Today’s report: No surprises from RBA

Holidays in Asia are making for thinner trading conditions in the opening sessions on Tuesday, though overall, the picture is looking a little more upbeat, with stocks recovering and the US Dollar selling off.

Wake-up call

- German inflation

- BOE hikes

- Japan data

- RBA decision

- Oil demand

- stocks rebound

- Stocks vulnerable

- Dealers report

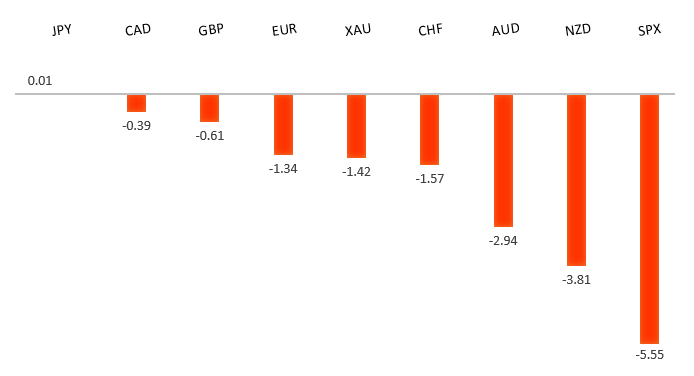

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Be Warned — the Turbulence This Time Is Different, J. Authers, Bloomberg (February 1, 2022)

- Is Wealth Management Changing for Women?, Financial Times (February 1, 2022)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The latest breakdown back below 1.1200 opens the door for a fresh downside extension towards the 1.0900 area. At this point, it will take a break back above the 2022 high at 1.1483 to take the immediate pressure off the downside.EURUSD – fundamental overview

The Euro got a bit of a boost on German inflation data, which came in well above forecast. This could bake in a little more hawkishness to this week's ECB meeting. Looking ahead, we get German retail sales, German unemployment, German manufacturing PMIs, Eurozone manufacturing PMIs, Canada GDP, and US reads highlighted by ISM manufacturing, construction spending, and JOLTs job openings.EURUSD - Technical charts in detail

GBPUSD – technical overview

The market is in a correction phase in the aftermath of the run to fresh multi-month highs in 2021. At this stage, additional setbacks should be limited to the 1.3000 area ahead of the next major upside extension towards a retest and break of critical resistance in the form of the 2018 high. Back above 1.3835 takes pressure off the downside.GBPUSD – fundamental overview

The Pound has held up relatively well against its peers, on the back of hawkish BOE expectations. The market is pricing 5 total rate hikes from the BOE for 2022 and BOE Bailey has warned of more persistent inflation. Looking ahead, we get German retail sales, German unemployment, German manufacturing PMIs, Eurozone manufacturing PMIs, Canada GDP, and US reads highlighted by ISM manufacturing, construction spending, and JOLTs job openings.USDJPY – technical overview

The longer-term trend is bearish despite the recent run higher. Look for additional upside to be limited, with scope for a topside failure and bearish resumption back down towards the 100.00 area. It would take a clear break back above 117.00 to negate the outlook.USDJPY – fundamental overview

The Bank of Japan remains committed to accommodative policy which has made the yield differential gap with the US Dollar that much wider in favour of the Buck in the aftermath of a hawkish FOMC decision last week. This along with a rebound in global sentiment have contributed to this latest run of Yen weakness. Perhaps we're also seeing some Yen weakness on a recent round of discouraging Japan economic data highlighted by industrial production and consumer confidence. Looking ahead, we get German retail sales, German unemployment, German manufacturing PMIs, Eurozone manufacturing PMIs, Canada GDP, and US reads highlighted by ISM manufacturing, construction spending, and JOLTs job openings.AUDUSD – technical overview

The Australian Dollar has been in the process of a healthy correction following the impressive run towards a retest of the 2018 high in 2021. At this stage, the correction is starting to look stretched and setbacks should be well supported above 0.7000 on a weekly close basis. A weekly close below 0.7000 will force a bearish shift.AUDUSD – fundamental overview

Not a lot of surprise from the RBA on Tuesday. As expected, the RBA announced it was ending its QE program. A number of factors were cited, but the most important one was the central bank is getting closer to achieving its employment and inflation goals. The RBA also kept the cash rate at 0.10% and the interest rate on exchange settlement balances at 0%. On the data front, Aussie retail sales were a big miss. Looking ahead, we get German retail sales, German unemployment, German manufacturing PMIs, Eurozone manufacturing PMIs, Canada GDP, and US reads highlighted by ISM manufacturing, construction spending, and JOLTs job openings.USDCAD – technical overview

Finally signs of a major bottom in the works after a severe decline from the 2020 high. A recent weekly close back above 1.2500 encourages the constructive outlook and opens the door for a push back towards next critical resistance in the 1.3000 area. Any setbacks should be well supported into the 1.2200s.USDCAD – fundamental overview

The Canadian Dollar has managed a decent recovery on the back of rallying oil prices and a recovery in global risk sentiment. Looking ahead, we get German retail sales, German unemployment, German manufacturing PMIs, Eurozone manufacturing PMIs, Canada GDP, and US reads highlighted by ISM manufacturing, construction spending, and JOLTs job openings.NZDUSD – technical overview

Setbacks have intensified in recent weeks with the market trading down to fresh multi-month lows. A recent breakdown below the 0.6700 area opens the door for a drop towards 0.6500 in the sessions ahead.NZDUSD – fundamental overview

The New Zealand Dollar has finally found some demand after getting slammed to multi-month lows, with the currency propped up on the rebound in stocks and hawkish expectations from the RBNZ in 2022. Looking ahead, we get German retail sales, German unemployment, German manufacturing PMIs, Eurozone manufacturing PMIs, Canada GDP, and US reads highlighted by ISM manufacturing, construction spending, and JOLTs job openings.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. The latest breakdown below 4,272 opens the door for the next major downside extension towards 3,500. Back above 4,612 will be required at a minimum to take the immediate pressure off the downside.US SPX 500 – fundamental overview

With so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on easy money policy incentives and government stimulus, should no longer be as enticing to investors. Meanwhile, ongoing worry associated with coronavirus fallout and risk of rising inflation should weigh more heavily on investor sentiment in Q1 2022.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and an acceleration beyond the next major psychological barrier at 2000. Setbacks should now be well supported above 1600.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about exhausted monetary policy, extended global equities, and coronavirus fallout. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.