Next 24 hours: Japan and UK economies contend with recessions

Today’s report: Investor friendly policy at all costs

We’ve spent a lot of time talking about how the market is committed to doing whatever it can to push for a narrative that is always pressuring the Fed into lower rates. This shouldn’t come as a surprise given the fact that lower rates means a more investor friendly market environment.

Wake-up call

- growth call

- UK CPI

- technical recession

- RBA Bullock

- lower oil

- Net migration

- reconsider bets

- Macro themes

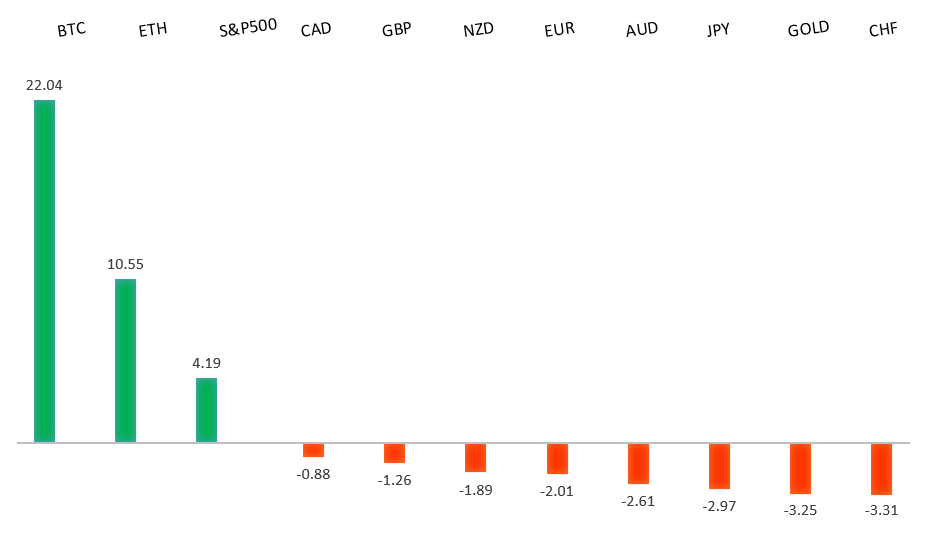

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- Why Investors Should Prepare For a Market Correction, S. McBride, RiskHedge (February 11, 2024)

- Carbon problem for damaged peatlands, K. Bryan, Financial Times (February 14, 2024)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the 2023 high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

ECB Makhlouf was on the wires talking European stagnation in the short-term, while expressing confidence about the 2% inflation goal. Meanwhile, the German government revised its 2024 growth projection to 0.2% from 1.3% pervious. Key standouts on Thursday’s calendar come from UK GDP, trade, industrial production, construction output, an ECB Lagarde speech, Eurozone trade, Canada housing starts, US retail sales, initial jobless claims, empire manufacturing, industrial production, business inventories, NAHB housing, and the Philly Fed.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2000. Next key resistance comes in at 1.2849.GBPUSD – fundamental overview

The Pound came under notable pressure on Wednesday after UK inflation data surprised to the downside. BOE rate cut odds have turned up in the aftermath and BOE Bailey has said the CPI number leaves the things where they were after December's overshoot. The local rate market now sees 78 basis points of rate cuts in 2024, up from 64 basis points on Tuesday. Key standouts on Thursday’s calendar come from UK GDP, trade, industrial production, construction output, an ECB Lagarde speech, Eurozone trade, Canada housing starts, US retail sales, initial jobless claims, empire manufacturing, industrial production, business inventories, NAHB housing, and the Philly Fed.USDJPY – technical overview

The market remains confined to a strong uptrend, with sights set on a retest and break of the multi-year high from 2022 at 151.95. A push through this level will open the next major upside extension towards 155.00. Key support comes in at 145.90, with only a weekly close below to delay the constructive outlook.USDJPY – fundamental overview

Warnings from Japanese officials about excessive and rapid weakness in the Yen don't usually have any meaningful impact on the market. At the same time, the latest wave of concerns has perhaps slowed the pace of Yen declines for a moment. On the data front, Japan GDP came in softer than expected and points to the economy sliding into technical recession. Key standouts on Thursday’s calendar come from UK GDP, trade, industrial production, construction output, an ECB Lagarde speech, Eurozone trade, Canada housing starts, US retail sales, initial jobless claims, empire manufacturing, industrial production, business inventories, NAHB housing, and the Philly Fed.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6900 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

Aussie jobs data came in softer than expected but hasn't had any material impact on the currency on Thursday. Aussie household spending came in unchanged, and RBA Bullock said Australian inflation expectations remain well anchored. Key standouts on Thursday’s calendar come from UK GDP, trade, industrial production, construction output, an ECB Lagarde speech, Eurozone trade, Canada housing starts, US retail sales, initial jobless claims, empire manufacturing, industrial production, business inventories, NAHB housing, and the Philly Fed.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar has been a relative underperformer in recent sessions, taking a hit from the slide in oil and slowing Canada existing home sales. The Bank of Canada is eyeing the end of quantitative tightening as the balance sheet shrinks to CAD313 billion. Key standouts on Thursday’s calendar come from UK GDP, trade, industrial production, construction output, an ECB Lagarde speech, Eurozone trade, Canada housing starts, US retail sales, initial jobless claims, empire manufacturing, industrial production, business inventories, NAHB housing, and the Philly Fed.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

New Zealand net migration data for December produced a slight increase from the previous print. Key standouts on Thursday’s calendar come from UK GDP, trade, industrial production, construction output, an ECB Lagarde speech, Eurozone trade, Canada housing starts, US retail sales, initial jobless claims, empire manufacturing, industrial production, business inventories, NAHB housing, and the Philly Fed.US SPX 500 – technical overview

Longer-term technical studies continue to look quite extended after pushing to fresh record highs, begging for a deeper correction ahead. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close above 5000 will be required to delay the outlook. Next key support comes in at 4842.US SPX 500 – fundamental overview

The Fed has finally bent to the will of the market, with the December 2023 policy decision revealing rate projections coming down from previous and more in line with what the market has been looking for. This has translated to more investor friendly policy going forward, opening the door for a run to fresh record highs in early 2024. At the same time, with the inflation outlook still uncertain, the central bank not willing to fully play into market expectations for aggressive rate cuts, which could prove to be a disappointment for investors and start to weigh more heavily on stocks.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1900 on a monthly close basis ahead of the next major upside extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less stable and upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.