Next 24 hours: Still plenty of worry out there

Today’s report: Minor relief as new week gets going

That things didn’t get materially worse in the Middle East over the weekend has helped to stabilize markets a bit as the new week gets going. But overall, we’re in a place where risk assets are vulnerable to the combination of this escalation in geopolitical tension against a backdrop of stagflation risk.

Wake-up call

- hawkish speak

- more shocks

- yield differentials

- Macro pressures

- BoC Macklem

- New government

- Geopolitical risk

- Global outlook

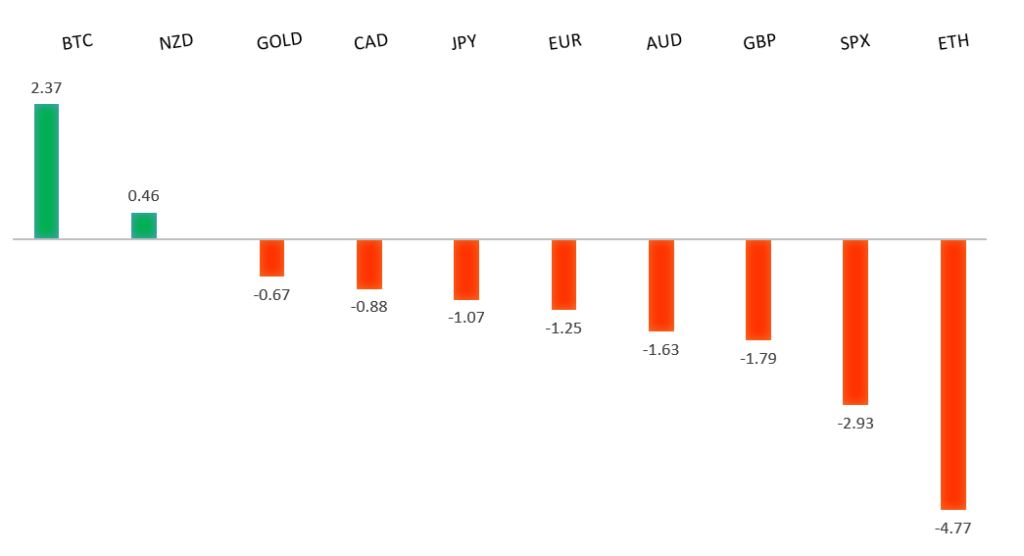

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Financial Markets Clearly In a Risk-Off Mode, J. McMilan, Commonwealth (October 10, 2023)

- JPMorgan and Citi Pass Pain to Hedge Fund Shorts, P. Davies, Bloomberg (October 13, 2023)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

Any additional setbacks should be well supported on dips below 1.0500 in favor of the start to the next major upside extension. Ultimately, only a monthly close back below 1.0500 would give reason for concern. Back above 1.0618 will take the immediate pressure off the downside.EURUSD – fundamental overview

Most of the news out of the Eurozone of late has been more supportive of the Euro than anything else. We've just come out of a round of more hawkish speak from the likes of Lagarde, Knot, and Nagel. Key standouts on Monday’s calendar come from German wholesale prices, some ECB speak, BOE speak, Canada manufacturing sales, New York empire manufacturing, and some Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2000. Next key resistance comes in at 1.3143.GBPUSD – fundamental overview

In his latest comments, BoE Governor Bailey said the UK outlook was "very subdued" and that policy was restrictive. He also warned the central bank needed to be prepared for more shocks ahead. Key standouts on Monday’s calendar come from German wholesale prices, some ECB speak, BOE speak, Canada manufacturing sales, New York empire manufacturing, and some Fed speak.USDJPY – technical overview

At this stage, it looks like the market is wanting to resume the bigger picture uptrend and head back towards a retest of that multi-year high from October 2022 up at 151.95. Look for any weakness to continue to be well supported on dips.USDJPY – fundamental overview

Yield differentials continue to widen in favor of the US Dollar, with downside pressure in the Yen picking up some more after Japan inflation data came in softer than expected earlier last week and an MOF official said there was no change in the stance on FX moves. Key standouts on Monday’s calendar come from German wholesale prices, some ECB speak, BOE speak, Canada manufacturing sales, New York empire manufacturing, and some Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6300 would give reason for rethink. Back above 0.6523 will take the immediate pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Renewed downside pressure on commodities and stocks, along with broad based demand for the US Dollar, have been what has factored into the latest round of Australian Dollar selling. Key standouts on Monday’s calendar come from German wholesale prices, some ECB speak, BOE speak, Canada manufacturing sales, New York empire manufacturing, and some Fed speak.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

Bank of Canada Governor Macklem said higher long-term bond yields were not a substitute for doing what needs to be done to get inflation back down to target. Macklem also added the central bank is not expecting a recession in Canada, but is "not really seeing downward momentum in underlying inflation" which is a concern. Oil prices have turned back up aggressively which has helped to support the Canadian Dollar. Key standouts on Monday’s calendar come from German wholesale prices, some ECB speak, BOE speak, Canada manufacturing sales, New York empire manufacturing, and some Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market once again stalling out on a run up into the 0.6500 area. Ultimately, a break back above 0.6049 would be required to take the immediate pressure off the downside. A monthly close below 0.5900 would intensify bearish price action.NZDUSD – fundamental overview

The National Party and ACT collectively won 61 of the 122 seats contested in the New Zealand election and will likely form the next government. The National Party has been vocal about removing RBNZ's dual mandate and returning it to focus on inflation control solely. We have seen some mild Kiwi demand in the aftermath. Key standouts on Monday’s calendar come from German wholesale prices, some ECB speak, BOE speak, Canada manufacturing sales, New York empire manufacturing, and some Fed speak.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4600 will be required to take the immediate pressure off the downside. Next key support comes in at 4200.US SPX 500 – fundamental overview

Investors continue to struggle with the reality of a higher for longer Fed policy track in the face of ongoing worry around inflation, while also contending with an escalation in geopolitical risk. Overall, we expect inflation to continue to be a problem in 2023 that results in downside pressure into rallies despite market expectations that would argue otherwise.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1600 on a monthly close basis ahead of the next major upside extension. Next major resistance comes in at 2100, above which opens the next extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less stable and upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.