| ||

| 5th December 2025 | view in browser | ||

| Slowdown signals shape Friday mood | ||

| Global markets head into Friday on a cautious footing, balancing signs of slowing momentum across major economies with rising expectations of targeted policy support. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

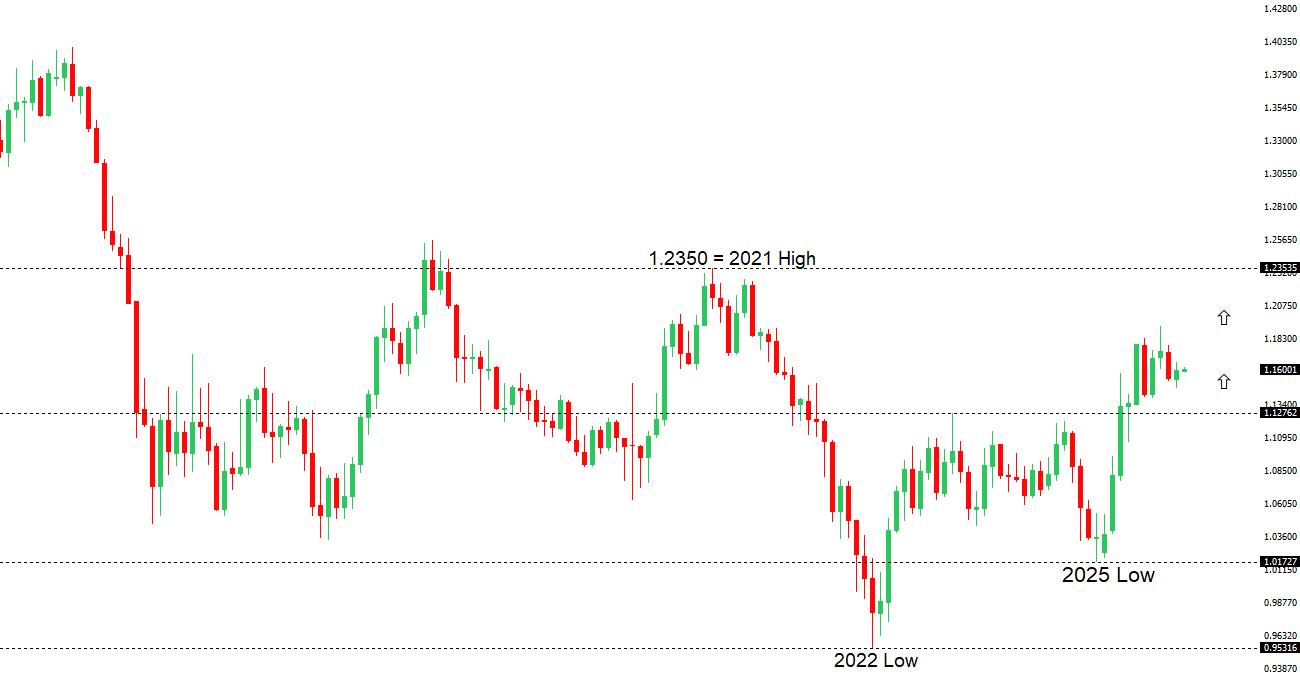

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1682 - 4 December high - Medium S1 1.1547 - 26 November low - Medium S2 1.1469 - 5 November low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro climbed to a seven-week high as markets increasingly expect a U.S. Fed rate cut before the 10 December meeting, adding to broad dollar weakness. Support also came from slightly stronger eurozone data, steady ECB messaging, and comments from President Lagarde suggesting no imminent policy changes. Many bank analysts expect further EURUSD gains into year-end—helped by seasonal dollar softness, a Fed cut, and a still-undervalued euro—with potential upside if any Russia-Ukraine truce emerges. Meanwhile, the EU advanced plans to deepen its single financial market, and geopolitical tensions remain elevated as European leaders urge Ukraine not to concede without strong U.S. guarantees. Upcoming data include German factory orders, expected to show only tentative stabilization, and the eurozone’s third estimate of Q3 GDP. | ||

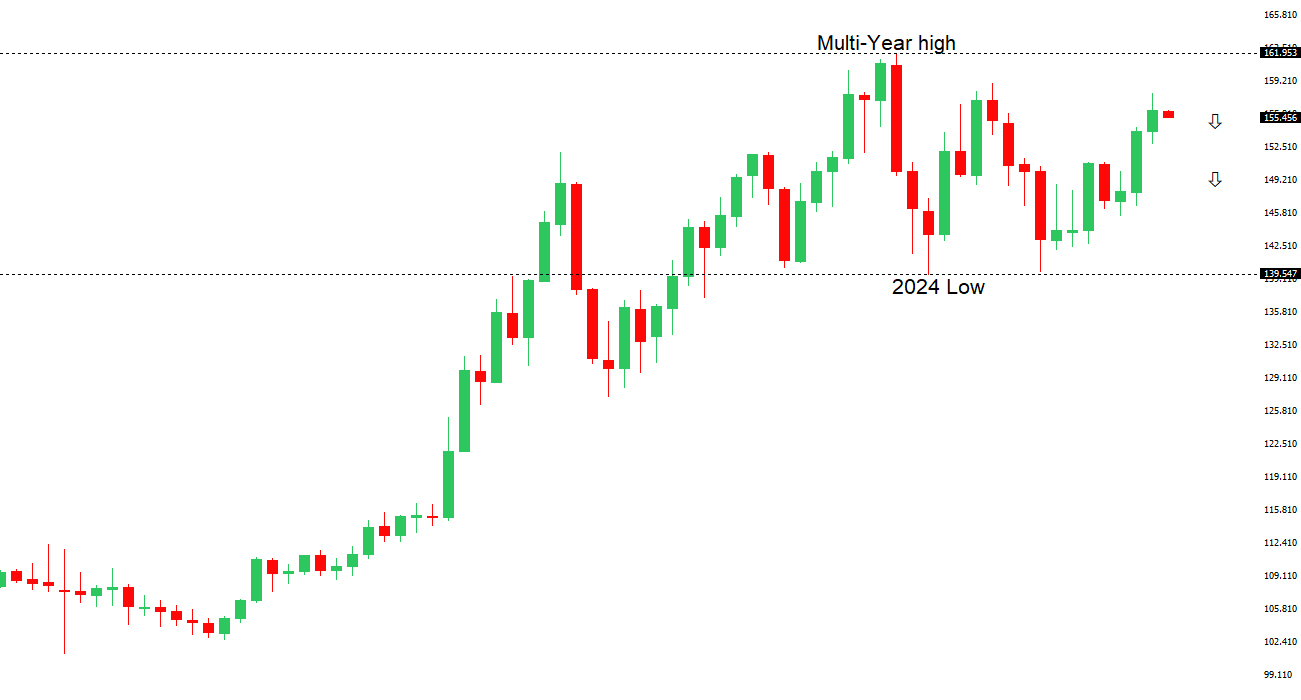

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.90 - 20 November/2025 high - Strong R1 156.59 - 28 November high - Medium S1 154.00 - Figure - Medium S2 153.61 - 14 November low - Strong | ||

| USDJPY: fundamental overview | ||

| BOJ Governor Ueda signaled that Japan’s “neutral” interest rate is likely above current levels, implying room for further hikes, and his comments about weighing a move on December 18–19 boosted market expectations of an imminent increase, pushing JGB yields to their highest since before the global financial crisis. Reports also suggest the government would not stand in the BOJ’s way, reinforcing market pricing of a 90%+ chance of a December hike. While a move this month is now widely expected, markets doubt the BOJ will tighten much further given its cautious stance and the government’s expansionary fiscal plans. A durable drop in USDJPY would still depend more on the Fed easing aggressively; otherwise, Japan’s attempt to maintain loose fiscal policy, negative real rates, and a stronger yen looks unsustainable. Meanwhile, weak October household spending (-3% YoY) underscores soft domestic demand, though the BOJ still expects consumption to stabilize and gradually pick up as wages rise. The data adds complexity but is unlikely to derail a December hike, and consumption trends will be key for Japan’s broader economic recovery. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6625 - 4 December high - Medium S1 0.6520 - 28 November low - Medium S2 0.6421 - 21 November low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australian data shows household spending surged 1.3% in October—more than double expectations—lifting annual growth to 5.6% and signalling strong demand, especially in discretionary areas like clothing, furnishings, hospitality, and entertainment. The strength in spending, alongside rising unit labor costs and signs the economy is hitting capacity limits, reinforces inflation risks and supports the RBA’s decision to pause in December, though major banks now see a February rate hike as increasingly likely. Markets have shifted toward a more hawkish outlook, with bond yields climbing and OIS pricing suggesting higher rates ahead, positioning the AUD as one of the highest-yielding G10 currencies by 2026. | ||

| Suggested reading | ||

| What the Economics of Envy Can’t Answer, D. Boudreaux, The Daily Economy (December 4, 2025) Why Corporate Earnings Are About To Take A Hit, B. Khurana, Barron’s (December 3, 2025) | ||