Next 24 hours: What the Fed Chair says

Today’s report: Post Fed panic subsides

The initial wave of panic post Fed has subsided and we’re right back to seeing what we’ve seen any time risk has come off over the past decade plus. Stocks have been bid right back up, presumably this time on the expectation that 2023 is still a ways away.

Wake-up call

- ECB Lagarde

- hawkish BOE

- risk appetite

- leveraged selling

- Commodities rebound

- Fed Chair

- Stocks vulnerable

- Dealers report

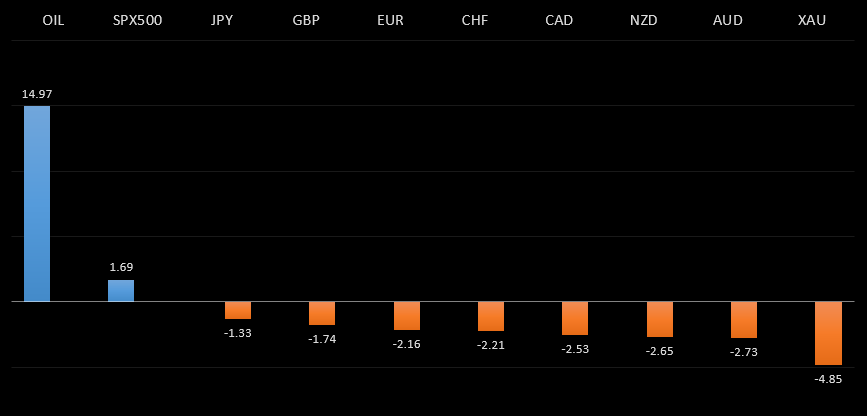

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Following the Money Suggests Stocks Have a Problem, J. Authers, Bloomberg (June 22, 2021)

- Will China Become the Centre of the World Economy?, J. Kynge, Forbes (June 21, 2021)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has been looking for a higher low since topping out in 2021 up at 1.2350. Ideally, this next higher low is sought out ahead of 1.1600 in favour of the next major upside extension back through 1.2350 and towards a retest of the 2018 high at 1.2555 further up.EURUSD – fundamental overview

The Euro recovered in Monday trade, helped along by the broad recovery in currencies against the Buck. We also heard from ECB Lagarde who talked about the necessity to tighten market rates in periods of recovery. Looking ahead, key standouts on today’s calendar include UK CBI trends, Eurozone consumer confidence, US existing home sales, Richmond Fed manufacturing, speeches from ECB Lane, Fed Daly. And ECB Schnabel, and Fed Chair Powell testimony.EURUSD - Technical charts in detail

GBPUSD – technical overview

Technical studies are in the process of consolidating from stretched levels after the push to fresh multi-month highs. This leaves room for additional consolidation, before the market considers a meaningful bullish continuation towards a retest of the 2018 high. But look for setbacks to now be very well supported into the 1.3500 area.GBPUSD – fundamental overview

A nice recovery for the Pound on Monday. Not only did the Pound benefit from broad based selling of the US Dollar, there has also been a growing expectation that the BOE will come out with a similar hawkish tone in its policy decision later this week. Looking ahead, key standouts on today’s calendar include UK CBI trends, Eurozone consumer confidence, US existing home sales, Richmond Fed manufacturing, speeches from ECB Lane, Fed Daly. And ECB Schnabel, and Fed Chair Powell testimony.USDJPY – technical overview

The major pair has run into massive resistance in the form of the monthly Ichimoku cloud, and has since stalled out. This t