|

||

| 10th April 2025 | view in browser | ||

| Trump’s tariff timeout boosts markets | ||

|

The financial strain on global markets was getting to be a little too much following the 100%+ US levy on China and China’s retaliatory 34% and 50% tariffs on US goods. And so finally, on Wednesday, President Trump cooled things down after announcing a 90-day pause on reciprocal tariffs. |

||

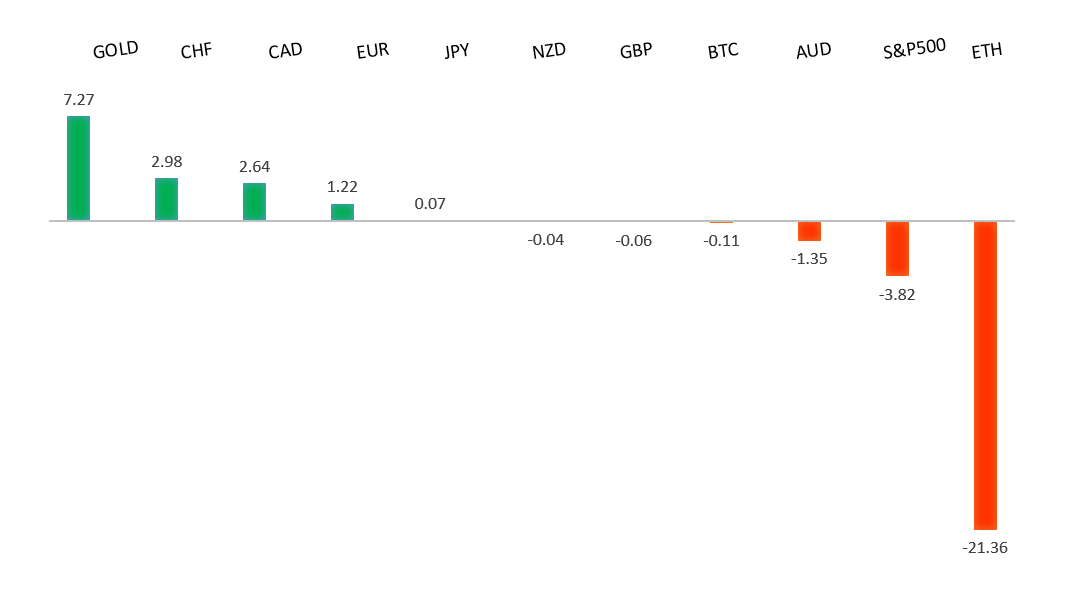

| Performance chart 30day v. USD (%) | ||

|

||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

|

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips towards parity, with a higher platform sought out ahead of the next major upside extension. Look for a push back towards the 2023 high at 1.1276 in the days ahead. Only a monthly close below 1.0000 negates. |

||

|

||

| R2 1.1148 - 3 April/2025 high - Strong - S1 1.0880 - 7 April low - Medium | ||

| R1 1.1108 - 4 April high - Medium - S2 1.0733 - 27 March low - Strong | ||

| EURUSD: fundamental overview | ||

|

ECB Villeroy cautiously welcomed President Trump’s 90-day tariff pause but noted US unpredictability still hampered the growth outlook. Meanwhile, BNP Paribas’ chief economist urged the EU to focus on domestic growth via single-market investments rather than retaliation. ECB Holzmann suggested pausing rate cuts in April due to trade uncertainty, despite markets expecting a cut. And a UK-EU defense pact eyes a May 19 completion date to bolster European security amid US policy shifts. Finally, ECB Cipollone was out pushing for digital euro and cash regulations to reduce reliance on foreign payment firms. As far as today’s economic calendar goes, key standouts come from US initial jobless claims and inflation data. |

||

| USDJPY: technical overview | ||

|

There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback towards the 140 area. |

||

|

||

| R2 148.28 - 9 April high - Strong - S1 145.96 - 8 April low - Medium | ||

| R1 147.88 - 10 April high - Medium - S2 144.00 - 9 April/2025 low - Strong | ||

| USDJPY: fundamental overview | ||

|

President Trump’s erratic tariff policies have undermined the dollar’s safe-haven status, boosting the Yen as a consequence. Japan PM Ishiba aims to leverage Trump’s pause on reciprocal tariffs to negotiate better terms on steel and auto levies, banking on Japan’s strategic alliance and investment in the US, with key appointees Bessent and Greer leading talks. Bloomberg Economics has warned that if the 24% tariffs and 25% auto levy resume, Japan’s GDP could drop by 0.9%, while OIS markets now see little chance of rate hikes this year. As far as today’s economic calendar goes, key standouts come from US initial jobless claims and inflation data. |

||

| AUDUSD: technical overview | ||

|

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. |

||

|

||

| R2 0.6332 - 4 April high - Medium - S1 0.6100 - Figure - Medium | ||

| R1 0.6219 - 31 March low - Medium - S2 0.5914 - 9 April/2025 low - Strong | ||

| AUDUSD: fundamental overview | ||

|

The Australian Dollar rebounded from a year-to-date low after President Trump’s tariff pause eased risk aversion. Despite levies persisting on China, and Trump’s unpredictable tariff stance, the risk of deeper setbacks in 2025 has eased for now. In fact, there have been some strategists making a bullish case for the Australian Dollar, citing China’s stimulus boosting commodity demand and US economic self-harm from tariffs. There is support for this view via CME data showing call options doubling puts. Meanwhile, Treasurer Chalmers has convened top economic leaders to mitigate global volatility. Speculation has been growing for a potential 50 basis point RBA cut in May. As far as today’s economic calendar goes, key standouts come from US initial jobless claims and inflation data. |

||

| USDCAD: technical overview | ||

|

A sustained hold above 1.3000 over the past several months signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in at the 1.5000 psychological barrier. Setbacks should be very well supported ahead of 1.3500. |

||

|

||

| R2 1.4297 - 7 April high - Strong - S1 1.4054 - 4 April low - Medium | ||

| R1 1.4143 - 8 April low - Medium - S2 1.4027 - 3 April/2025 low - Strong | ||

| USDCAD: fundamental overview | ||

|

We’ve seen a surge in demand for the Canadian Dollar on the back of President Trump’s 90-day tariff pause. The resulting development has translated to broad based risk on flow and concurrent surge in the price of oil. Meanwhile, PM Carney has been helping the Canadian Dollar as well, after pledging to make Canada an energy superpower. As far as today’s economic calendar goes, key standouts come from Canada building permits, US initial jobless claims and US inflation data. |

||

| Suggested reading | ||

|

Why The Dollar Will Keep Falling, V. Katsenelson, The Intellectual Investor (April 7, 2025) Bear Markets and Bad Decisions, J. Wiggins, Behavioral Investment (April 8, 2025) |

||