| ||

| 10th November 2025 | view in browser | ||

| Fed cut bets grow after dollar’s shaky week | ||

| The dollar enters Monday on the defensive after a sharp retreat late last week, weighed down by soft U.S. labor data, political gridlock, and a sharp selloff in AI-linked stocks that triggered a broad risk-off tone. | ||

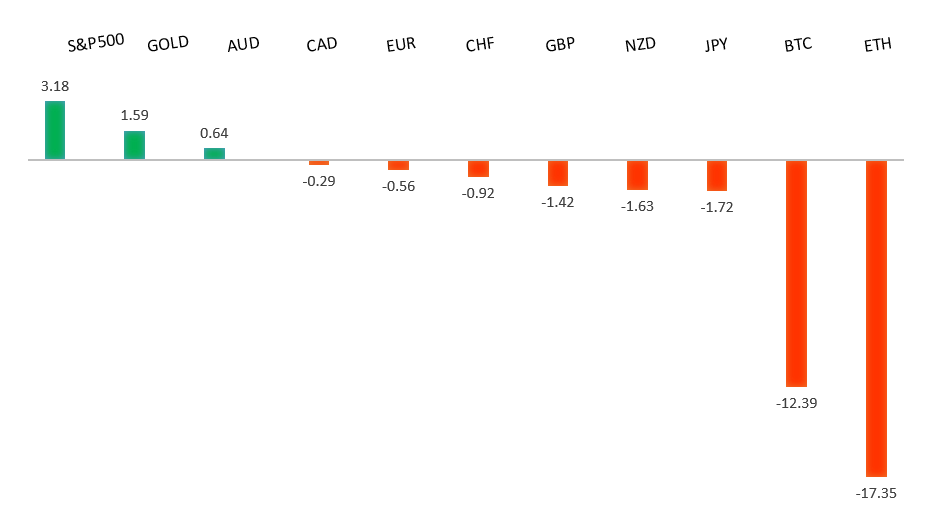

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| ECB Vice President Luis de Guindos and Board member Frank Elderson highlighted a more balanced outlook for eurozone growth, with inflation easing (especially in services), fewer downside risks due to easing trade tensions, a Middle East ceasefire, and potential boosts from rising military spending. Policymakers are pausing after eight quarter-point rate cuts, holding the deposit rate at 2% amid stable inflation near target and resilient growth despite U.S. tariffs. One major bank sees a positive macro environment and expects the ECB to keep rates steady until at least June 2026, while the Fed begins cuts, forecasting the euro to strengthen to $1.20 by Q4 2025 and $1.26 by Q3 2026. Key upcoming data includes Germany’s ZEW sentiment (Nov 11), Eurozone Sentix Investor Confidence (forecast -4.0 vs prior -5.4, signaling cautious recovery), Q3 GDP, employment, industrial production, and trade balance, which could lift the euro if upbeat. | ||

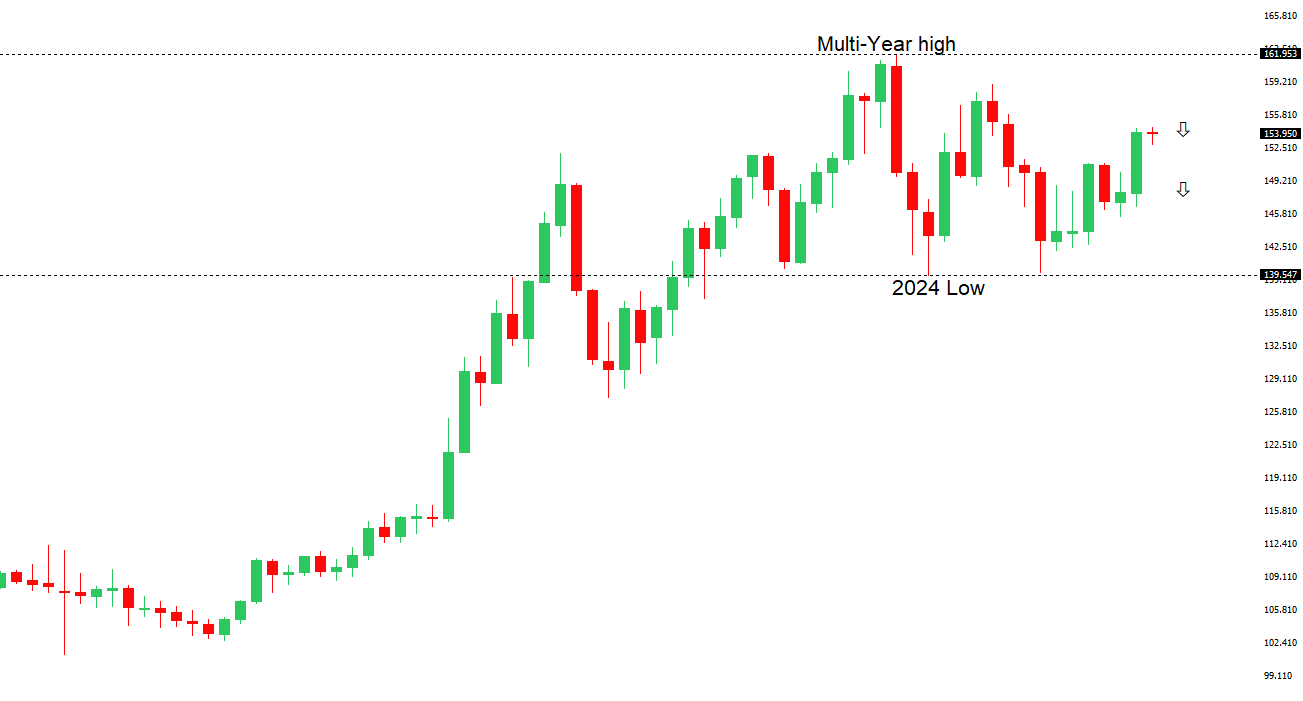

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 154.48 - 4 November high - Medium S1 152.82 - 7 November low - Medium S2 151.54 - 29 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Last week, the yen gained from a dollar sell-off. PM Sanae Takaichi’s shift to multi-year budgeting, reflationist appointments, and a potential ¥15–20 trillion stimulus have raised expectations of looser fiscal policy and prolonged BOJ accommodation, widening the U.S.-Japan yield gap and pressuring the yen. However, the BOJ’s October meeting summary and board member Junko Nakagawa’s speech today signaled readiness for a rate hike amid improving conditions, reduced uncertainty, and focus on wages and global risks—though a sustained yen rally likely needs aggressive Fed cuts beyond a one-off BOJ move. Key data this week: September current account, October bank lending, preliminary machine tool orders, and PPI. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6458 - 5 November low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| The RBA’s hold at 3.6% with no cuts until mid-2026, alongside Australia’s stronger GDP outlook (1.8% in 2025, rising to 2.3% by 2027) versus the US, supports AUD appreciation, bolstered by a tight labor market, rising assets, and sustained commodity gains—despite vulnerability to AI-driven risk-off moves. With inflation above target until mid-2026, markets expect only mild RBA easing to 3.4% by late 2026 versus sharper Fed cuts to ~3%; positioning has improved as shorts unwind, with AUD ~8% undervalued (fair value 0.71 vs. ~0.65) and far below historical norms. Positive China signals—bottoming CPI and PBOC’s stable yuan policy—add support, favoring AUDUSD holding up unless risk aversion deepens. Key data this week: consumer and business confidence, home loans, and jobs. | ||

| Suggested reading | ||

| Cockroaches in the Coal Mine, H. Marx, Oaktree Capital (November 6, 2025) Should You Buy At All Time Highs?, N. Maggiulli, Of Dollars & Data (November 4, 2025) | ||