Next 24 hours: US Dollar alternatives considered

Today’s report: An ugly Q1 2025

Investors have been stunned by US tariff moves in the first quarter of 2025 and risk assets have been paying the price. As we come into the new week, there is a new anticipation around reciprocal tariffs out of the US in response to retaliatory measures from US trading partners.

Wake-up call

- shrugs off

- retail sales

- Japan data

- macro headwinds

- some relief

- business confidence

- Trump policies

- Macro themes

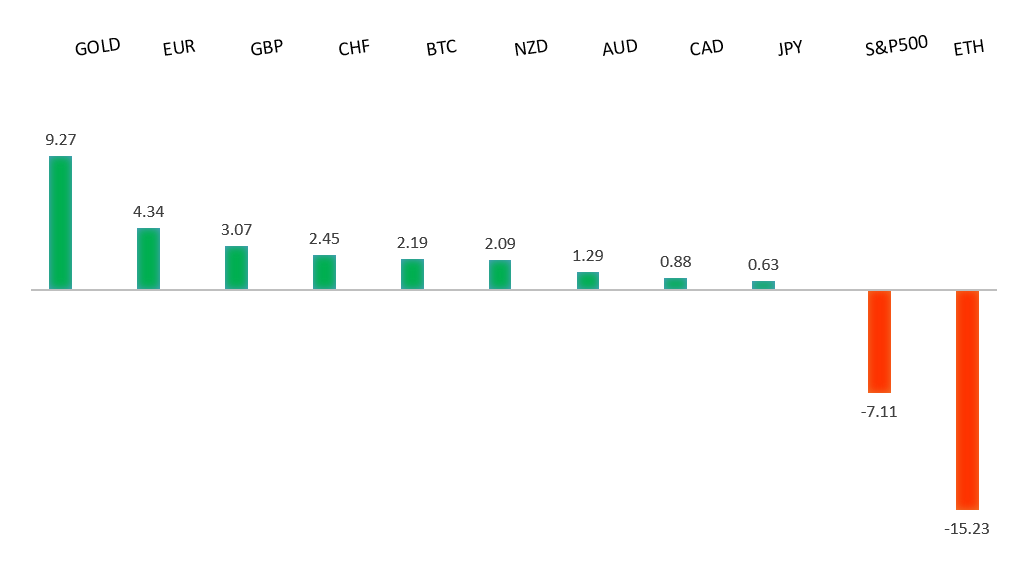

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- Why governments are 'addicted' to debt, D. Garahan, Financial Times (March 27, 2025)

- Why is International Investing Working Again?, C. Roche, Discipline Funds (March 26, 2025)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips towards parity, with a higher platform sought out ahead of the next major upside extension. Look for a push back towards the 2023 high at 1.1276 in the days ahead. Only a monthly close below 1.0000 negates.EURUSD – fundamental overview

The Euro has managed to squeeze higher in recent sessions despite Friday's round of discouraging European data. Key standouts on Monday’s calendar come from German retail sales, German inflation reads, BOE consumer credit, UK mortgage approvals, Chicago PMIs, and Dallas Fed manufacturing.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The door is now open for the next major upside extension towards the 2018 high at 1.4377. Setbacks should be well supported above 1.2000 on a monthly close basis.GBPUSD – fundamental overview

The Pound is getting some more support as the new week gets going, particularly in the aftermath of the latest pop in UK retail sales. Key standouts on Monday’s calendar come from German retail sales, German inflation reads, BOE consumer credit, UK mortgage approvals, Chicago PMIs, and Dallas Fed manufacturing.USDJPY – technical overview

There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback towards the 140 area.USDJPY – fundamental overview

The Yen was already well bid in the aftermath of hotter Japan inflation data in the previous week. The currency is finding more bids as the new week gets going after taking in some more positive data in the form of industrial production and retail sales. All of this is helping to support the case for additional BOJ rate hikes. Key standouts on Monday’s calendar come from German retail sales, German inflation reads, BOE consumer credit, UK mortgage approvals, Chicago PMIs, and Dallas Fed manufacturing.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6000 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar is struggling with softer Aussie economic data and fallout in global risk appetite. Since the last RBA decision, which was seen as a hawkish cut, things have been looking worse and this could invite a shift back towards a more accommodative bias. Key standouts on Monday’s calendar come from German retail sales, German inflation reads, BOE consumer credit, UK mortgage approvals, Chicago PMIs, and Dallas Fed manufacturing.USDCAD – technical overview

A sustained hold above 1.3000 over the past several months signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in at the 1.5000 psychological barrier. Setbacks should be very well supported ahead of 1.4000.USDCAD – fundamental overview

The Canadian Dollar continues to feel the heat from US tariff fallout, with PM Carney telling Trump Canada would retaliate. But we have seen some of the setbacks in the Loonie mitigated by Friday's round of better than expected Canada GDP. Key standouts on Monday’s calendar come from German retail sales, German inflation reads, BOE consumer credit, UK mortgage approvals, Chicago PMIs, and Dallas Fed manufacturing.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5469 will intensify bearish price action.NZDUSD – fundamental overview

A dip in New Zealand business confidence has further contributed to the dovish outlook at the RBNZ. This along with a major reduction in global risk appetite should continue to weigh on the correlated currency. Key standouts on Monday’s calendar come from German retail sales, German inflation reads, BOE consumer credit, UK mortgage approvals, Chicago PMIs, and Dallas Fed manufacturing.US SPX 500 – technical overview

The longer term uptrend remains intact and dips continue to be exceptionally well supported. But we are in the throes of a meaningful correction with scope for the pullback to extend back towards major previous resistance turned support in the form of the 2022 high at 4820.US SPX 500 – fundamental overview

Going forward, it will be important to keep an eye on Trump trade policies, inflation, bigger picture economic data and the Fed policy outlook. Any of these variables are capable of easily ruffling some feathers and we've already seen a little of this as 2025 gets going.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and this next major upside extension towards 3500. Setbacks should now be well supported above 2800 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in recent months with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported over the coming months.