measure has eased, opening the door to thoughts about a dovish shift in RBA policy and the consideration of a rate cut. This has weighed on the commodity currency on this Wednesday. Looking ahead, we get German factory orders, German retail sales, Eurozone confidence and sentiment reads, Eurozone producer prices, US ADP employment, US initial jobless claims, and the Fed Minutes late in the day.USDCAD – technical overview

A sustained hold above 1.3000 over the past several months signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4500-1.5000 area, exposing a retest of the 2020 high just ahead of 1.4700. Setbacks should be very well supported ahead of 1.3500.USDCAD – fundamental overview

The Canadian Dollar came back under pressure on Tuesday, getting hit from solid US economic data and a resumption of tough trade talk from President-elect Trump. Looking ahead, we get German factory orders, German retail sales, Eurozone confidence and sentiment reads, Eurozone producer prices, US ADP employment, US initial jobless claims, and the Fed Minutes late in the day.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5500 will intensify bearish price action.NZDUSD – fundamental overview

Though we did see a rise in milk powder prices, the other prices for dairy commodities softened, which has translated to a net downside pressure on the New Zealand Dollar. Looking ahead, we get German factory orders, German retail sales, Eurozone confidence and sentiment reads, Eurozone producer prices, US ADP employment, US initial jobless claims, and the Fed Minutes late in the day.US SPX 500 – technical overview

The longer term uptrend remains intact and dips continue to be exceptionally well supported. Critical support comes in at 5679, with only a break back below this level to compromise the structure and open the door for a more significant corrective decline. Until then, the focus remains on a continued push to fresh record highs.US SPX 500 – fundamental overview

Investors are feeling better about a soft landing in the US economy. Moreover, there has been a fresh wave of market optimism in anticipation of a market bullish Trump presidency. It will however be important to keep an eye on inflation, bigger picture economic data and the latest shift in the Fed dot plot. Any of these variables are capable of easily ruffling some feathers and we've already seen a little of this in the aftermath of the latest Fed decision.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and this next major upside extension into the 3000 area. Setbacks should now be well supported above 2500 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in recent months with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported over the coming months.