Next 24 hours: Risk appetite holds up well despite Fed Chair testimony

Today’s report: Powell pushes back on rate cut bets

The Fed Chair shook things up a bit in his Tuesday testimony after pushing back on rate cut timing and warning against premature easing. This all but takes July rate cut prospects off the table, with September now seen as the earliest date for the next rate cut.

Wake-up call

- Renewed stress

- GBPUSDUK retailers report slower sales

- BOJ initiative

- consumer confidence

- oil weakness

- No change

- Fed outlook

- Macro themes

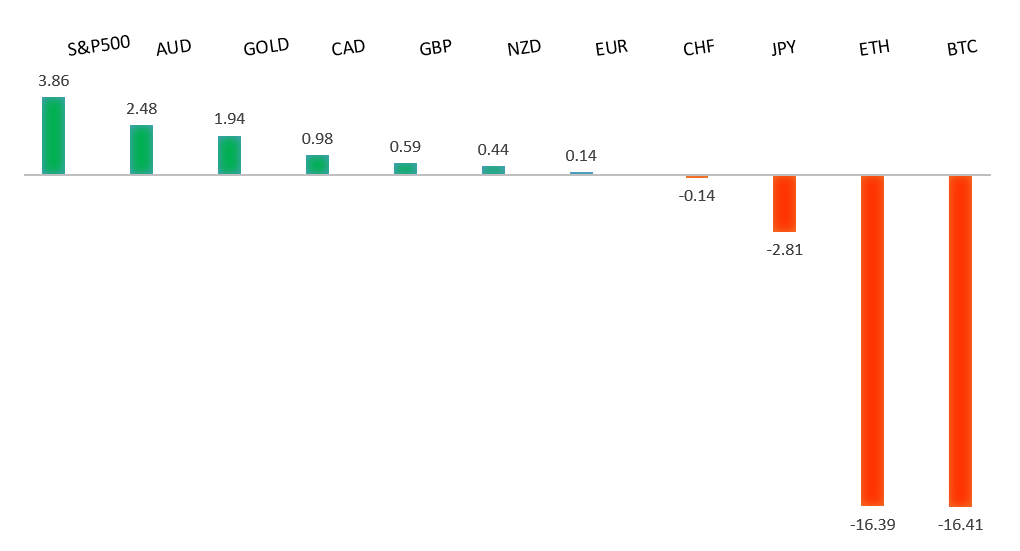

Peformance chart: 30-Day Performance vs. US dollar (%)

Suggested reading

- With AI, we need both competition and safety, T. Wheeler, Brookings (July 8, 2024)

- Paper Money Is Hardly Scarce. and That’s Why Gold Beats It, E. Fry, InvestorPlace (July 8, 2024)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro has been in a multi-month consolidation since bottoming out in 2022. Setbacks have since been exceptionally well supported on dips below 1.0500, with a higher platform sought out ahead of the next major upside extension. Look for a push through the 2023 high at 1.1276 to strengthen the constructive outlook and extend the recovery run towards 1.2000. Only back below 1.0400 negates.EURUSD – fundamental overview

The Euro is back to showing some stress around the French election. French unions have called for a strike at Paris airports, while Moody's has warned there could be a downgrade to France absent a commitment to fiscal consolidation. Absence of first tier data on Wednesday’s calendar will leave the focus on another round of Fed Chair testimony and some Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The door is now open for the next major upside extension towards the 2023 high at 1.3143. Any setbacks should be well supported ahead of 1.2000.GBPUSD – fundamental overview

The Pound slumped on Tuesday after retailers reported slower sales. Meanwhile, the Labour government's immediate push for an increase in the minimum wage was also seen steepening the Gilt curve. Absence of first tier data on Wednesday’s calendar will leave the focus on another round of Fed Chair testimony and some Fed speak.USDJPY – technical overview

The market remains confined to a strong uptrend, most recently extending to a multi-year high through 160.00. Key support comes in at 151.95, with only a weekly close below to delay the constructive outlook. Next major resistance comes in at 165.00.USDJPY – fundamental overview

There is no strong indication the BOJ will be looking to tighten up policy at the upcoming meeting and the odds for a change remain up in the air, something that continues to weigh on the Yen. Ultimately, the market will continue to lean towards selling Yen until the BOJ proves otherwise. Absence of first tier data on Wednesday’s calendar will leave the focus on another round of Fed Chair testimony and some Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6200 would give reason for rethink. Back above 0.6900 will take the big picture pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar has run into resistance from softer Aussie consumer confidence data and sagging metals prices. Absence of first tier data on Wednesday’s calendar will leave the focus on another round of Fed Chair testimony and some Fed speak.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Canadian Dollar was back under pressure on Tuesday, taking its hits from a slide in commodities prices, with a notable focus on oil weakness. Absence of first tier data on Wednesday’s calendar will leave the focus on another round of Fed Chair testimony and some Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.NZDUSD – fundamental overview

There is no change expected from the RBNZ today, though we have seen profit taking into the event risk. We've also seen some Kiwi selling on the New Zealand Treasury's reporting of weaker sales, with consumers experiencing hardship. Absence of first tier data on Wednesday’s calendar will leave the focus on another round of Fed Chair testimony and some Fed speak.US SPX 500 – technical overview

Longer-term technical studies continue to look quite extended, begging for a deeper correction ahead. At the same time, the latest bullish breakout to a fresh record high beyond the 2024 high opens the door for the next measured move upside extension targeting the 5650 area. Key support comes in at 5194.US SPX 500 – fundamental overview

Though we have seen a healthy adjustment of investor expectations towards the amount of rate cuts in 2024, the market still hopes policy will end up erring more towards the investor friendly, accommodative side of things. This bet has kept stocks well bid into dips and consistently pushing record highs. Still, if there is a sense the Fed will need to be more sensitive towards erring on the side of higher rates, it could invite major disruption to the stock market.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and this next major upside extension into the 2500-3000 area. Setbacks should now be well supported above 2000 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal has pushed record highs in 2024 with solid demand from medium and longer-term accounts. These players are more concerned about inflation, geopolitical risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an end.